.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.constructive svg path:nth-of-type(2) {

stroke: #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive {

coloration: #008868 !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.constructive {

border: 1px strong #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive::earlier than {

border-bottom: 4px strong #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.unfavourable svg path:nth-of-type(2) {

stroke: #A90C0C !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.unfavourable {

border: 1px strong #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavourable {

coloration: #A90C0C !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavourable::earlier than {

border-top: 4px strong #A90C0C !necessary;

}

1.08%

Bitcoin

BTC

Value

$87,159.04

1.08% /24h

Quantity in 24h

$48.72B

<!–

?

–>

Value 7d

// Make SVG responsive

jQuery(doc).prepared(operate($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘top’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘top’);

svg.css({‘width’: ‘100%’, ‘top’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Be taught extra

has climbed from its dip to $84,000 and is now buying and selling near $87,000, drawing consideration once more from giant traders and smaller merchants searching for the following 100x crypto. As we speak’s rebound displays fast stabilization after Bitcoin briefly fell beneath $84,000 as a consequence of skinny liquidity and almost $1 billion in pressured liquidations throughout leveraged positions.

By noon, BTC returned to the $86,500–$87,200 zone, roughly 3% above its intraday low. The transfer follows a troublesome November wherein Bitcoin shed over $18,000 as ETFs noticed file month-to-month redemptions of $3.47 billion, the worst since February.

But on-chain exercise exhibits giant holders quietly accumulating, whereas technical information highlights agency assist close to $86,000. Analysts consider Bitcoin might try a run towards $100,000 if December inflows reappear, particularly with historic averages pointing to a 9.7% acquire for the month.

Grayscale Analysis expects Bitcoin to set new all-time highs in 2026, pushing again towards the extensively held “four-year cycle” narrative. The agency mentioned this cycle has not seen the same old parabolic surge pushed by retail merchants, with institutional inflows, potential charge cuts, and…

— Wu Blockchain (@WuBlockchain) December 2, 2025

EXPLORE: 10+ Subsequent 100x Crypto to Purchase

Merchants Discover the Subsequent 100x Crypto As Vanguard’s New Coverage Indicators a Main Shift for Conventional Finance

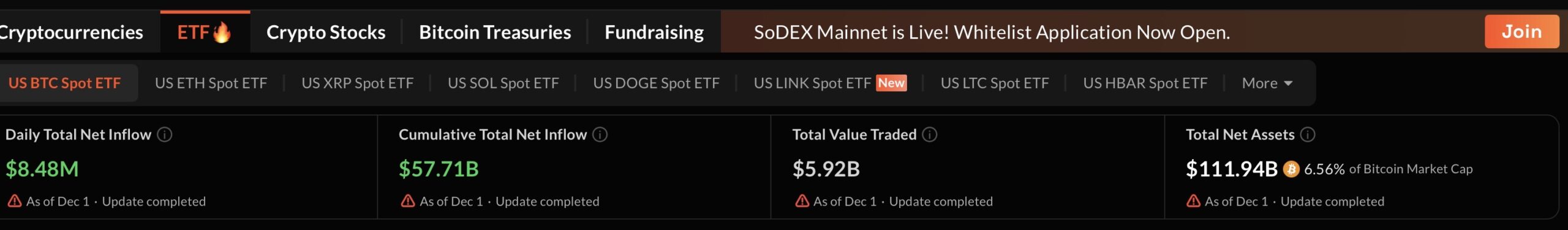

One of many primary catalysts behind at this time’s restoration is Vanguard’s sweeping coverage change. The $11 trillion asset supervisor introduced that, beginning December 2, it’s going to enable shoppers to commerce crypto ETFs and mutual funds, reversing years of exclusion. This consists of merchandise monitoring Bitcoin, Ether, XRP, and Solana, opening entry to greater than 50 million prospects. Vanguard cited improved administrative frameworks and shifts in investor conduct, even because the crypto market has declined by $1 trillion since October. The change might introduce new capital into Bitcoin ETFs, which collectively maintain $113 billion, providing potential reduction from current outflows and supporting value stability.

ETF exercise stays essential, with spot Bitcoin funds experiencing heavy withdrawals in November however now displaying early indicators of levelling off.

BlackRock’s IBIT, at present the most important with $70 billion in belongings, lately elevated its inside allocations, contributing to at this time’s rebound. In the meantime, the Federal Reserve’s determination to finish quantitative tightening, pausing its $2.2 trillion discount in balance-sheet belongings, eases liquidity constraints: circumstances that usually profit belongings like Bitcoin.

