Layer-1 blockchain, Mantra, has launched a $108,888,888 ecosystem fund geared toward accelerating the expansion of startups centered on real-world asset (RWA) tokenization and decentralized finance (DeFi).

The launch of this fund, named the Mantra Ecosystem Fund (MEF), comes amid the rising demand for secure, asset-backed digital merchandise.

At present, we’re asserting the launch of the MEF – a $108,888,888 million funding initiative designed to propel actual world asset innovation, adoption and development.

However we’re not doing this alone. We’ve acquired main incubators, accelerators and capital companions by our aspect;… pic.twitter.com/oyeCOJ9QrE

— MANTRA | Tokenizing RWAs (@MANTRA_Chain) April 7, 2025

Large Gamers Have Invested Into The Mantra ‘MEF’ Fund

Mantra, a L1 blockchain constructed particularly for tokenized RWAs, has launched its ‘MEF’ fund to speed up the expansion and adoption of tasks and startups constructing on its community, per its official announcement from right now (April 7) on X.

The press launch from Mantra states that it’s going to deploy the capital over the following 4 years amongst “high-potential blockchain tasks” worldwide, with funding alternatives sourced by way of Mantra’s community of companions.

Backing the fund are a number of the greatest institutional companions round, together with; Laser Digital, Shorooq, Brevan Howard Digital, Valor Capital, Three Level Capital and Amber Group, amongst others.

The launch of the Mantra Ecosystem Fund comes a month after the L1 grew to become the primary DeFi/RWA platform to acquire a digital asset service supplier (VASP) license below Dubai’s Digital Property Regulatory Authority (VARA).

Per CoinGecko, Mantra’s native token, OM, is at the moment buying and selling at $6.1 with a market cap of $5.9 billion, making it the twenty second largest cryptocurrency by market cap.

(COINGECKO)

EXPLORE: Will CME Hole Save BTC USD? Over $1Bn Liquidated in 1 Hour Forward of Crypto Black Monday

Tokenized RWA Gem No.1 – Landshare (LAND)

Landshare (LAND) provides its holders the chance for actual property funding through its user-friendly platform constructed on the BNB Good Chain (BSC) chain.

This platform removes the stress and heavy monetary necessities (reminiscent of massive down funds), that usually include actual property funding. With the Landshare ecosystem, customers have a plethora of alternatives to realize actual property publicity with RWA belongings.

By way of Landshare, buyers can stake stablecoins to earn a share of rental revenue and property worth appreciation and take part in crowd-funded property flips.

Notably, the Landshare platform is led by its well-developed NFT ecosystem. All NFTs minted on Landshare characterize fractional possession of actual property belongings.

Holders can improve and restore their digital properties utilizing NFTs, this innovation provides a gamified layer to the expertise, a cause why many are actually selecting to put money into LAND.

Landshare represents a real micro cap gem, as its market cap stands at a tiny $3.1 million. With its groups huge expertise, being practically 4 years outdated at this level, this stage of blue chip undertaking might probably be one which Mantra’s RWA ecosystem fund can have an in depth eye on.

LAND is at the moment buying and selling at $0.55 and is down 9% on the day, which is spectacular when contemplating that multi-billion greenback ETH is down practically 20% in the identical timeframe.

(COINGECKO)

Tokenized RWA Gem No.2 – Clearpool Finance (CPOOL)

Clearpool Finance (CPOOL) is a number one hybrid DeFi/RWA crypto platform with over $67 million in Whole-Worth Locked (TVL) to its title. It additionally acts as a decentralized credit score market and to-date has issued greater than $770 million in loans, per its web site dashboard.

The Clearpool platform gives its person entry to a number of merchandise. These embrace staking swimming pools, credit score vaults, institutional DeFi swimming pools, and treasury swimming pools.

Only in the near past, through its Clearpool Prime product which acts as a KYC & AML compliant community for wholesale borrowing and lending of digital belongings, Euronext-listed international buying and selling agency FlowTraders efficiently secured a $10 million USDC mortgage.

This marked an enormous milestone for the platform with such an enormous participant utilizing its platform for a 10-figure stablecoin mortgage.

