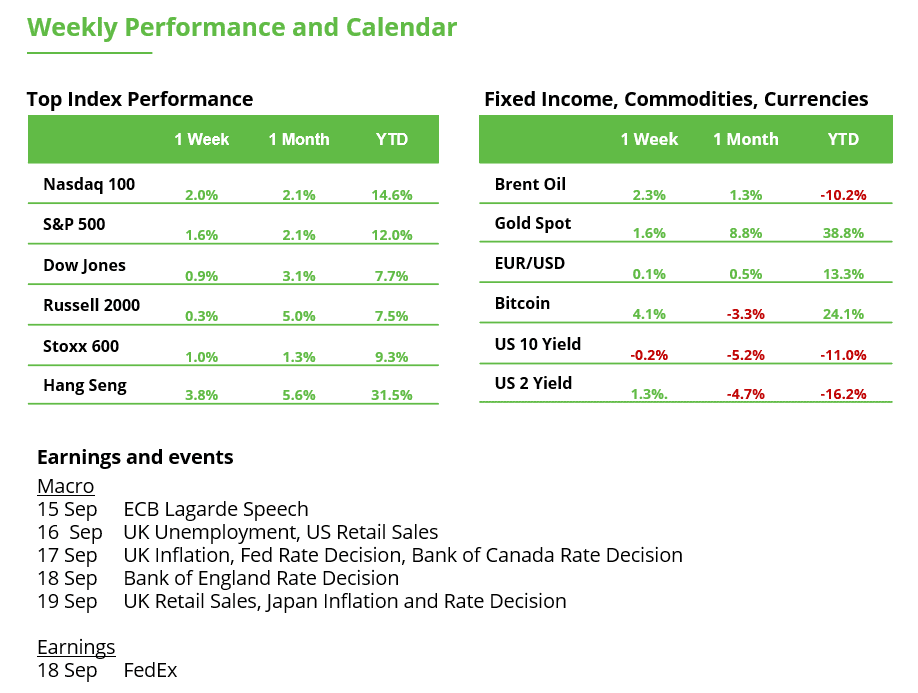

Analyst Weekly September 15, 2025

From EM tech power to report US buybacks, market drivers are stacking up forward of the Fed’s first fee lower of 2025. With US progress nonetheless uneven and inflation expectations anchored, Powell is anticipated to ship a 25 bp lower this week, however markets might be watching his steering on the tempo of additional easing simply as carefully.

Tech is the New EM Engine

Rising markets (EM) have usually been seen as risky and arduous to navigate, however the newest earnings season suggests issues could also be turning a nook. Whereas general EM earnings progress was flat in Q2, the breadth of earnings revisions is bettering for the primary time in months, particularly in Asia, because of tech power and supportive coverage strikes.

Semis lead the pack: The standout theme is know-how. Corporations tied to the worldwide AI cycle are fueling earnings upgrades. Taiwan and South Korea, each tech-heavy markets, delivered stable revenue progress because of sturdy demand for superior chips. Taiwan’s TSMC and Korea’s SK Hynix are clear beneficiaries, with management in areas like AI accelerators and high-bandwidth reminiscence.

Web shake-up: China’s large e-commerce corporations like Alibaba, JD, and Meituan stay beneath strain from intense competitors, particularly in meals supply and fast commerce. Nevertheless, Alibaba’s cloud and worldwide companies are serving to offset home challenges. In the meantime, ASEAN web corporations equivalent to Seize and Sea are thriving. They’re displaying sturdy consumer progress, resilient profitability, and increasing into fintech and digital companies. For buyers long-term structural progress in EM, it is a key theme: the digital financial system is alive and nicely exterior of China.

Financials Regaining Power: One other vivid spot is financials. Chinese language banks (like China Retailers Financial institution, Financial institution of China) noticed income rebound in Q2, helped by larger price earnings. Indian and Brazilian banks additionally reported resilient outcomes, with names like ICICI Financial institution and Itau Unibanco highlighted as well-positioned leaders. Sturdy capitalization and regular mortgage progress make them standouts in areas which are nonetheless under-owned by world buyers. For retail shoppers, this implies the monetary sector, lengthy a spine of EM indices, is regaining relevance as a driver of regular returns.

