Bitcoin and cryptocurrency buying and selling have gained immense reputation in recent times. However what about crypto margin buying and selling? Is it authorized within the US? Margin buying and selling permits merchants to borrow funds to extend their buying and selling energy, doubtlessly resulting in greater income. Nevertheless, it additionally entails greater dangers. The legality of margin buying and selling, particularly altcoin and Bitcoin margin buying and selling within the US, is a posh situation, so, in the event you’re contemplating partaking in such a exercise, it’s essential to know the authorized panorama and potential dangers.

On this article, we’ll discover the legality of margin buying and selling and crypto leverage buying and selling within the USA, together with the rules and restrictions in place, and supply some suggestions that will help you navigate this advanced terrain.

Crypto Leverage Buying and selling within the US: Key Takeaways

Margin buying and selling lets you commerce extra funds than you personal by borrowing a conventional or a crypto asset out of your dealer.

Crypto leverage buying and selling is authorized within the US, however regulation varies from state to state.

The transaction charges related to crypto margin buying and selling sometimes contain platform charges, community and transaction prices, and doable liquidation charges.

The perfect crypto leverage buying and selling platforms within the US are Kraken, Coinbase Professional, and Poloniex.

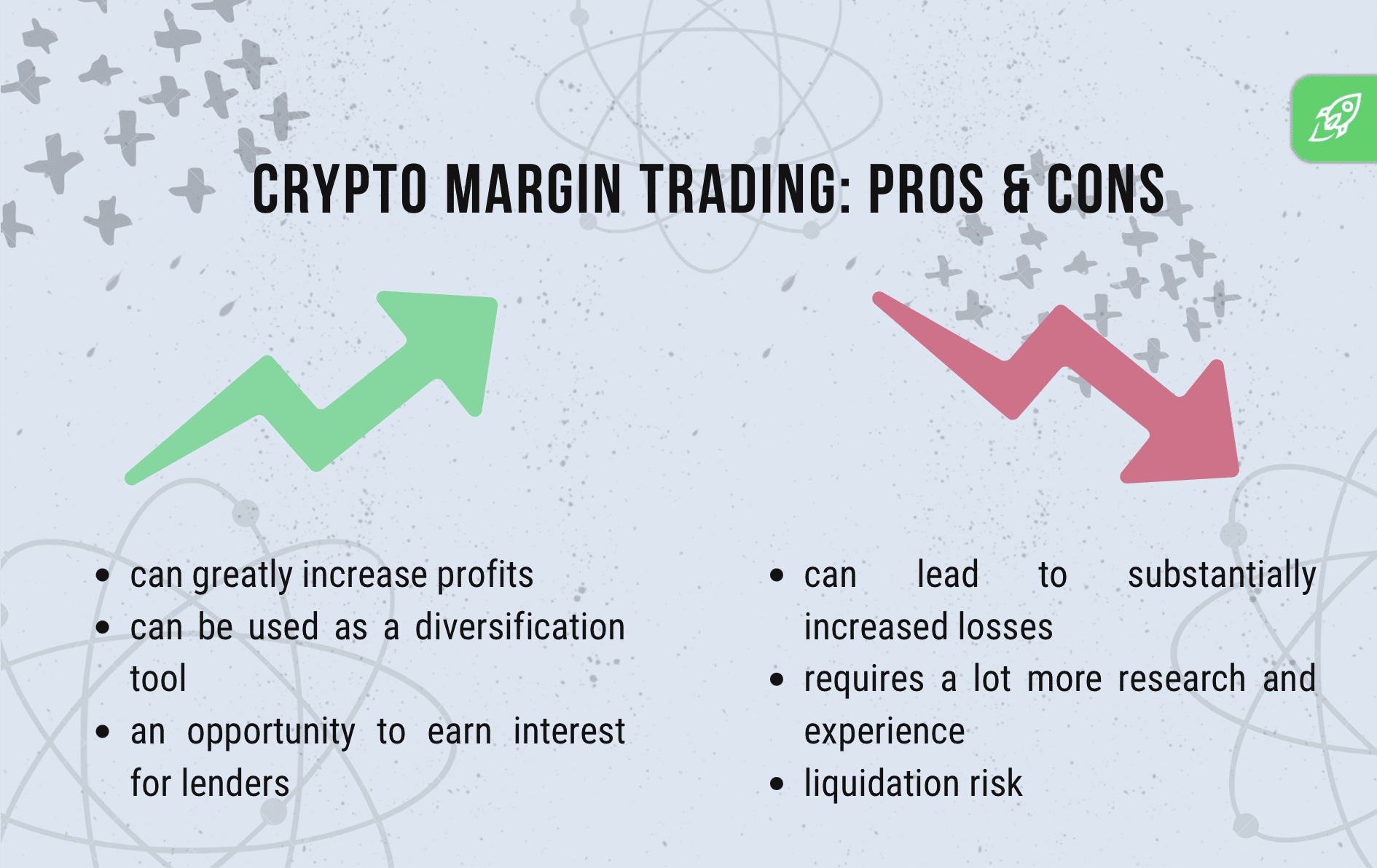

A number of the dangers concerned in margin buying and selling embody margin calls and liquidation, each of which might trigger monumental losses.

What Is Margin Buying and selling?

Margin buying and selling is a complicated buying and selling technique that enables cryptocurrency merchants to open positions with extra funds than they really have. It really works by borrowing funds from a dealer or an change. Primarily, a dealer deposits a certain quantity of funds as collateral, and the platform lends the dealer further funds to extend their shopping for energy, permitting them to take bigger positions than they’d be capable to in any other case.

One of many principal advantages of margin buying and selling is the power to extend revenue potential. With leverage, merchants can amplify their positive factors by taking bigger positions available in the market. That is significantly helpful within the extremely unstable world of cryptocurrencies, the place costs fluctuate quickly, and merchants can earn greater income by well-timed trades.

You’ll be able to be taught extra about crypto margin buying and selling on this article.

Is Cryptocurrency Margin Buying and selling Authorized within the USA?

Sure, you possibly can commerce leveraged tokens within the US, nevertheless it’s not as simple as in different international locations attributable to strict rules.

