Bitcoin’s 2025 value motion has been something however clean, however one group of traders has quietly dominated the yr’s revenue statistics. Quick-term holders, that are labeled as addresses holding BTC for just one to 3 months, spent a lot of the yr within the inexperienced amidst the push to a number of all-time highs and ensuing drawdowns all year long.

On-chain information from 2025 now offers a clearer reply as to if short-term publicity to Bitcoin truly paid off for holders, though situations look far much less snug on the time of writing.

Quick-Time period Holders Spent Most Of 2025 In Revenue

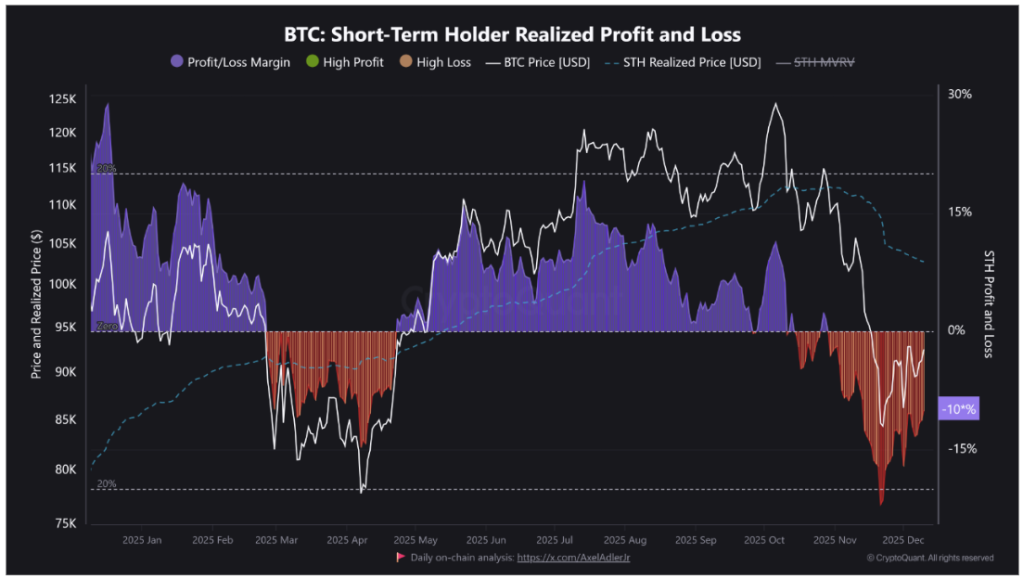

In response to information from on-chain analytics platform CryptoQuant, Bitcoin short-term holders have been in a worthwhile place for roughly two-thirds of 2025. On-chain revenue and loss information reveals that this cohort was in revenue for about 66% of buying and selling days, which interprets to about 230 buying and selling days.

Throughout the first half of 2025, Bitcoin’s value continuously traded above the common realized value of short-term holders, permitting current patrons to lock in positive aspects at the same time as volatility remained elevated. This sample grew to become particularly seen throughout mid-year rallies, when Bitcoin pushed above the $100,000 area and short-term revenue margins expanded sharply.

Every time the worth reclaimed ranges above the short-term realized value, realized positive aspects dominated the distribution. Again in January, Bitcoin maintained a place above the short-term value foundation for practically two consecutive months, creating the primary prolonged window of sustained profitability for this cohort in 2025.

The same, and much more pronounced, part unfolded between Might and October, when short-term holders sat on substantial unrealized positive aspects. Throughout this era, the profit-and-loss margin climbed as excessive as 20 % in July, coinciding with Bitcoin’s first breakout above $115,000. Throughout this era, Spot Bitcoin ETFs have been witnessing enormous institutional inflows that cancelled out any profit-taking from short-term holders.

BTC: STH Realized Revenue and Loss. Supply: CryptoQuant

Present Image Reveals Quick-Time period Holders Underwater

That favorable backdrop has turned into losses in current weeks. On the time of writing, Bitcoin is buying and selling across the low-$90,000 vary, whereas the short-term holder realized value is simply above $100,000. This locations the present revenue/loss margin at a lack of about 10%.

Curiously, this margin just lately fell to as little as detrimental 20% when the Bitcoin value broke under $85,000 in November, which is the deepest loss regime for short-term holders in 2025.

Nonetheless, the 2025 information reveals that short-term holding was worthwhile for a lot of the yr, however the outlook shouldn’t be favorable proper now. Structurally, these deep loss pockets often present up nearer to the late levels of a correction than the early ones.

Proper now, an important factor for short-term holders is for Bitcoin to reclaim the short-term realized value and push again above $100,000. Till then, short-term holders will keep beneath strain, even with the yearly statistics leaning of their favor.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.