Within the dynamic monetary sector, Bitcoin ETFs are quickly gaining floor in opposition to their gold counterparts, with inflows pushing complete belongings below administration towards document highs. Bitcoin ETFs are set to overhaul gold ETFs in complete belongings below administration.

Bitcoin ETFs Cement Function As Institutional Gateway To Crypto

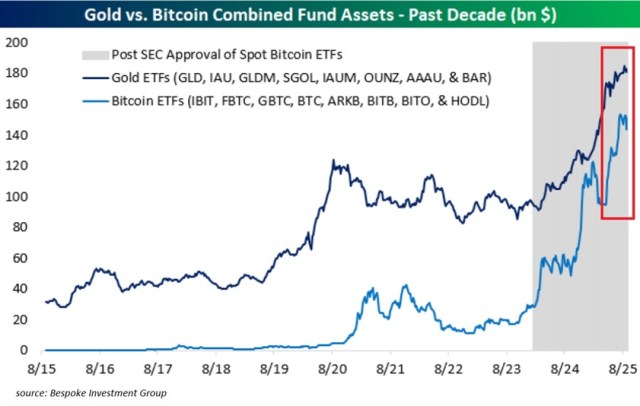

Bitcoin Change-Traded Funds (ETFs) are getting ready to making historical past globally. In an X publish, the Kobeissi Letter, an industry-leading commentary on international capital markets, has revealed that BTC ETFs are on observe to surpass Gold ETFs in belongings below administration (AUM) for the primary time in historical past, marking a historic milestone in international markets. Over the previous 12 months, AUM within the largest cryptocurrency ETFs has doubled to $150 billion, whereas gold ETFs have climbed 40% to a document of $180 billion.

The comparability highlights how quickly momentum has shifted. Simply three years in the past, gold ETFs had been 5 occasions bigger than Bitcoin ETFs. Presently, with accelerating inflows into digital asset merchandise, that hole is narrowing at a historic velocity.

If present tendencies proceed, Bitcoin ETFs might surpass gold ETFs as early as subsequent 12 months. It is a symbolic flip that underscores the rise of crypto from speculative asset to mainstream portfolio allocation.

Recently, ETFs are proving to be the engine behind the present crypto bull market. In accordance to Ucan_Coin, BlackRock, the world’s largest asset supervisor, oversees almost 2,000 funds, with about 1,400 of them being ETFs. Shoppers purchase into these funds, whereas BlackRock earns charges on the belongings below administration.

Nevertheless, the Bitcoin Spot ETF price is simply 0.25%, however the energy lies in scale and liquidity. During the last two years, ETFs have supplied the essential gasoline for this rally, with almost 20% of all liquidity coming into crypto now flowing immediately from ETF merchandise.

As Ucan_Coin highlights, BlackRock’s IBIT stands out. Because the chart demonstrates, IBIT is the locomotive pulling your complete market, driving inflows and setting the tempo for the broader bull run.

ETF Inflows Sign Rising Institutional Urge for food For Bitcoin

The US spot Bitcoin ETFs are gaining outstanding momentum, whereas producing $5 to $10 billion in day by day quantity on their most lively buying and selling days. Pushpendra Singh, Co-founder of PushpendraTech and SmartViewAi, has defined that this surge is a transparent signal that institutional buyers are more and more looking for regulated publicity to Bitcoin, and ETFs are quickly turning into their most well-liked gateway.

Regardless of the ETF growth, Binance continues to dominate the spot market, processing between $10 to $18 billion in day by day spot quantity and holding a 29% market share. That is greater than double the 13% market share presently held by US-based ETFs, and it places Binance comfortably forward of different main exchanges when it comes to liquidity.

Featured picture from Getty Photos, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.