US residents who want to take part in margin buying and selling of cryptocurrencies should accomplish that on regulated exchanges that adjust to the rules set forth by supervisory authorities such because the Commodity Futures Buying and selling Fee (CFTC) and Nationwide Futures Affiliation (NFA). These embody licensed futures fee retailers (FCMs) and registered introducing brokers (IBs) who supply leverage buying and selling.

The CFTC has categorised cryptocurrencies, together with Bitcoin and Ethereum, as commodities, therefore they fall below the jurisdiction of their regulatory mandate. This regulatory physique has enacted a number of rules that exchanges should observe to function as respectable margin buying and selling service suppliers for US residents.

Moreover, regulated exchanges should present clear steering on particular margin necessities and most leverage limits for every buying and selling pair. This data helps crypto merchants make knowledgeable selections in regards to the dangers of margin buying and selling and their potential losses when collaborating within the cryptocurrency market.

What About Crypto Leveraged Buying and selling in Different Nations?

In the UK, the Monetary Conduct Authority (FCA) has taken a agency stance in opposition to the sale of crypto derivatives to retail shoppers, banning such actions in 2020. This contains leveraged tokens and crypto futures, though margin buying and selling for different monetary devices stays permitted below strict rules. The FCA has targeted on defending retail buyers from the excessive dangers related to buying and selling with leverage, particularly in unstable markets like crypto, the place the potential for sudden and important losses might be excessive.

In Canada, the Canadian Securities Directors (CSA) have applied a extra cautious method, banning margin buying and selling on crypto platforms solely in 2022, reflecting issues in regards to the inherent volatility and threat of liquidation that may happen when leveraging crypto belongings.

These international regulatory modifications have pressured main exchanges to adapt, usually by geofencing expertise to limit entry in areas with stricter guidelines or, in some instances, exiting markets solely, as seen with Binance’s withdrawal from Canada in 2023. As rules proceed to tighten, merchants have to be more and more conscious of the dangers concerned in leverage commerce crypto, perpetual contracts, and different leveraged merchandise, in addition to the potential for liquidation if markets flip in opposition to their buying and selling positions.

The Greatest Leverage Buying and selling Crypto Brokers within the US

Listed here are a few of the finest crypto leverage buying and selling platforms. Please be aware that a few of them aren’t out there to customers positioned within the US or might limit some options.

