Key Takeaways:

32 consecutive months of Proof of Reserves (PoR) stories—no different main trade comes shut.KuCoin’s holdings exceed person property: BTC and ETH at 110%, USDT at 114%, and USDC at 112%.Audit carried out by cybersecurity agency Hacken confirms pockets possession and full person fund protection.

As regulatory scrutiny tightens and person skepticism grows, KuCoin is pushing arduous on transparency. Backed by its newest third-party audit, the trade has not solely met business reserve expectations—it has surpassed them. The message is obvious: in a risky market, KuCoin is positioning itself as a fortress of economic integrity.

Proof of Reserves: Why It Issues Now Extra Than Ever

Within the wake of crypto collapses like FTX and Celsius, the phrase “totally backed” is now not a buzzword—it’s a survival requirement. KuCoin is responding by doubling down on Proof of Reserves (PoR), a way used to confirm that each one buyer deposits are matched by precise property held by the trade.

What units KuCoin aside isn’t simply that it conducts PoR audits—it’s that it’s been doing so for 32 consecutive months. That consistency speaks volumes about its inner asset administration self-discipline and operational maturity.

Audit Outcomes That Go Past the Naked Minimal

BTC, ETH, and Stablecoins All Over-Collateralized

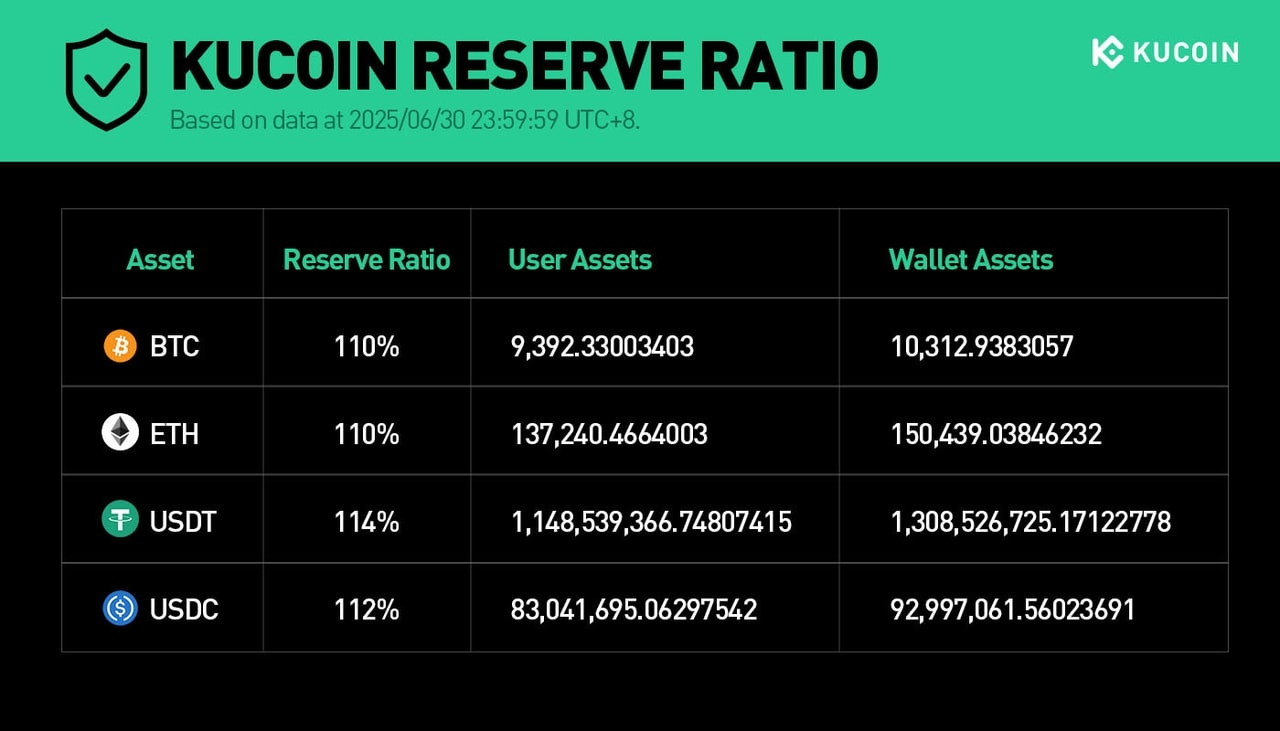

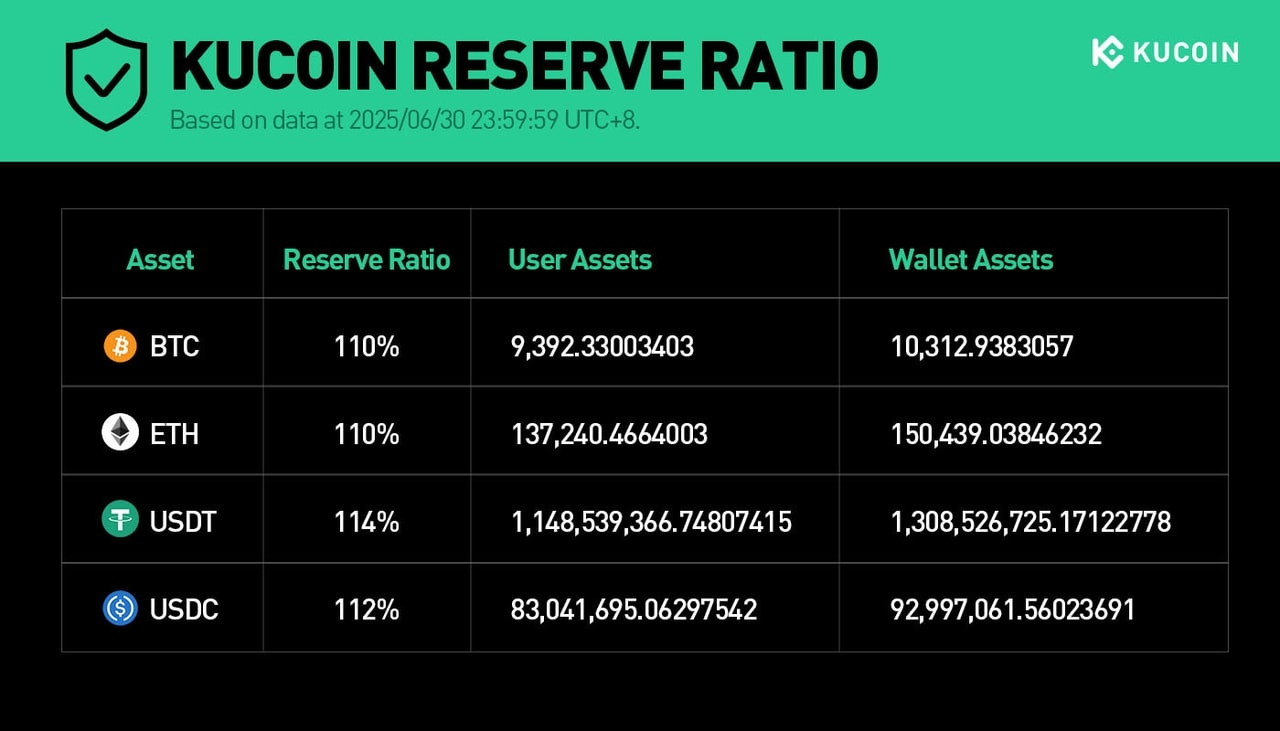

KuCoin’s newest audit—accomplished by Ukraine-based blockchain safety agency Hacken—exhibits overcollateralization throughout all main property. Based on the report (as of June 30, 2025):

Bitcoin (BTC): 110percentEthereum (ETH): 110percentTether (USDT): 114percentUSD Coin (USDC): 112%

In actual phrases what this implies, is that KuCoin holds extra of every specific asset than customers have deposited. For instance, if customers deposited a complete of 9,392 BTC, the trade holds 10,312 BTC in reserve. This shields the platform from value oscillations, liquidity shortfalls and sudden withdrawals.

The Hacken Course of—Full-Scope Verification

The third-party audit was not merely a rudimentary checkbox train. Hacken Methodology A mixture of Proof of Liabilities, Proof of Possession, and Reserve Calculation strategies on greater than 30 blockchain networks:

It’s vital to notice that Hacken found no discrepancies, verifying KuCoin’s inner accounting and confirming that each one wallets are certainly a part of the trade.

