Till lately, most builders considered the Ethereum mainnet as this unscalable but irresistibly enticing layer on which it was inconceivable to launch a purposeful perpetual DEX. Ethereum has every thing. It’s the second most dear community after Bitcoin and the primary sensible contracts platform. After dYdX, there was no different main perpetual DEX on Ethereum till Lighter took over from Q3 2025.

Lighter is shifting numbers; massive numbers taking up prime centralized exchanges, and shortly Binance. As of October 9, Lighter generated over $8.5Bn in buying and selling quantity in 24 hours. On this platform, merchants are putting leveraged positions. Cumulatively, there may be over $2.2Bn in open curiosity positioned on 91 totally different pairs, some enabling the buying and selling of among the finest cryptos to purchase.

(Supply: Coingecko)

As anticipated, over 50% of all buying and selling quantity is related to Bitcoin, whereas 20% is from the ETH USDC pair. Though BNB crypto is the third most dear crypto when writing, merchants are putting extra HYPE and SOL trades than BNB.

7d

30d

1y

All Time

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in 2025

What Makes Lighter DEX Tremendous Enticing

If you’re simply another retail dealer, the very first thing it would be best to know is the price paid when seeking to clip positive aspects, even from the prime Solana meme cash.

On Binance, putting a market order means paying a complete price of 0.08%: 0.04% to open and one other 0.04% to shut. This cost is outrageously excessive.

Binance costs an excessive amount of charges for Future Buying and selling, it’s important to set limits for small traders. For instance individuals who commerce >$500 it’s possible you’ll cost $1.5 most and for large traders<$500 it’s possible you’ll repair costs accordingly. That is an excessive amount of. Purchase Charges Promote Charges pic.twitter.com/lVnEtqVcgf

— Cryptozap (@CrazyCryptozap) August 21, 2025

When putting a BTC USDT place on the platform, assuming a modest 50X leverage, the commerce shall be at break-even provided that the Bitcoin worth ticks increased by a minimum of $90. For scalpers, it is a enormous obstacle.

Lighter DEX modifications this. Retail merchants don’t need to pay a cent. It’s free to position a market or a restrict order. What’s extra? Although Lighter DEX is absolutely non-custodial, critics might need complained about technical hitches and scaling issues.

To resolve this and guarantee transactions are all the time processed as quick as they’d on Binance, Bybit, or Coinbase, Lighter processes tens of 1000’s of orders and cancellations each second with sub-millisecond latency.

The superior transaction processing throughput is because of Lighter’s use of zero-knowledge infrastructure, which handles 1000’s of operations effectively with out compromising decentralization.

Lighter batches all orders and settle them on the Ethereum mainnet, successfully staying true to Ethereum’s ecosystem whereas avoiding liquidity fragmentation.