Kraken.com – General Greatest Crypto Leverage Buying and selling Platform

In case you are a US citizen excited about margin buying and selling cryptocurrencies, Kraken.com is the platform for you. Kraken is a number one crypto change and margin dealer that gives customers with a excessive stage of safety, a user-friendly interface, a wide range of buying and selling pairs, low buying and selling charges, and as much as 5x leverage.

Safety is a high precedence for Kraken. That’s the reason they make use of numerous measures to maintain person funds and private data protected. Kraken makes use of two-factor authentication, SSL encryption, and chilly storage to guard person accounts and make sure the integrity of knowledge.

Kraken’s buying and selling interface is simple to make use of and navigate, making it splendid for each skilled merchants and novices. The platform presents a variety of buying and selling pairs with fiat currencies and cryptocurrencies, permitting merchants to diversify their portfolios and benefit from market alternatives.

By way of charges, Kraken expenses a few of the lowest buying and selling charges within the business. Moreover, Kraken presents many margin buying and selling choices, together with small leverage, which offers a stage of safety in opposition to potential losses, in addition to bigger commerce positions with as much as 5x leverage. All in all, merchants can select the leverage best suited for his or her buying and selling technique and threat profile.

Binance – Main Crypto Derivatives Buying and selling Platform

Binance presents a sturdy margin buying and selling platform that enables customers to commerce with borrowed funds, growing their publicity and potential income. With cross margin and remoted margin buying and selling choices, customers can entry varied leverage ratios relying on their threat tolerance and buying and selling technique. Binance helps leveraged buying and selling on quite a few cryptocurrencies with versatile leverage choices, as much as 10x for cross margin and 100x for futures contracts.

Merchants can simply monitor their positions utilizing superior technical indicators, making certain that they meet the required preliminary margin and upkeep margin. Binance’s platform can also be built-in with each spot and derivatives markets, providing a seamless expertise throughout totally different buying and selling merchandise.

Whereas Binance’s international platform presents intensive leverage buying and selling options, Binance.US offers restricted companies, primarily targeted on spot buying and selling with no margin buying and selling choices attributable to US rules. For merchants exterior the US, Binance stays the best choice attributable to its aggressive leverage buying and selling charges, excessive liquidity, and user-friendly interface.

eToro – Consumer-Pleasant Crypto Buying and selling Platform

eToro is a social buying and selling platform providing a mix of spot buying and selling and restricted leverage buying and selling choices. Identified for its intuitive interface and intensive instructional sources, eToro additionally offers margin buying and selling with decrease leverage ratios than some opponents.

US residents have entry to eToro for spot markets, however margin buying and selling choices are restricted. It’s splendid for merchants with decrease threat tolerance and smaller preliminary investments because of the platform’s deal with simplifying crypto trades for brand new market individuals. Taker charges and different prices stay aggressive, permitting merchants to steadiness threat with potential returns.

BYDFI – Versatile Crypto Leverage Buying and selling Platform

BYDFI is a rising crypto platform providing leveraged trades with as much as 125x leverage on crypto. This platform helps margin accounts, perpetual futures contracts, and varied leverage ratios, making it appropriate for merchants with greater threat tolerance. BYDFI offers an easy interface, accessible instructional sources, and buying and selling futures with a low preliminary margin. The platform’s strong safety measures and aggressive buying and selling charges have attracted market takers.

Different Leverage Crypto Buying and selling Platforms

BitMEX focuses on high-leverage buying and selling with as much as 100x leverage on derivatives and futures contracts. It’s not accessible to US residents.

Phemex presents crypto futures with as much as 100x leverage. US merchants might face restrictions.

Coinbase Worldwide shouldn’t be out there within the US. Coinbase presents spot markets and futures buying and selling with restricted leverage choices. Aggressive buying and selling charges and a user-friendly platform make it appropriate for novices.

KuCoin presents derivatives buying and selling and leveraged trades however shouldn’t be out there to US residents for margin buying and selling.

Bybit is understood for derivatives buying and selling with excessive leverage ratios, although it restricts entry for US merchants.

Every of those platforms presents varied leverage ratios, buying and selling charges, and safety features, so merchants ought to assess primarily based on their methods, threat tolerance, and availability within the US.

What Are the Charges Associated to Crypto Margin Buying and selling within the USA?

One of many principal charges related to margin buying and selling is platform charges. These charges cowl the price of utilizing the platform and the margin buying and selling service offered by the change. Some exchanges cost a proportion of the commerce quantity as a charge, whereas others cost a hard and fast fee. Merchants ought to analysis the platform charges and take them into consideration when making margin trades.

