The Every day Breakdown takes a better look into Costco inventory. Does this premium firm deserve this a lot of a premium valuation? Let’s dive in.

Earlier than we dive in, let’s be sure you’re set to obtain The Every day Breakdown every morning. To maintain getting our each day insights, all you have to do is log in to your eToro account.

Deep Dive

Costco has established itself as a premier retailer as its market cap has swelled to greater than $400 billion. By establishing a high-margin membership and an elevated procuring expertise, Costco has differentiated itself from most different retailers within the US. This has allowed the corporate to deal with high quality, whereas rising its membership base and opening new shops (each within the US and overseas).

As such, we’ve seen the corporate’s earnings and income steadily climb over time (proven beneath) — together with its inventory worth. Shares are up 102% over the previous three years, 169% over the previous 5 years and 561% over the previous decade. Costco inventory has outperformed the S&P 500 on all three of those timeframes.

Progress Is Good, however Valuation in Query

Analysts count on about 13% earnings development this yr, adopted by 10% to 11% development in 2026 and 2027. On the income entrance, estimates name for gross sales development of roughly 7% to eight% in every of these three years (2025 by 2027).

That’s very regular, constant development. Nevertheless, one hang-up may very well be Costco’s valuation.

Shares commerce with ahead price-to-earnings ratio (fP/E) of roughly 48 instances (48x). As shares have pulled again over the previous few months — down about 11% from the February highs — that’s allowed the inventory’s fP/E to shrink from its 2025 highs (close to 58x).

For reference, the S&P 500 at the moment trades with a fP/E ratio of about 23x.

Nearly each valuation metric for Costco is elevated on a relative foundation — that means once we look again at its personal historic measures (on this case, about 10 years). Traders typically justify paying the next valuation for a premium firm. Regardless, whereas Costco is a premium firm, the inventory’s valuation is a threat.

Some traders will see this and shrug, arguing that they’ll pay the elevated valuation now with a plan to carry for years. Others could also be extra tactical, opting to attend for the valuation to probably transfer decrease, permitting them to purchase at a less expensive worth. Each events assume threat — those that purchase now threat a valuation contraction that sends the share worth decrease, whereas those that look forward to a decrease valuation could by no means get it and miss out on additional upside.

Be aware: Consensus worth targets at the moment assume about 15% upside potential in COST inventory.

Wish to obtain these insights straight to your inbox?

Join right here

Diving Deeper

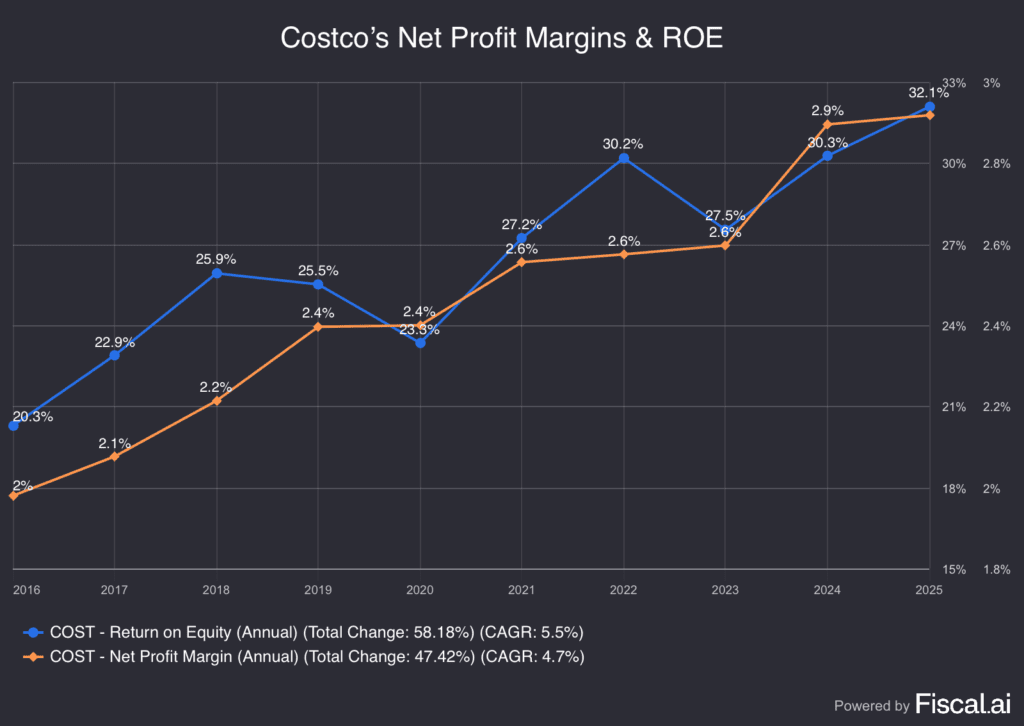

Our dialogue has centered on two information: The corporate’s constant income and revenue development, and its elevated valuation. Nevertheless, one other a part of the dialogue hinges on what Costco’s executed in different areas. For instance, take into account its improve in margins and return on fairness (ROE).

Discover how the corporate’s web revenue margins have elevated 45% over the previous decade, whereas the corporate’s ROE — or “Return on Fairness,” which exhibits how effectively an organization makes use of traders’ cash — has climbed 58% in that span.

Some traders will use these metrics — and others — to justify the inventory’s present valuation. Others could not discover these numbers engaging sufficient to justify the present valuation. Nevertheless, it’s as much as them to find out whether or not the inventory is price a premium, and if not, at what worth — if any — they really feel Costco is price it.

Lastly, it’s price mentioning that whereas Costco pays a meager 0.5% dividend yield, it has dolled out two particular dividends within the final 5 years, with a $10 per share payout in 2020 and a $15 a share payout in 2024.

Disclaimer:

Please be aware that resulting from market volatility, among the costs could have already been reached and eventualities performed out.