Watch place sizes & FX Danger: EM strikes will be sharp, pacing publicity helps handle swings– broad EM or Asia ex-Japan ETFs assist easy out country-specific shocks. Pair EM tech/financials with publicity to gold (a traditional EM hedge) or developed markets. To remove foreign money danger, buyers can spend money on a foreign money hedged fairness ETF; exchange-traded foreign money (ETCs); or by CFDs or unfold bets.

Funding Takeaway: Rising markets might look boring on the floor, however momentum is quietly constructing. Tech is flourishing, banks are stabilizing, and coverage assist is boosting home demand. The scary “tariff shock” from US commerce coverage has been much less extreme than anticipated, giving exporters some respiration room. AI and tech cycles stay a world resilience issue, serving to offset weak spots like client staples. Alternatives are broadening from Taiwan semis to Indian banks to Southeast Asian web platforms. With valuations nonetheless low-cost and progress choosing up together with Fed fee cuts, EM publicity may very well be a method to stability portfolios tilted closely towards US mega-caps.

Huge Buybacks, Larger Affect

US firms are shopping for again inventory at report ranges in 2025. Practically $1 trillion in buyback bulletins have been made up to now this 12 months, placing 2025 on tempo to surpass final 12 months’s whole. Tech giants are main the best way; Apple ($100B), Google ($70B), and Nvidia ($60B) all unveiled large buyback applications this earnings season. Huge banks like JPM ($50B), GS ($40B), WFC ($40B), and BAC ($40B) have additionally dedicated tens of billions every.

For buyers, buybacks matter as a result of they cut back the variety of shares in circulation. That may increase earnings per share, present value assist, and sign that administration is assured within the firm’s future. However the exercise is very concentrated – a handful of mega-caps characterize about 66% of all buybacks this 12 months. For retail portfolios tilted towards tech and financials, that focus means buybacks might play an outsized position in driving returns.

VIX Slips as Markets Keep Pinned

Volatility retains grinding decrease (14.76), with the VIX sliding as key financial knowledge passes with out sparking main swings. Market focus has shifted extra towards indicators of labor market weak spot than inflation, whereas the backdrop of doable stagflation, slower progress alongside sticky costs, stays a part of the dialog. AI-related shares past the “Magazine 7” have been a vivid spot, serving to sentiment stabilize.

Nonetheless, seller positioning into month-end suggests rallies are bought into and pullbacks are purchased, conserving the S&P 500 range-bound. As soon as September choices and quarter-end expirations are behind us, the market might commerce extra freely, although company buyback blackouts might take away a layer of assist. With volatility low, some buyers are eyeing October as a superb window so as to add safety with methods equivalent to QQQ put unfold collars – which cap upside in alternate for cheaper draw back safety – drawing elevated consideration.

