US-based cryptocurrency change, Gemini has formally launched operations in France after securing a Digital Asset Service Supplier (VASP) registration earlier this 12 months.

Based by the Winklevoss twins, Gemini’s growth coincides with the European Union’s complete Markets in Crypto-Belongings (MiCA) regulatory framework, set to take full impact later this 12 months

Gemini crypto change expands into France after being granted VASP license https://t.co/QYr1hMfBGl

— The Block (Meet Us at Emergence) (@TheBlock__) November 19, 2024

The growth aligns with France’s supportive regulatory setting and growing adoption of digital property, striving to be hub for crypto innovation.

France As Strategic Market For Gemini

France ranks among the many most pro-crypto nations in Gemini’s 2024 World State of Crypto report. The entry into the French market highlights the nation’s rising prominence within the world cryptocurrency panorama.

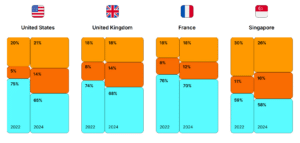

The report signifies a 2% enhance in crypto possession in France since 2022, with 18% of the inhabitants now holding digital property—making it one of many fastest-growing markets post-crypto winter.

The European boss of @Gemini particulars their arrival in France in @TheBigWhale_

“We imagine that reaching a number one place within the French market is achievable inside 12 to 18 months”

Free entry article

https://t.co/TcZTscdOp8

— Grégory Raymond

(@gregory_raymond) November 19, 2024

By capitalizing on this momentum, Gemini goals to bridge the hole between institutional-grade crypto options and retail adoption in France.

Emphasizing on the importance of the launch Gillian Lynch, Gemini’s CEO for U.Okay. and Europe mentioned “Our analysis into the French market reveals Gemini’s rising curiosity in digital property.

Additional including, “Together with a strong regulatory framework, the growth presents a singular alternative to introduce our platform to the buying and selling neighborhood and prolong our presence within the European market over the approaching months.”

EXPLORE: France To Block Entry To Polymarket After Surge In Crypto Betting On US Election

Leveraging MiCA And Native Market Tendencies

With the implementation of the EU’s MiCA rules within the close to future, the launch in France may nicely be strategically timed as MiCA goals to streamline operations for crypto corporations throughout the 27-nation buying and selling bloc.

As soon as absolutely applied, MiCA will permit firms accepted in a single member state to function throughout the EU, lowering regulatory hurdles and fostering cross-border innovation.

The change will supply native customers entry to over 70 digital property with cost choices together with Euros, British kilos, Debit playing cards and Apple Pay.

The proactive regulatory stance of France, coupled with the broader MiCA framework, has lowered the proportion of French crypto customers citing regulatory issues—from 37% on the peak of the bear market two years in the past to 32% right now.

This decline displays the rising belief in crypto’s legitimacy inside the nation, paving the way in which for additional adoption and innovation.

It’s vital to notice that 62% of respondents from France take into account cryptocurrency to be a long-term funding, and 46% reported buying their preliminary cryptocurrency inside the final three to 5 years.

Moreover, 49% of people who’ve beforehand owned cryptocurrency indicated that they’re more likely to re-enter the market within the coming 12 months, whereas 28% expressed their intention to allocate 5% of their funding portfolios to cryptocurrency.

Constructing Sturdy Crypto Ecosystem In France

France’s supportive setting for crypto corporations is just not solely attracting firms like Gemini however can also be fostering the event of a strong ecosystem.

The nation is dwelling to a fairly a number of influential crypto initiatives together with Ledger, a number one {hardware} pockets producer and DeFi platform Morpho.

By aligning its operations with native regulatory requirements and shopper preferences, the change is about to play a pivotal function in shaping the way forward for digital property within the area.

“We imagine in empowering people by means of crypto, and our growth into France marks a major milestone in our mission to make crypto accessible to everybody,” Gillian Lynch highlighted.

As France continues to guide in crypto adoption and regulatory readability, Gemini’s growth could be seen as a benchmark for different corporations seeking to faucet into the European market.

The publish Gemini Crypto Trade Expands To France Following VASP License Approval appeared first on .