The Day by day Breakdown takes a take a look at the rebound in tech, particularly throughout the Magnificent 7, as this group is powering the latest rally.

Earlier than we dive in, let’s be sure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our each day insights, all you could do is log in to your eToro account.

Friday’s TLDR

Tech lagged badly in Q1

However it has led the latest rally

What’s Taking place?

At one level, tech was one of many worst-performing sectors within the S&P 500 this 12 months, down greater than 10%. Whereas tech continues to be down on the 12 months — decrease by about 1.5% — it’s not scraping the underside of the sector-performance barrel.

(Sadly, that belongs to the power, healthcare, and client discretionary sectors, all three of that are down about 5% to date in 2025).

The rebound in tech may be attributed to the Magnificent 7. Aside from Apple, each holding within the Magazine 7 is outperforming the S&P 500 over the previous month — and bear in mind, about 30% of the S&P 500 is tech.

Nvidia, Tesla, Microsoft and Meta have been main leaders amid the latest rally, significantly Microsoft and Nvidia given their measurement (with a mixed market cap of greater than $6.6 trillion).

The year-to-date readings are a bit of lumpy, highlighting the robust efficiency from this group in Q1, whereas the one-year efficiency is blended; a mixture of huge outperformers, and some gentle under-performing stragglers.

The information doesn’t inform the entire story, both.

As an illustration, TSLA stays almost 30% beneath its report excessive, almost twice as a lot as the following worst-performer by that metric — Alphabet. Actually, 5 of the Magazine 7 parts are down greater than 10% from their report highs, whereas the S&P 500 is down rather less than 5% from its report.

The Backside Line: It’s been a troublesome stretch for mega-cap tech, each in Q1 2025 and after we look again over the previous few quarters (observe: solely three Magazine 7 names have outperformed the S&P 500 over the previous 12 months).

Like the general market, these shares are liable to volatility. Nevertheless, if this group maintains momentum, it’s doable that the Magnificent 7 nonetheless has room to the upside provided that many are nonetheless down notably from their highs. And in the event that they proceed to rally, this group may very nicely buoy US shares, given their outsized weighting within the indices.

Wish to obtain these insights straight to your inbox?

Join right here

The Setup — Amazon

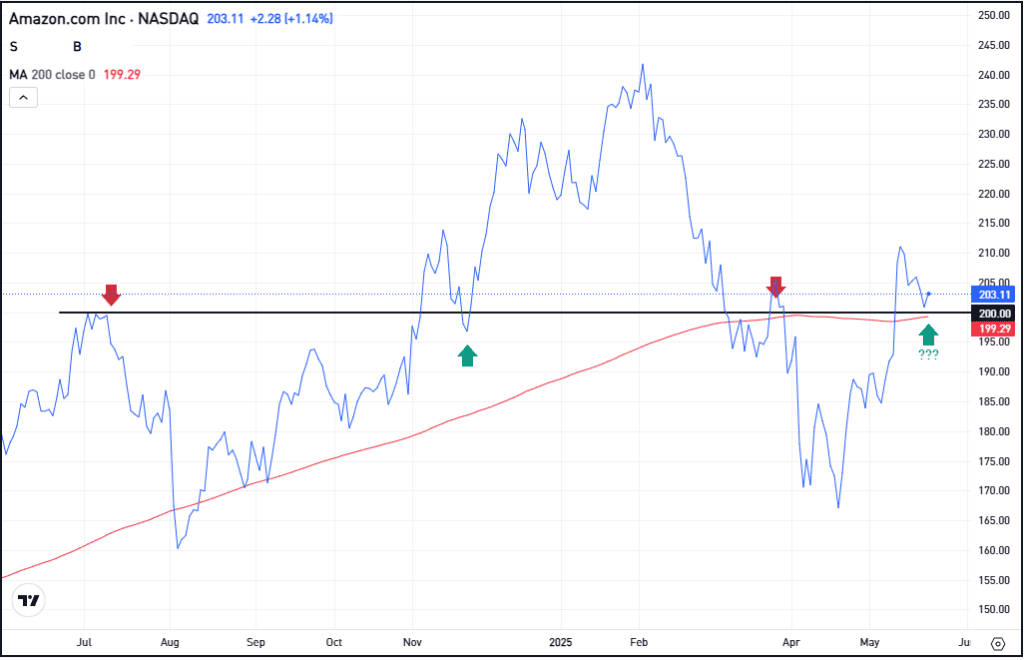

The one inventory we didn’t point out above? Amazon. And curiously, its chart actually stands out. That’s as shares have loved a robust rebound from the latest lows, up about 25%, however have since pulled again to search out help close to $200.

Not solely is $200 a key technical space on the charts — having served as each help and resistance prior to now — but it surely’s close to the place the 200-day shifting common additionally comes into play.

Amazon was in deal with Thursday on stories that Invoice Ackman’s Pershing Sq. acquired a place within the inventory.

Whereas Amazon has finished nice these days, take into account simply how far the inventory fell from its excessive in Q1. Actually, shares are nonetheless down greater than 16% from the highs.

Bulls wish to see the inventory maintain close by help (~$200 and the 200-day). If AMZN can try this, traders will hope for extra upside within the coming weeks. If help doesn’t maintain, extra draw back is feasible.

It’s essential to notice that, simply because help holds, doesn’t essentially imply AMZN will hurry again to report highs. Nor does it imply that failure to carry this degree will ship shares again to the latest low. The $200 space is only one spot on the chart for lively traders to control.

Choices

That is one space the place choices can come into play, as the chance is tied to the premium paid when shopping for choices or possibility spreads.

Bulls can make the most of calls or name spreads to invest on a rebound, whereas bears can use places or places unfold to invest on extra draw back ought to help break.

For these seeking to be taught extra about choices, take into account visiting the eToro Academy.

Disclaimer:

Please observe that attributable to market volatility, a number of the costs could have already been reached and situations performed out.