Further actions embrace Coinbase’s This autumn index replace, including HBAR, MANTLE, VET, FLR, SEI, and IMX to trace high-liquidity performers. Franklin Templeton additionally expanded its Crypto Index ETF to incorporate Bitcoin, Ether, Solana, XRP, and several other others, widening publicity for traders.

Altogether, Bitcoin’s rebound, Vanguard’s sudden coverage reversal, and the Fed’s liquidity shift create a constructive setup for the market. With merchants monitoring each established belongings and potential subsequent 100x crypto alternatives, December might open the door to significant market progress.

DISCOVER: Vanguard Crypto ETF Greenlight Might Finish The Crypto Crash As we speak

Purchase Now, Pay Later use surges this Black Friday

Utilization of Purchase-Now-Pay-Later (BNPL) jumped about 9% throughout this Black Friday interval, the largest surge in years. Youthful consumers led the cost: 41% of individuals aged 16–24 used BNPL, and youthful millennials boosted their utilization by a dramatic 87% in contrast with final 12 months.

Wealthier households are more and more embracing BNPL too, with 38% of these incomes over US$100,000 reporting they used it. Crucially, BNPL is not reserved for luxurious purchases: now round one in 4 BNPL customers are financing necessities like groceries.

Crypto Mixer Crushed: Europe Shuts Down Cryptomixer.io in Main Anti-Laundering Sweep

Swiss and German regulation enforcement simply dropped the hammer on Cryptomixer.io, one of many largest Bitcoin “tumblers” within the wild. A number of companies, together with Zurich police and Germany’s BKA, dismantled the platform final week.

Europol helps Germany and Switzerland in taking down 'Cryptomixer', seizing EUR 25 million in Bitcoin. This illicit mixing service facilitated cash laundering of proceeds from quite a lot of prison actions.

Particulars

https://t.co/d3oTlbrDzd pic.twitter.com/Qtml6nhGlX

— Europol (@Europol) December 1, 2025

Cryptomixer had been mixing cash since 2016, allegedly shuffling billions of euros in doubtlessly soiled Bitcoin. By mixing funds throughout customers and randomizing payouts, it masked the place cash got here from and the place they ended up — a basic setup for laundering proceeds from ransomware, drug dealing, fraud, and different shady enterprise.

The takedown was sweeping: authorities seized three servers, the area cryptomixer.io, 12 terabytes of information, and over €25 million (~$29 million) in Bitcoin.

Businesses behind the raid, together with Europol and Eurojust, mentioned this isn’t nearly a single platform: the proof and information they grabbed might gasoline investigations into total networks of cybercrime.

DISCOVER: Finest New Cryptocurrencies to Spend money on 2025

Learn the Full Article Right here

Merlin BTC Layer 2 Defies Market Dip as MERL Crypto Pumps +30%: Is Bitcoin Hyper Subsequent BTC Layer 2 To Blast?

MERL Crypto or Merlin Chain (MERL) is again within the highlight after doubling in value at this time, persevering with a comeback that has been constructing quietly since early fall. The most recent surge follows the challenge’s November 7 community improve, which improved scalability, lowered congestion and boosted ZK-Rollup effectivity throughout the chain.

Mixed with August’s Sui integration, bringing new Bitcoin DeFi performance by M-BTC bridging, Merlin is lastly delivering on the infrastructure that early supporters anticipated.

Merlin spent a lot of the summer time caught in a grinding correction, bottoming in June earlier than starting a gradual climb. The actual shift occurred in September when MERL broke out of a diagonal resistance trendline. In the meantime, a brand new crypto presale is making waves as the following massive Bitcoin play. Right here’s what to know:

Learn the Full Article Right here

Japan Crypto Strikes Towards Flat 20% Crypto Tax as Authorities Backs Main Reform

Japan is getting ready to overtake its crypto tax system after greater than a decade of investor complaints and trade lobbying. In response to new reporting from Nikkei Asia, the federal government and ruling coalition have formally endorsed a plan to chop the nation’s most crypto tax charge to a flat 20%, aligning digital belongings with equities and funding trusts.

The Monetary Providers Company (FSA) is predicted to introduce the crypto invoice in the course of the common Weight loss plan session in early 2026.

The choice marks probably the most consequential shifts in Japan’s digital-asset coverage since the collapse of Mt. Gox in 2014. It additionally displays a rising political will to revitalize Japan’s stagnant cryptocurrency sector, which has been hindered for years by punitive tax guidelines.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Learn the Full Article Right here

The submit [LIVE] Crypto Information As we speak, December 2 – Bitcoin Rebounds to $87K, Vanguard Opens to Crypto ETFs, Fed Ends QT: Subsequent 100x Crypto? appeared first on 99Bitcoins.