Spot Ethereum ETFs recorded a sturdy buying and selling debut within the US on July 24 after months of hypothesis and regulatory uncertainty.

The ETFs recorded a powerful quantity of $1.11 billion on the primary buying and selling day, led by BlackRock’s $266.5 million inflows. Throughout the first 90 minutes of buying and selling, ETH ETFs recorded $361 in buying and selling quantity, reflecting robust curiosity and confidence in Ethereum.

Whereas the first-day buying and selling quantity for Ethereum ETFs nonetheless represents round 1 / 4 of the amount Bitcoin ETFs noticed upon launch, it’s nonetheless a significant growth for ETH. Except for a short spike in spot value, the surge in curiosity for ETFs has additionally affected the derivatives market.

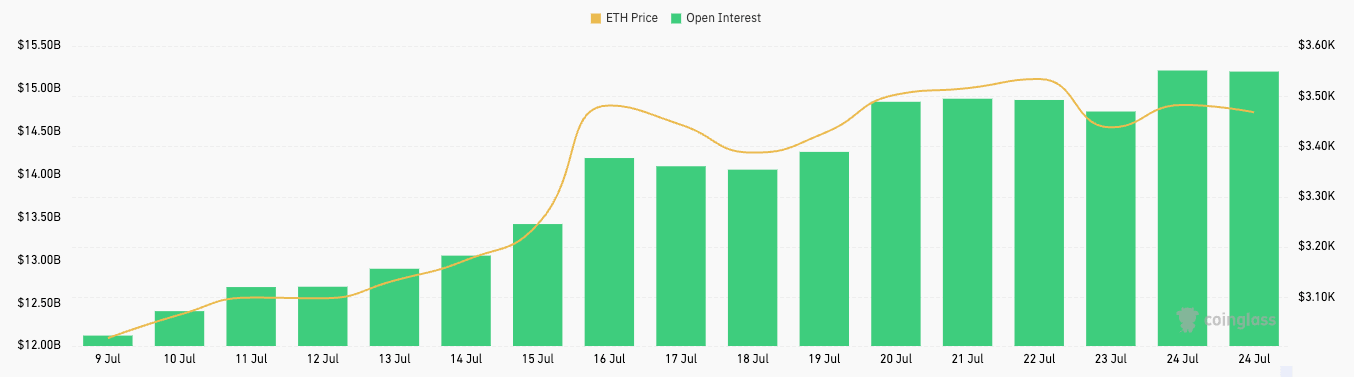

Ethereum derivatives noticed a risky June however had a comparatively calm July. Over the previous week, the complete derivatives market noticed gradual however noticeable development that appears to have sped up after the ETFs launched. Information from CoinGlass confirmed a gradual climb in choices open curiosity, significantly on July 24, when it reached $7.39 billion.

Ethereum futures adopted the same pattern, albeit the bigger dimension of the market meant that the $460 million enhance in open curiosity didn’t present up as such a big uptick.

An increase in open curiosity is important because it usually brings about elevated liquidity and buying and selling quantity, offering Ethereum with a extra strong market construction. Because the buying and selling exercise round ETH ETFs heats up within the coming weeks, we are able to anticipate the derivatives market to proceed its upward trajectory.

The rising institutional curiosity in ETH ETFs might very properly translate into derivatives. Institutional and complex traders might start using foundation commerce methods, resulting in a rise in derivatives OI and quantity.

Foundation buying and selling is a classy technique that includes making the most of the value distinction between the spot and futures market. It has turn out to be a big a part of the Bitcoin market, particularly after the launch of Bitcoin ETFs. Earlier CryptoSlate evaluation discovered that the Bitcoin foundation commerce has considerably influenced the market, resulting in flat value motion that defies the inflows and quantity seen in spot ETFs. With the introduction of Ethereum ETFs, the same factor might additionally occur within the ETH market.

Whereas this buying and selling technique suppresses any vital value motion, it might bode properly for Ethereum by rising OI, making a extra liquid and energetic derivatives market. Such a market enhances value discovery and danger administration capabilities.

Nevertheless, if a foundation commerce involving Ethereum ETFs and derivatives features plenty of traction, it might negatively have an effect on the market. Essentially the most vital danger for Ethereum comes from the potential for market manipulation, the place massive institutional gamers might exploit discrepancies to govern costs.

Moreover, if the idea commerce turns into too crowded, it might cut back the technique’s profitability, resulting in abrupt exits and probably triggering sharp corrections. Given the dimensions of Ethereum’s DeFi market, this might show particularly harmful for the coin.

The publish Ethereum open curiosity grows as market hype grows round spot ETFs appeared first on CryptoSlate.