Margin buying and selling charges are divided into maker and taker charges. Maker charges are charged when a dealer provides liquidity to the order e-book by putting an order that isn’t instantly matched (e.g., a restrict order). Taker charges apply when a dealer removes liquidity by executing an order that matches an current one (e.g., a market order). Maker charges are sometimes decrease to incentivize including liquidity to the change, whereas taker charges are typically greater as they cut back out there liquidity. These charges can considerably impression the profitability of margin trades and ought to be thought-about rigorously.

Merchants may additionally incur liquidation charges. Liquidation charges are charged if a margin place is closed attributable to a scarcity of funds or margin upkeep. These charges can range relying on the change and the scale of the place.

You must also contemplate the corresponding community and transaction prices related to the underlying blockchain. These prices aren’t immediately associated to margin buying and selling charges, however they will impression the general value of margin buying and selling. Blockchain community charges are charged for transacting on the blockchain and are sometimes dynamic and rely on community congestion.

Grow to be the neatest crypto fanatic within the room

Get the highest 50 crypto definitions it’s worthwhile to know within the business at no cost

What to Search for in a Crypto Leverage Buying and selling Platform

When selecting a crypto leverage buying and selling platform, a number of elements ought to be thought-about to make sure it meets your buying and selling wants successfully:

1. Cross Margin Buying and selling and Margin Account Choices: Search for platforms that provide each cross margin buying and selling and remoted margin accounts. Cross margin permits merchants to share their out there margin throughout a number of buying and selling positions, lowering the danger of liquidation, whereas remoted margin limits the margin to a single place for higher threat administration.

2. Leverage Ratio: Totally different platforms supply various leverage ratios, usually starting from 5x to 100x. Select a platform that gives leverage ratios appropriate to your threat tolerance and buying and selling technique. Greater leverage permits for bigger publicity with a smaller preliminary funding but will increase the potential for important losses.

3. Futures Contracts: A very good platform ought to supply varied forms of futures contracts, together with perpetual futures that shouldn’t have an expiry date. This enables for larger flexibility in executing long-term and short-term trades with leverage.

4. Buying and selling Quantity: Excessive buying and selling quantity on a platform signifies liquidity, which is essential for coming into and exiting trades rapidly, particularly when utilizing leverage. Platforms with bigger volumes assist guarantee your trades are executed with out important slippage, a crucial facet in leveraged positions.

5. Superior Buying and selling Instruments: Superior buying and selling instruments corresponding to technical indicators, automated buying and selling bots, and threat administration options are important for profitable leverage buying and selling. They assist merchants handle advanced methods and monitor their positions extra successfully.

6. Preliminary Funding Necessities: Test the platform’s minimal margin necessities for opening leveraged positions. Some exchanges enable small preliminary investments to begin buying and selling with leverage, whereas others may require the next quantity.

7. Leverage Buying and selling Charges: Do not forget that respected platforms will all the time have a transparent and clear charge construction with no hidden charges.

By contemplating these elements, you possibly can choose a crypto leverage buying and selling platform that aligns together with your buying and selling targets and threat administration wants.

Dangers Related to Margin Buying and selling

Margin buying and selling might be an efficient device for knowledgeable merchants to amplify their income within the extremely unstable cryptocurrency market. Nevertheless, the usage of leverage additionally exposes merchants to potential dangers and losses. On this part, we are going to define varied dangers related to margin buying and selling within the US and supply insights on how merchants can mitigate these dangers to enhance their possibilities of success.

The Horrendous Margin Calls

Margin buying and selling might be an efficient technique for knowledgeable merchants trying to amplify their positive factors within the crypto market. Nevertheless, it comes with a major stage of threat and accountability. Some of the feared facets of margin buying and selling is the margin name.

A margin name happens when the worth of a dealer’s belongings falls beneath the minimal margin requirement set by the change. This minimal requirement is the bottom quantity of fairness {that a} dealer wants to take care of of their account relative to their leveraged place. If the worth of the underlying asset decreases considerably, the fairness within the dealer’s account might not meet the minimal margin necessities.

When a margin name is triggered, the dealer will obtain a notification from the change so as to add extra funds to their account to take care of the minimal margin requirement. If the dealer fails to high up their account, the change might liquidate their place, promoting off their belongings to cowl the margin necessities.