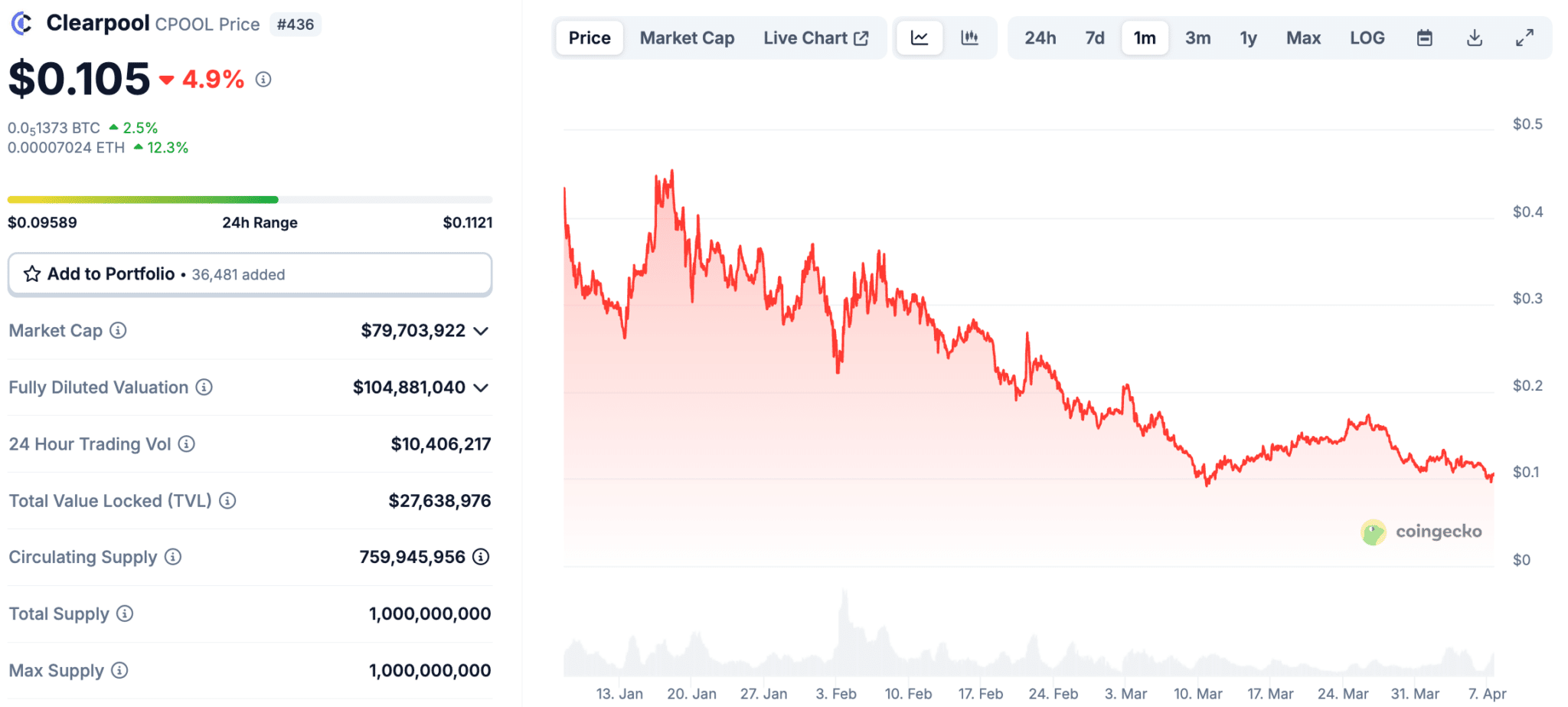

Nonetheless, Clearpool has been affected together with the remainder of the market and consequently, is at the moment buying and selling at simply over $0.1. Per CoinGecko, it’s down practically 20% up to now month and 5% alone up to now 24 hours.

With a tokenized RWA undertaking that continues to construct and thrive whatever the wider market situations, this dip for CPOOL appears to be like like an excellent level for an inexpensive entry earlier than the market reversal comes.

(COINGECKO)

DISCOVER: Finest Meme Coin ICOs to Put money into April 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Mantra, a L1 blockchain constructed for tokenizied RWA, has launched a $108m ecosystem fund

Traders within the fund embrace Three Arrows Capital, Amber Group and Brevan Howard Digital

Mantra just lately obtained a digital asset service supplier (VASP) from Dubai’s Digital Property Regulatory Authority (VARA)

The native token for Mantra, OM, is at the moment buying and selling at simply over $6 with a $5.9 billion market cap

Landshare (LAND) and Clearpool Finance (CPOOL) are two RWA gems that the Mantra ecosystem fund may very well be eyeing for funding

The publish Mantra Blockchain Launches $108M RWA Fund: Finest Tokenized Asset Gems To Purchase On The Dip appeared first on 99Bitcoins.