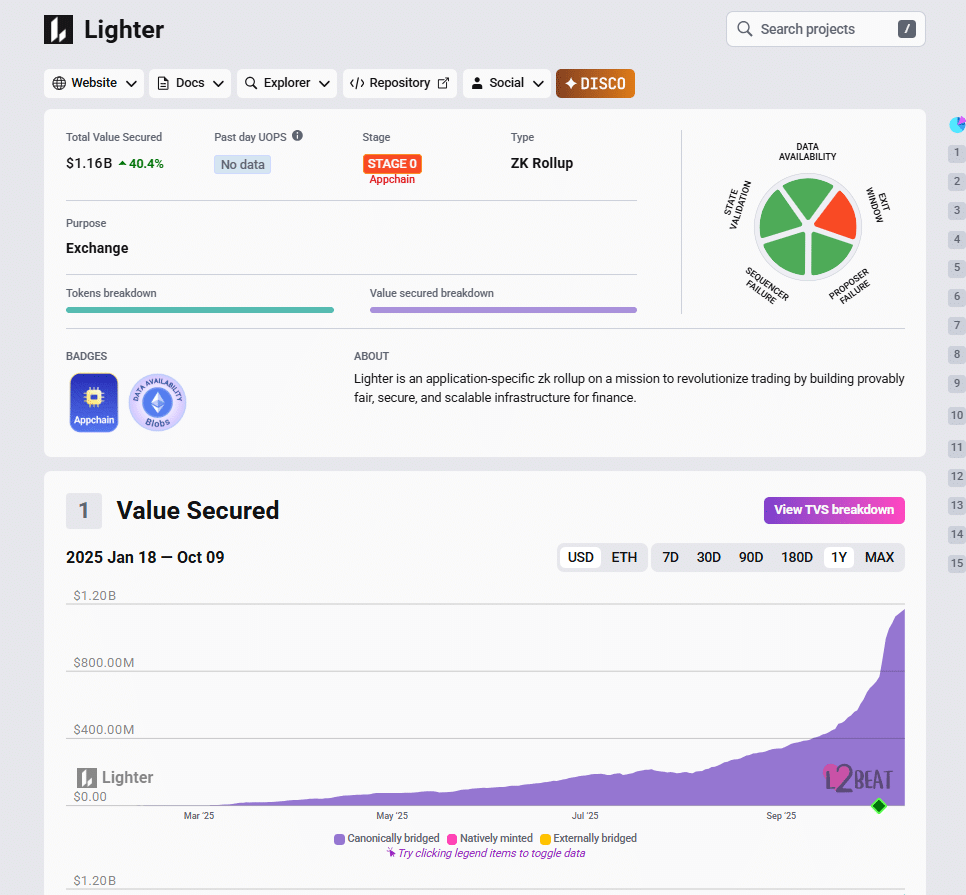

Already, in response to L2Beat, Lighter has a TVL of over $1.1Bn, roughly up 2000X from late March 2025.

(Supply: L2Beat)

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Is Lighter The Lacking Hyperlink in Ethereum?

Due to the fast progress of Lighter and the DEX, which proves that it’s potential to construct a extremely scalable and safe perpetual DEX reliant on the Ethereum mainnet for safety, analysts are upbeat and now suppose the primary sensible contracts platform is full.

In a submit on X, the analyst stated Lighter might be described as the primary native perpetual DEX for Ethereum, the “birthplace of all DeFi primitives.” With Lighter pulling in billions in buying and selling quantity, the observer is satisfied that the platform is the “ultimate DeFi primitive” that can rework Ethereum right into a “full-fledged monetary platform” that can lastly substitute the worldwide monetary ecosystem.

Lighter is the lacking hyperlink in Ethereum DeFi Eco

Ethereum is the engine of innovation within the DeFi area, having developed the biggest DeFi primitives that everybody is aware of about right now.

Different networks are merely copying these primitives.

However Ethereum has one clear downside: it… pic.twitter.com/PRWBmsyoiJ

— Eugene Bulltime (@Eugene_Bulltime) October 8, 2025

Lighter, he continued, is the trade and the buying and selling engine that can allow the constructing of a thriving ecosystem. Not like Hyperliquid, which can also be trending and in style however costs a price, Lighter will construct on an already developed ecosystem comprising protocols that already handle billions.

One other chimed in, saying Lighter is an enchancment of Hyperliquid in that the DEX integrates Ethereum-grade property rights and is infinitely scalable because of the usage of zero data.

Spectacular debut on L2Beat by @Lighter_xyz.

Lighter is a perps trade – Hyperliquid with Ethereum grade property rights.

Already the sixth largest L2 by TVL and the #1 appchain L2 on Ethereum.

Benefits:– No token issuance prices– Ethereum grade safety– Infinitely… pic.twitter.com/yVXOjhhS1Y

— RYAN SΞAN ADAMS – rsa.eth

(@RyanSAdams) October 8, 2025

The success of Lighter, the observer added, is “bullish for Ethereum appchains.”

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

Lighter TVL Up 2000X In 6 Months: Lacking Hyperlink In Ethereum?

Ethereum is the supply of all DeFi primitives

The primary sensible contracts platform missed a high-volume perpetual DEX

Lighter TVL up 2000X from late March 2025

Is Lighter the lacking hyperlink in Ethereum?

The submit Lighter TVL Up 2000X In 6 Months: Is This Perp DEX The Lacking Hyperlink In Ethereum? appeared first on 99Bitcoins.