The Czech Nationwide Financial institution (CNB) stated on Thursday that it has purchased $1M in cryptocurrencies for the primary time.

The transfer is a small take a look at meant to see how a digital asset reserve would possibly work and to offer the financial institution hands-on expertise with managing crypto.

The pilot reserve will maintain Bitcoin, a US dollar-linked stablecoin, and a tokenized financial institution deposit.

CNB officers described the step as a managed experiment. They stated the aim is to grasp how these belongings behave in actual circumstances and to arrange for a future the place digital belongings might play a bigger function in international finance.

Bitcoin Replace:I’ll begin broadly: in case you intend to spend money on crypto belongings, train excessive warning. The market continues to be in its infancy. I bear in mind the Nineties in our nation, when the transition from socialism to capitalism noticed the delivery and simultaneous collapse of many… https://t.co/UxGF0R7NwO

— Aleš Michl (@MICHLiq_) February 19, 2025

The CNB stated it has no plans to maneuver towards a full digital asset reserve anytime quickly.

DISCOVER: 9+ Finest Memecoin to Purchase in 2025

What Does the CNB Need to Be taught From Its Digital Asset Trial?

Governor Aleš Michl defined that the transfer is a part of a broader effort to maintain the financial institution consistent with quick modifications in international finance.

He stated the establishment wants firsthand expertise with new instruments if it desires to arrange for what’s forward.

Together with the crypto buy, the financial institution additionally launched the CNB Lab Innovation Hub. The brand new unit will take a look at blockchain methods and different monetary applied sciences that will discover business use within the coming years.

The hub’s aim is easy: assist the financial institution perceive how these applied sciences may affect funds, banking operations, and future financial coverage.

The announcement exhibits how central banks and governments are paying nearer consideration to digital belongings as extra monetary exercise strikes on-chain.

The shift to internet-based infrastructure is pushing main establishments to grasp how these methods work and what dangers or benefits they could carry.

DISCOVER: High Solana Meme Cash to Purchase in 2025

Why Did the CNB Board Reject the Plan for a Massive Bitcoin Buy?

The CNB began wanting at Bitcoin in January as a part of a plan to broaden its worldwide reserves.

That assessment got here after regulators in america signaled a extra open stance towards crypto earlier this 12 months, a transfer that caught the eye of a number of international monetary authorities.

Across the identical time, Governor Aleš Michl raised a a lot greater concept.

He instructed the financial institution take into account shopping for as much as $7.3Bn price of Bitcoin, roughly 5% of its reserves, to construct a proper Bitcoin reserve.

The proposal didn’t win assist from the CNB board and was put aside.

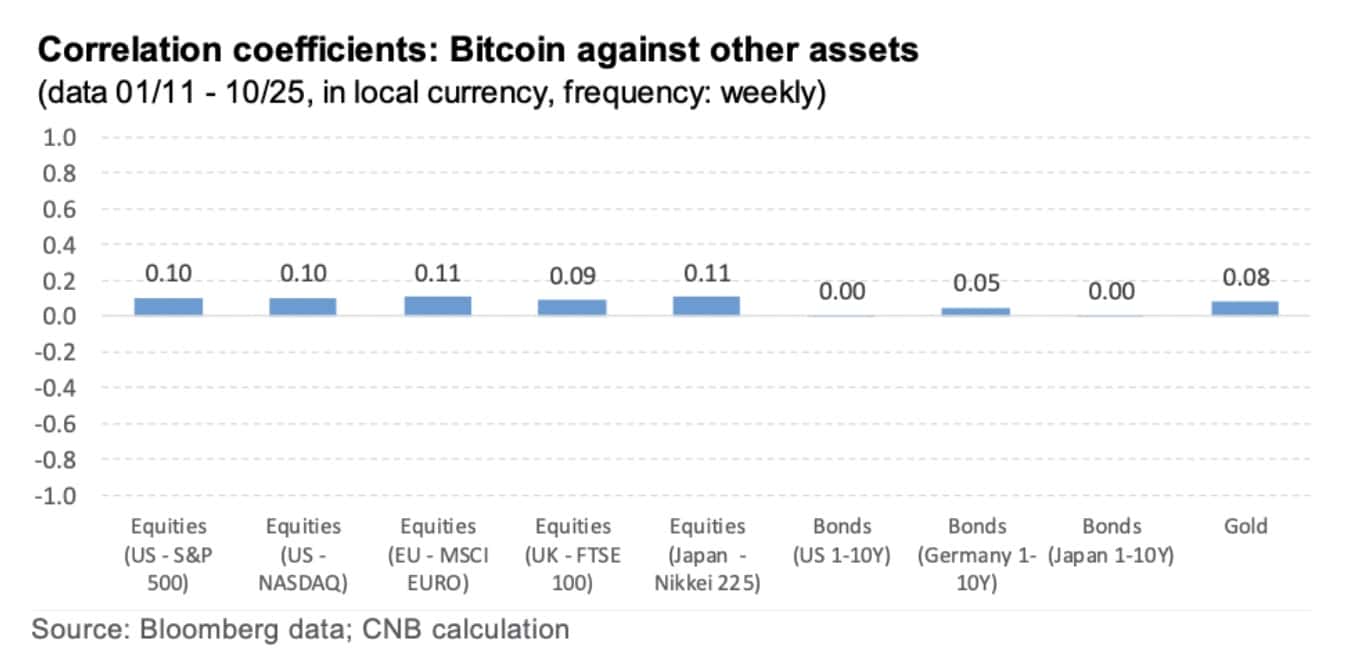

Michl stated the financial institution was additionally weighing Bitcoin as a attainable reserve asset. He famous that it at present exhibits no correlation with bonds and will play a job in a bigger portfolio.

On the identical time, he pressured that its long-term worth is unsure, saying it may “find yourself being price nothing or presumably a really great amount.”

The CNB elevated its publicity to the broader crypto sector earlier this 12 months. In July, it purchased 51,732 shares of Coinbase.

The stake was valued at about $18M on the time and is now price greater than $15.7M.

EXPLORE: How To Purchase Sui – A Newbie’s Information

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The put up Euro Zone Shock: Czech Nationwide Financial institution (CNB) Provides Bitcoin to Its Reserve Playbook appeared first on 99Bitcoins.