With crypto staking gaining mainstream traction, asset managers are exploring methods to package deal staking rewards into regulated funding merchandise like exchange-traded funds (ETFs). However not all blockchains are suited to the job.

Bitwise CEO, Hunter Horsley, showing on the Singapore Token2049 occasion, agreed with that sentiment and opined that Solana

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

2.02%

Solana

SOL

Worth

$225.15

2.02% /24h

Quantity in 24h

$7.84B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘top’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘top’);

svg.css({‘width’: ‘100%’, ‘top’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Study extra

might have an edge over ETH

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

1.46%

Ethereum

ETH

Worth

$4,401.18

1.46% /24h

Quantity in 24h

$31.75B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘top’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘top’);

svg.css({‘width’: ‘100%’, ‘top’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Study extra

crypto staking.

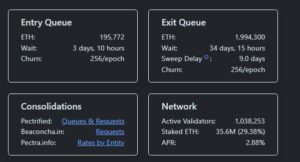

The important thing distinction lies in how shortly staked property will be withdrawn.

ETH staking struggles with sluggish withdrawals when the community will get busy. In early September, over 860,000 ETH have been ready to be staked, the very best in over a 12 months. That quantity has dropped to round 202,000 ETH with a three-day wait, however getting your staked ETH again nonetheless takes for much longer.

(Supply: Validator Queue)

Solana, however, affords quicker unstaking, permitting customers to return investor funds extra shortly. It is a essential requirement for ETF suppliers who’ve to fulfill redemption timelines.

Bitwise CEO Hunter Horsley highlights Solana's benefit over Ethereum within the staking ETF race, due to its shorter unstaking interval. Consumer sentiment has proven fluctuating preferences between the 2, with Solana gaining traction just lately, indicating its potential enchantment as a…

— Gaal (@Gaal_ai) October 2, 2025

Staking means locking up crypto to assist the community and earn rewards. However as soon as locked, it’s tougher to entry shortly. That’s an issue for ETFs and different funding merchandise that want quick entry to funds.

“It’s an enormous downside,” Horsley mentioned. “ETFs want to have the ability to return property on a really quick time-frame. So it is a large problem,” he added.

Solana’s design, with shorter unstaking durations and smoother withdrawal mechanics because of this, might give it a sensible edge as staking ETFs evolve.

(Supply: Solana Validators)

Nevertheless, as with every little thing, there are workarounds accessible. Horsley talked about Bitwise’s ETH staking product in Europe, which makes use of a credit score facility to maintain investor redemption liquid. This feature, nonetheless, doesn’t come low cost and in addition has restricted scalability.

He additionally talked about utilizing liquid staking tokens like Lido’s ETH. These tokens characterize staked Ethereum and let buyers keep liquid whereas nonetheless incomes rewards.

EXPLORE: High 20 Crypto to Purchase in 2025

What Does The Prediction Market Suppose?

Nicely, the predictions market has spoken on this matter, and the decision is considerably sophisticated. With ETH gaining momentum, customers on the Myriad market are giving it a 62% likelihood of hitting $5,000 earlier than falling to $3,500.

(Supply: Myriad Markets)

That’s a pointy rise from simply 32% final week. From the place

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

1.46%

Ethereum

ETH

Worth

$4,401.18

1.46% /24h

Quantity in 24h

$31.75B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘top’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘top’);

svg.css({‘width’: ‘100%’, ‘top’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Study extra

is buying and selling proper now, it wants lower than a 15% push to achieve its new ATH.

7d

30d

1y

All Time

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

2.02%

Solana

SOL

Worth

$225.15

2.02% /24h

Quantity in 24h

$7.84B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘top’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘top’);

svg.css({‘width’: ‘100%’, ‘top’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Study extra

however faces a bit extra resistance. Myriad merchants now see solely a 49.9% likelihood of SOL reaching its earlier peak of $295.11 by this 12 months’s finish.

7d

30d

1y

All Time

With the token at the moment buying and selling at

, it could want a 34% rally. This appears unlikely given its ETF uncertainty and slower adoption price. Simply two weeks in the past, the market was much more optimistic at 67%, however clearly, the feelings have shifted.

EXPLORE: Subsequent 1000X Crypto – Right here’s 10+ Crypto Tokens That Can Hit 1000x This Yr

What Do The Charts Reveal?

ETH’s technical setup is displaying indicators of robust bullish momentum. Its 50-day exponential transferring common (EMA) is buying and selling above its 200-day EMA, signalling a powerful uptrend.

The short-term trendline, nonetheless, reveals a slight downward slope, hinting at a attainable consolidation or a minor pullback.

(Supply: TradingView)

If momentum holds, ETH might attain its ATH by December. If not, a correction in the direction of $3,000 is feasible.

SOL’s value reveals indicators of regular shopping for, but it surely hasn’t locked right into a string pattern but. The present RSI at 53 indicators that patrons are considerably lively, although not as aggressive as ETH.

Proper now, SOL is buying and selling above its 50-day and 200-day EMAs, with prospects of extra upside.

(Supply: TradingView)

The massive unknown issue is its ETF approval. A number of issuers imagine SOL ETF may very well be greenlit as early as subsequent week, which could give its value a serious increase.

Suffice to say, ETH has a neater path to an ATH. It solely wants a 13.8% value soar in comparison with Solana’s 34%. If present momentum holds, ETH might hit its peak inside weeks.

Solana, however, is a wild card. Its value motion has been subdued, however might break if an ETF will get a inexperienced gentle.

EXPLORE: 20+ Subsequent Crypto to Explode in 2025

Key Takeaways

Solana affords quicker unstaking, permitting customers to return investor funds extra shortly

In early September, over 860,000 ETH have been ready to be staked, the very best in over a 12 months

ETH has a greater likelihood at reaching ATH quicker than SOL, though information of a SOL ETF might set off a value surge

The put up Is Solana Is Destined To Beat Ethereum? Can Staking ETFs Set off SOL ATH Earlier than ETH? appeared first on 99Bitcoins.

![[LIVE] Crypto News Today, October 16 – Crypto Crash Continues as Bitcoin Stuck Below $112K, XRP Price at $2.42; Coinbase Lists BNB: What’s the Next Crypto To Explode? [LIVE] Crypto News Today, October 16 – Crypto Crash Continues as Bitcoin Stuck Below $112K, XRP Price at $2.42; Coinbase Lists BNB: What’s the Next Crypto To Explode?](https://blockchainbroadcast.net/wp-content/themes/jnews/jnews/assets/img/jeg-empty.png)