This is usually a devastating blow, leading to important losses that may wipe out a dealer’s total account. To keep away from being caught in a margin name, it’s important for merchants to have a stable understanding of the margin necessities and to implement threat administration methods.

One of many threat administration methods is to all the time set stop-loss orders to stop important losses. Moreover, merchants can think about using decrease ranges of leverage and buying and selling solely with funds that they will afford to lose in case of a margin name.

It’s price noting that margin calls aren’t unique to crypto buying and selling. They happen in conventional markets as properly, and the implications might be simply as extreme. Subsequently, merchants should all the time follow warning and make use of methods that reduce threat whereas maximizing positive factors.

Liquidation of Collateral

When partaking in common and crypto margin buying and selling, it’s necessary to know the idea of collateral and the way it elements into the liquidation course of. When a dealer opens a leveraged place, they need to deposit collateral. This collateral serves as a assure that the dealer can cowl their potential losses.

If the worth of the dealer’s belongings begins to say no and falls beneath the minimal margin requirement set by the change, they could obtain a margin name. Which means they’re required so as to add extra collateral. In any other case, they threat having their place liquidated.

Liquidation happens when a dealer’s collateral can not cowl their losses, and the change or brokerage closes their place and sells their collateral to repay the borrowed funds. In easier phrases, the dealer’s belongings are offered off to assist offset their losses.

The method of liquidation is usually influenced by change insurance policies and the dealer’s actions. The change could have particular insurance policies and procedures to find out when a dealer’s place ought to be liquidated. These insurance policies will normally rely on elements corresponding to minimal margin necessities, the volatility of the belongings in query, and the scale of leverage used.

Talking of a dealer’s actions, they will additionally contribute to the probability of their place being liquidated. For instance, if a dealer makes use of important leverage or fails to take care of ample collateral of their account, they’re at the next threat of getting their place liquidated.

Leverage Buying and selling Crypto (USA) FAQ

Is margin buying and selling crypto dangerous?

Sure, margin buying and selling in crypto is dangerous. It’s like betting more cash than you may have on a race. In case your prediction is improper, you would lose your cash rapidly.

What’s 10x leverage in crypto?

10x leverage in crypto means you’re betting ten occasions the amount of cash you even have. When you’ve got $100 and use 10x leverage, you’re buying and selling with $1,000, aiming for greater wins but in addition dealing with the danger of bigger losses.

Does Binance US help margin buying and selling?

No, as of March 2024, Binance doesn’t supply margin buying and selling companies.

Can US merchants use leverage?

Sure, US merchants have entry to leverage when buying and selling sure monetary devices, corresponding to futures contracts, choices, and margin accounts provided by regulated brokers. Nevertheless, the provision and particular rules surrounding leverage might range relying on the monetary product and the dealer/platform getting used.

Can US residents commerce crypto on margin?

Sure, US residents can commerce cryptocurrencies on margin. Some cryptocurrency exchanges and buying and selling platforms, each inside and outdoors the US, supply margin buying and selling companies to eligible customers, together with US residents. It’s important to adjust to the rules imposed by particular exchanges and to fulfill their necessities, corresponding to minimal fairness thresholds or verification processes.

Can US residents margin commerce on Kraken?

Sure, US residents can interact in margin buying and selling on Kraken. Kraken is a well known and respected cryptocurrency change that gives margin buying and selling companies to eligible customers, together with these from the US.

Are you able to commerce crypto on 100x leverage?

You’ll be able to commerce crypto futures on 100x leverage on the BitMart Futures buying and selling platform. Nevertheless, please understand that that is extremely dangerous, and also you shouldn’t enter trades like that except you might be completely assured you realize what you’re doing. Whereas the potential income you possibly can earn from buying and selling digital belongings on 100x or 50x leverage are excessive, so are the potential losses.

Can you employ buying and selling bots when leverage buying and selling crypto?

Sure, buying and selling bots might be highly effective instruments for crypto leverage buying and selling, automating methods to execute trades primarily based on predefined guidelines and market situations.

In leverage buying and selling, the place positions are amplified utilizing borrowed funds, bots can supply important benefits by reacting rapidly to market fluctuations, thus minimizing human errors and emotional decision-making. Nevertheless, they need to be used with a transparent understanding of the underlying dangers and buying and selling methods.

Disclaimer: Please be aware that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.