Person Transparency in Observe

Not identical to different platforms the place it’s darkish to the group however KuCoin permits their group to validate its reserves themselves via the Merkle Tree-based device out there of their Proof of Reserves web page. This operate permits customers to confirm that their particular balances are a part of the reserve calculations — and not using a privateness breach.

Transparency like that is uncommon, even on the high of the business. Certainly, a number of exchanges postpone or just refuse to publish PoR stories– due to “operational causes” or “authorized issues” as they’re fast to say.

Learn Extra: KuCoin Alternate Assessment: Execs and Cons, Charges and Security

The $2 Billion Belief Challenge and What’s Subsequent

The latest audit is way over a one-off occasion–it’s a part of KuCoin’s bigger $2 billion Belief Challenge, a concerted effort to:

Strengthening third-party verificationRising reserve transparencyEnhancing wallet-level safetyUpgrading inner infrastructure

This plan places KuCoin forward within the race of credibility and long-perspective methods. Based on CEO BC Wong, “This audit isn’t nearly compliance—it’s about setting a precedent. Belief, transparency, and person safety should outline the subsequent period of crypto.”

World Person Base and Recognition

Presently, KuCoin has over 41 million customers on board all world wide and it additionally offers quite a lot of providers past spot buying and selling, together with:

Crypto walletsFee infrastructureWealth administration instrumentsAI-based buying and selling programs

The trade has additionally been praised by Forbes and Hurun Media, who’ve famous the user-first nature of its safety insurance policies.

Learn Extra: KuCoin Surpasses 40 Million Customers, Securing World Enlargement and Compliance Dedication

Towards Trade Self-Regulation

Past compliance, KuCoin helps drive what many consider would be the business’s subsequent evolution: self-regulated safety requirements.

By going above and past what regulators at present demand—and doing so constantly—KuCoin is setting a brand new commonplace that others might quickly be compelled to observe.

Audits such because the one carried out by Hacken might sometime be regulated, like if the EU or Singapore made them a requisite. However for the second, KuCoin is taking the lead willingly — and reaping the fame advantages.