In one other groundbreaking announcement for SoFi, the monetary providers firm has confirmed a strategic cope with Fortress Group valued at $3.2 billion. This plan contains a $2 billion extension for a one-year time period and an extra settlement to originate $1.2 billion in loans over two years with Edge Focus, marking a major 150% enhance from earlier agreements. What’s much more thrilling is that this deal comes earlier than the prior deal of $2 billion has accomplished. That is additionally on high of the present Blue Owl deal, which was for $5 billion throughout two years. The collaboration with Fortress emphasizes the standard of loans being processed, because it illustrates their confidence in SoFi’s underwriting capabilities, showcasing development within the monetary know-how sector, regardless of this announcement coming in a difficult macroeconomic atmosphere that has influenced the inventory market negatively.

The implications of this settlement are multi-faceted, starting from an anticipated increase in mortgage origination, improved underwriting capabilities because of expanded information evaluation, and cross-selling alternatives inside different SoFi merchandise. As the corporate goals to shift extra lending in the direction of their mortgage platform mannequin, monetary development prospects seem very optimistic, promising larger return on fairness and the potential for a major uptick in income.

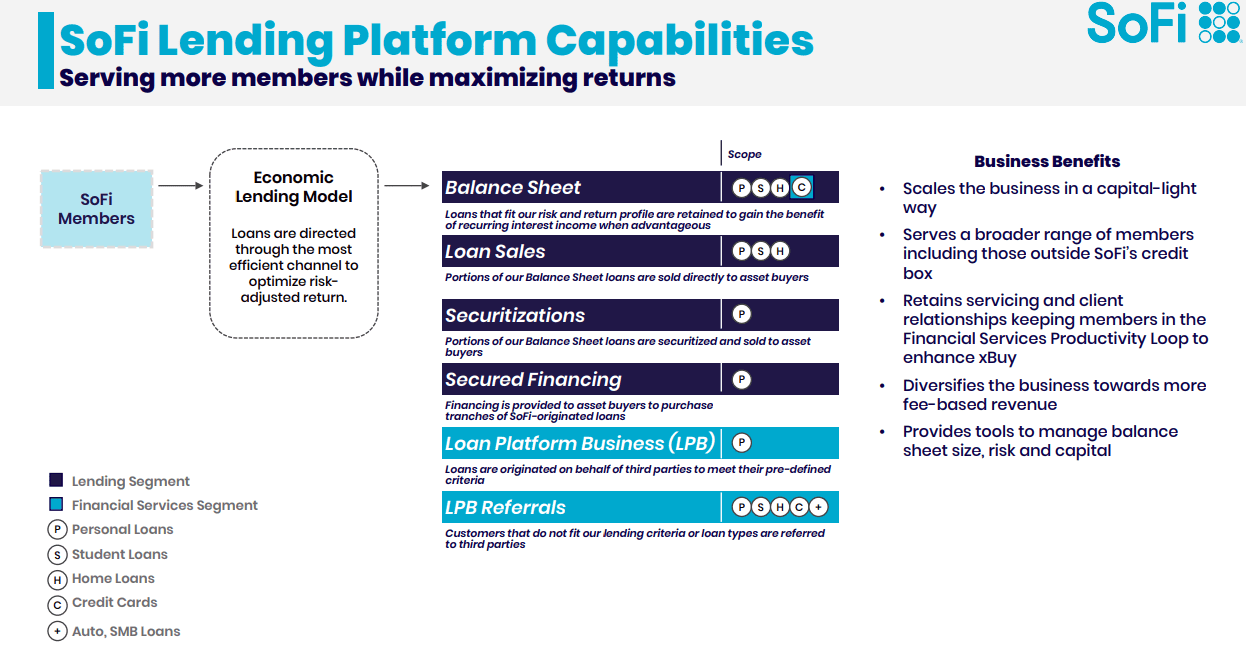

Supply: SoFi Investor Relations Web page

Highlights

🔹 Engaging Financial Mannequin: The shift in the direction of a mortgage platform mannequin helps a lighter stability sheet, in the end enhancing return on fairness. SoFi’s technique to originate loans on behalf of third events minimizes its personal threat publicity and by performing as a facilitator, SoFi shifts the danger of mortgage defaults away from its stability sheet, enhancing its monetary resilience even in turbulent financial climates.