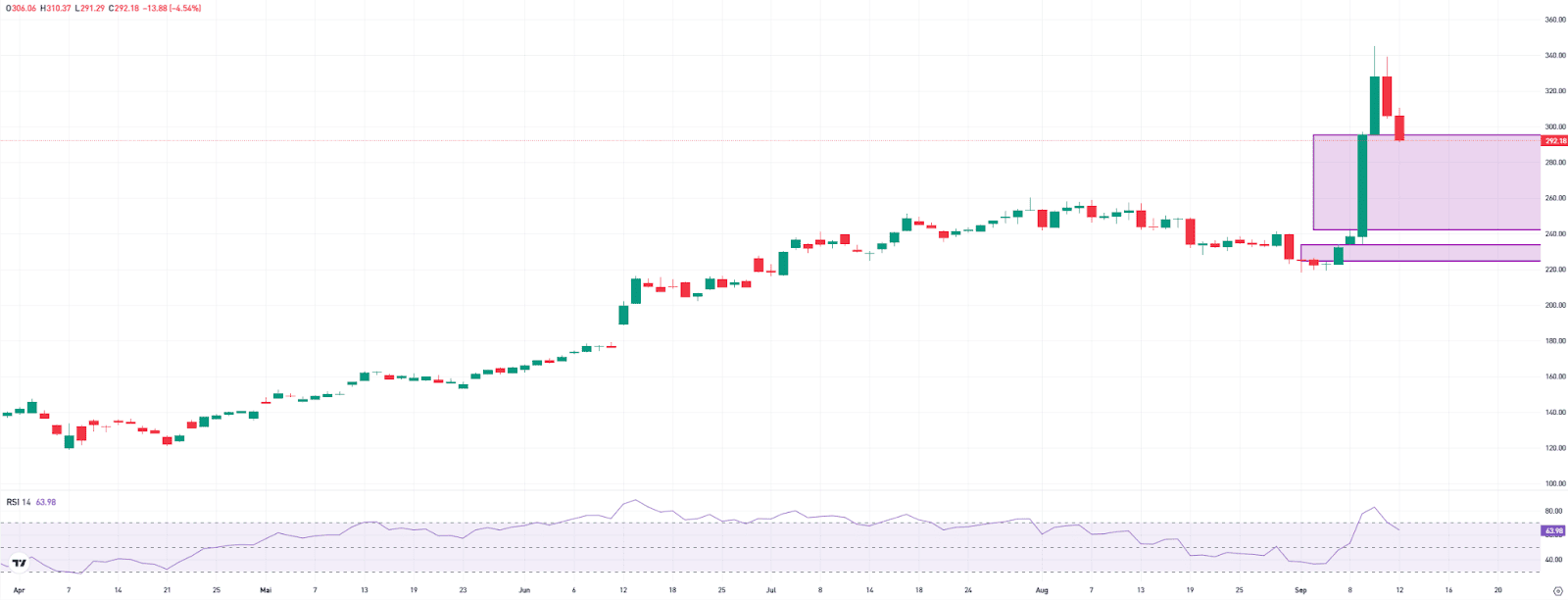

South Korean Shares With Dynamic Restoration

The EWY (iShares MSCI South Korea ETF) ended final week with a 7% achieve at 78.66 factors. In the long run, there may be nonetheless catching as much as do in comparison with the U.S. and European inventory markets. The final report excessive was reached on the finish of 2020 at 96.20 factors. The hole has now narrowed to 18%. Within the medium time period, buyers have more and more turned again to South Korean shares. Because the low in April, the index has risen 62%, whereas the S&P 500 gained solely 37% over the identical interval. From a technical perspective, EWY might proceed its restoration within the coming weeks and months – not less than so long as the assist zone between 70.96 and 69.59 factors (Truthful Worth Hole) holds.

EWY within the weekly chart. Supply: eToro

Cloud Enterprise Triggers a Surge in Oracle Shares

Oracle’s inventory skyrocketed final week, gaining over 25%. Sturdy cloud offers fueled a large order growth. In only one quarter, a number of multibillion-dollar contracts had been signed, together with with OpenAI, Nvidia, and TikTok. The order backlog surged to $455 billion — greater than 4 occasions the earlier 12 months’s stage. On the danger aspect, Oracle faces extraordinarily excessive investments, which put strain on money stream and margins. As well as, there’s a sturdy dependence on a couple of main prospects.

The market was closely overbought at occasions, however circumstances have since eased considerably. Buyers ought to watch the reactions within the two Truthful Worth Gaps created by the rally: between $241 and $296, and between $219 and $234. Bullish reversal indicators in these zones might point out {that a} new upward transfer is about to start.

Oracle within the day by day chart. Supply: eToro

Macro Calendar: All Eyes on Powell

The Fed is anticipated to chop rates of interest on Wednesday for the primary time this 12 months (determination at 8:00 p.m.). Weak spot within the labor market provides the Fed the inexperienced gentle for a lower. A small step of 25 foundation factors to a spread of 4.00 to 4.25 % is anticipated. By the top of 2026, markets anticipate a complete of six small cuts. Persistently excessive inflation might gradual this tempo. That’s why the brand new quarterly projections from the central financial institution might be decisive. In June, the Fed projected core PCE inflation of two.4% for 2026 and a pair of.1% for 2027. A downward revision would give shares and bonds a lift. As well as, Jerome Powell’s press convention at 8:30 p.m. might present key steering on what occurs after the September assembly.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.