The Israeli Air Pressure launched a sequence of coordinated preemptive strikes late Thursday focusing on dozens of web sites throughout Iran, together with amenities believed to be linked to the nation’s nuclear program. The escalation comes amid rising tensions between the 2 long-time adversaries, with Israeli officers declaring the operation as an try and get rid of Iran’s nuclear risk.

Senior Israeli officers, chatting with Channel 13, mentioned the nation is bracing for “days of battle,” following the aggressive navy marketing campaign aimed toward neutralizing what it calls existential threats. Whereas full particulars of the strikes are nonetheless rising, studies point out that the air raids hit navy installations, analysis amenities, and missile depots.

Market Response: Crypto Takes a Hit

The information instantly despatched shockwaves by means of the worldwide monetary markets, with threat belongings pulling again amid rising geopolitical uncertainty. Bitcoin (BTC) fell sharply by 2% inside an hour of the information breaking, whereas Ethereum (ETH) plunged 4.4% over the identical interval.

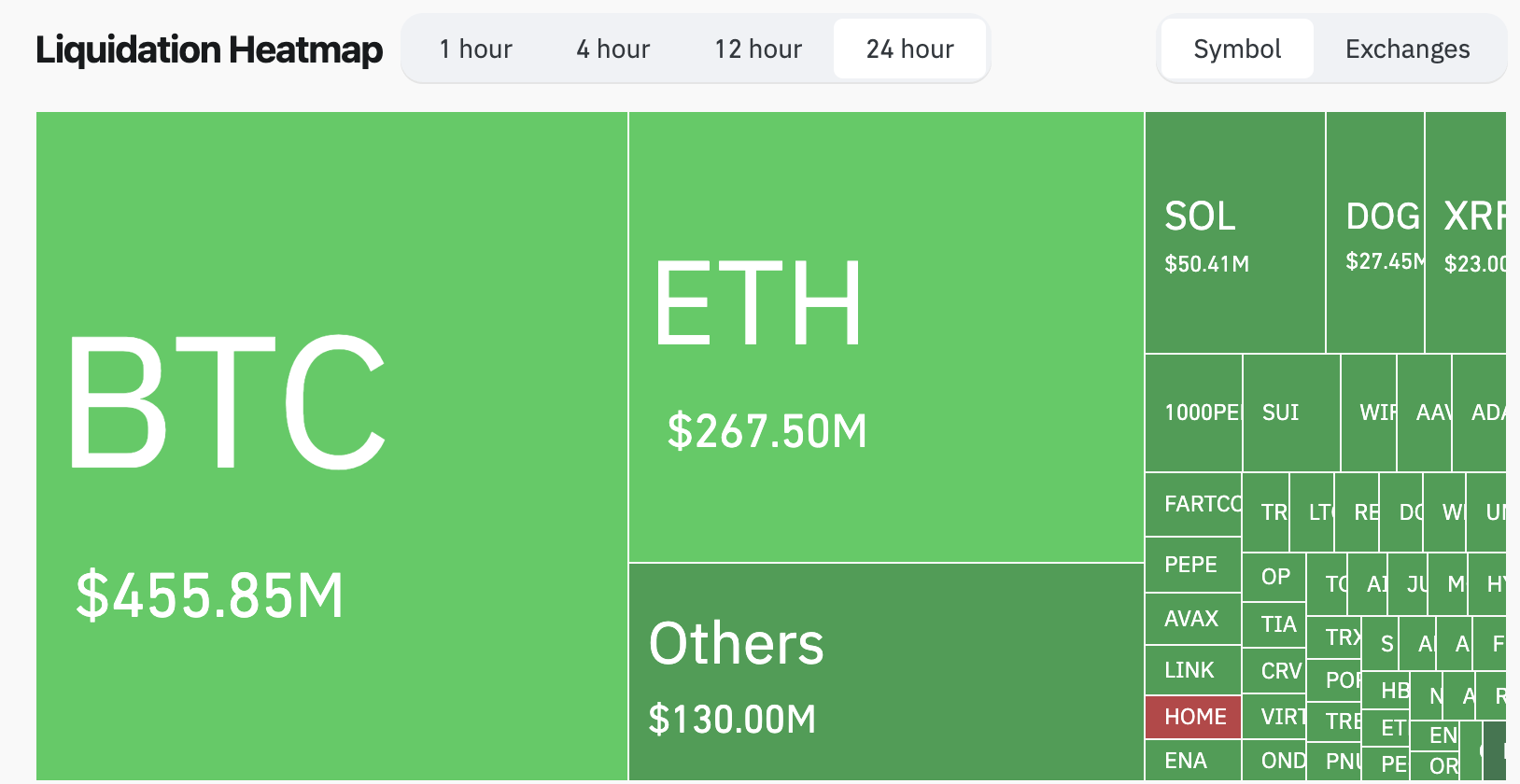

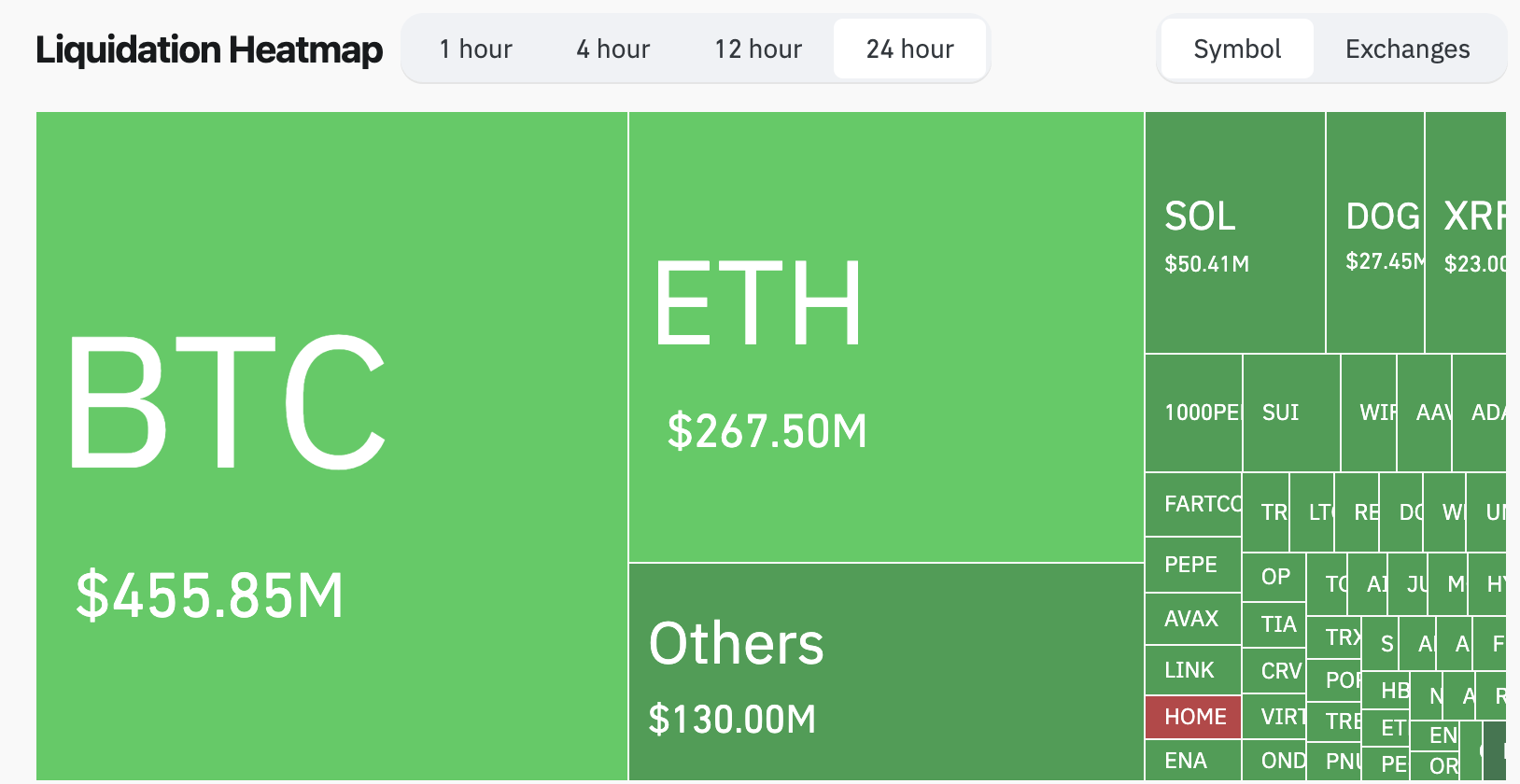

Based on information from CoinGlass, the sudden downturn within the crypto market led to huge liquidations. Prior to now 24 hours, roughly 215,000 merchants have been liquidated, totaling $1.019 billion in positions worn out. Lengthy positions accounted for a staggering $945 million of that whole. The most important single liquidation occurred on Binance’s BTCUSDT pair, with a worth of $201 million.

Supply: CoinGlass

Broader Implications

Whereas conventional fairness markets had closed earlier than the strikes have been confirmed, futures for world indices pointed to a unstable open, with vitality costs more likely to react strongly to any additional escalation within the Center East.

The scenario stays fluid. Worldwide observers and allies are carefully monitoring Iran’s potential response. Tehran has not but issued an official assertion, although Iranian media shops have begun acknowledging the injury.

Analysts warn that any extended battle may inject additional volatility into markets already grappling with inflation considerations, rate of interest uncertainty, and slowing world development.

Navy analysts consider the Israeli operation might not be a one-off. “This isn’t a single-night offensive. We’re trying on the early phases of what might be a protracted navy engagement,” mentioned Amos Harel, protection correspondent for Haaretz.