🔹 High quality Over Amount: The continuation of loans from Fortress Group signifies a vital understanding of SoFi’s method to underwriting. By discovering a renewed partnership so quickly, it highlights that Fortress sees worth within the asset high quality of loans being processed. This means that SoFi’s rigorous threat evaluation permits them to faucet into high-quality mortgage origination, thus enhancing their popularity throughout the trade.

🔹 Knowledge-Pushed Enhancements: With larger volumes of loans being processed, SoFi will collect extra information to refine its threat fashions. This steady evaluation will improve their capability to precisely consider creditworthiness, thus solidifying their underwriting requirements. The training from enhanced information analytics results in smarter enterprise choices, tabling SoFi as a data-driven group.

🔹 Cross-Promoting of Providers: SoFi’s construction facilitates the cross-selling of different monetary merchandise, resembling bank cards and banking providers, to clients making use of for loans. This creates a extra built-in client expertise, permitting the corporate to capitalize on client pockets share by encouraging utilization of a number of merchandise, drastically enhancing common income per consumer.

🔹 Projected Monetary Development: The cope with Fortress Group considerably boosts SoFi’s mortgage origination and income potential. With projections indicating that non-public mortgage gross sales might attain upwards of $4 billion, these figures help the argument for a valuation shift towards SoFi. Elevated origination leads to elevated liquidity, solidifying SoFi’s standing as a aggressive participant within the monetary know-how house.

🔹 Lengthy-Time period Income Constructing: SoFi’s technique, aiming to shift its lending construction to a mortgage platform mannequin, is critical. This mannequin helps constant quarterly income streams by specializing in mortgage agreements over time, relatively than one-off tasks, which inherently creates a extra secure monetary future and reduces income volatility. This shift holds long-term potential, as profitability metrics might enhance considerably over years of accrued studying and enterprise refinement.

🔹 Aggressive Edge: SoFi’s concentrate on their mortgage platform over different segments like brokerage providers positions them extra competitively throughout the trade. By leveraging their financial institution constitution’s benefits, they’ll effectively faucet into demand and pursue development avenues that different opponents could not be capable to exploit successfully, and in contrast to opponents that will solely concentrate on mortgage merchandise, SoFi is innovatively positioned to not solely present monetary merchandise but additionally faucet into a mix of inexpensive financing options and monetary planning providers. This holistic method enhances buyer retention, presenting SoFi as an all-encompassing monetary associate within the shoppers’ lives, giving it a novel edge over extra conventional monetary establishments.

🔹 Market Demand: Regardless of macroeconomic uncertainties, there stays a powerful demand for private loans, validating SoFi’s operational stability and development. The speed of those offers exhibits demand is excessive and implies the expectation of sustained enterprise efficiency.

🔹 Investor Attraction: Given the optimistic reception and analysis of SoFi’s mortgage high quality, it’s probably that analysts will revise their projections for the corporate favourably. Coupling a strong deal pipeline with investor confidence in earnings high quality might enhance market sentiment and result in a extra beneficial valuation of SoFi’s inventory.

Mortgage Platform Development

SoFi has traditionally expanded cautiously within the mortgage sector however in simply 12-15 months, SoFi has engaged in roughly $12 billion value of offers by its mortgage platform. The projected development in mortgage origination quantity implies that SoFi could quickly expertise a major surge in income. Assuming their estimate of a 4% take fee holds, projected revenues might attain round $470 million from the current $12 billion in complete mortgage originations, translating to an ongoing revenue stream that helps enterprise enlargement. If SoFi can scale this successfully, they may considerably drive their stability sheet development, while decreasing threat.

Supply: Newest SoFi earnings deck

Valuation

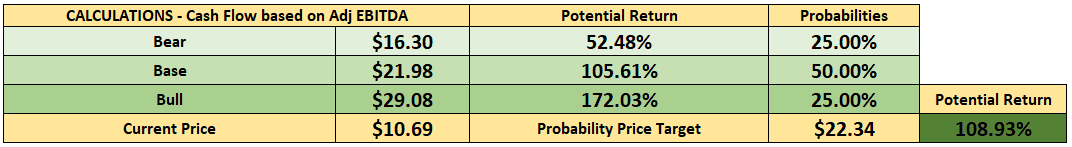

SoFi’s steerage for 2025 probably doesn’t absolutely account for the extra income anticipated from these current offers and even for the anticipated reintroduction of cryptocurrency, representing a major shock issue for potential traders and analysts alike. This underestimation of potential earnings energy creates a strategic shopping for alternative on the present market worth.

Regardless of vital enterprise advances, SoFi’s inventory doesn’t appear to mirror the sturdy fundamentals. Market costs mirror substantial discrepancies associated to the corporate’s development methods in opposition to macroeconomic elements resembling tariffs and hypothesis about recessions. These discrepancies might current a useful alternative for savvy traders, as enhanced development avenues may take time to be acknowledged by the market.

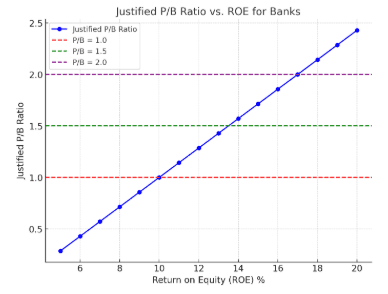

Presently, if we worth SoFi as a financial institution utilizing P/B, SoFi seems to be a bit on the costly aspect at 1.8x. Nevertheless, ROE might see some appreciable strikes to the upside with these new offers.

Extra importantly, this implies we aren’t giving SoFi a hybrid a number of, which remains to be a scorching matter with traders.

We will tweak a DCF calculation utilizing adjusted EBITDA, much less Capex, and including again the guide worth in lieu of money circulate, which might be extra acceptable for this sort of hybrid firm. We’re additionally utilizing a variable development fee, ranging from the 25% SoFi is guiding with and dropping all the way down to a terminal fee of 4% over a 10-year interval.

Dangers:

SoFi (Social Finance Inc.) operates a diversified fintech enterprise, and whereas it’s been rising quickly, a number of dangers might materially influence its efficiency. Right here’s a breakdown of key enterprise, monetary, regulatory, aggressive, and macroeconomic dangers:

🔹 Regulatory and Compliance Threat – Publicity to altering monetary rules and banking oversight because of its financial institution constitution and fintech operations, though one might argue that is much less impactful since monetary regulation is about to ease. That is mirrored partially within the leisure of crypto buying and selling for SoFi.

🔹 Credit score Threat – Potential for rising mortgage defaults, particularly in private and scholar mortgage portfolios, throughout financial downturns. SoFi does goal larger credit score scores, so one thing to keep in mind concerning this level.

🔹 Curiosity Fee Threat – Sensitivity to fee adjustments, which may have an effect on mortgage demand, deposit prices, and internet curiosity margins.

🔹 Aggressive Threat – Strain from each conventional banks and fintech rivals providing related or higher monetary merchandise.

🔹 Execution Threat – Challenges in scaling new enterprise traces or integrating acquisitions like Galileo and Technisys successfully. Not like the mortgage platform enterprise, these merchandise have had development issues.

In conclusion:

The developments surrounding SoFi’s current partnership with Fortress Group point out a paradigm shift in the direction of a extra strong, data-informed, and customer-centric monetary service mannequin. As they solidify their market presence by mortgage origination and improved underwriting accuracy, SoFi is making a aggressive hierarchy that positions them favourably for long-term development and success.

It’s a capital-light, high-margin development engine that’s scaling sooner than anybody anticipated and it’s solely simply getting began. With cross-sell potential, improved underwriting intelligence, and the flexibility to draw new institutional capital, SoFi isn’t just optimizing its present enterprise, it’s redefining the way forward for client lending. That is yet one more instance of how SoFi can pivot into new enterprise segments with ease, indicating a change that’s too vital to be ignored in at the moment’s monetary panorama. Finally, this partnership serves as a stepping stone to even larger achievements for SoFi within the coming years.

Given the sturdy demand for private loans, the longer term appears brilliant for SoFi’s development trajectory, even in unsure financial situations. Might SoFi transfer all their lending into the mortgage platform enterprise over time? The stability sheet could be lighter and who would complain a couple of larger return on fairness?

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.