MARA Holdings Inc. – a US-based cryptocurrency mining agency – elevated its Bitcoin (BTC) reserves by 373 BTC in September, pushing its whole holdings to 52,850 from 52,477 BTC. Following at the moment’s replace, MARA stays the second-largest public firm with BTC reserves, trailing Michael Saylor’s Technique.

MARA Holdings Will increase Bitcoin Reserves

In response to an official announcement earlier at the moment, MARA Holdings’ BTC reserves rose by 373 cash in September. The agency’s whole BTC holdings are valued at roughly $6.4 billion, in accordance with prevailing market costs.

Notably, MARA Holdings mined a complete of 736 BTC in September, valued at roughly $88.6 million. Compared, the corporate had mined 704 BTC in August 2025, representing a 4.4% enhance over the earlier month.

MARA Holdings’ quantity of BTC mined in September represents roughly 5.2% of all miner rewards. This consists of the transaction charges generated in the course of the month. Unsurprisingly, MARA Holdings continues to be the biggest public BTC miner when it comes to BTC held.

That mentioned, it’s value highlighting that MARA Holdings’ Bitcoin stack consists of BTC that’s loaned, actively managed, or used as collateral. Fred Thiel, Chairman and CEO, MARA Holdings, famous:

In September, we produced 218 blocks, a 5% enhance over August, demonstrating the continued power and resilience of our operations whilst international hashrate grew 9% month-over-month to a mean of 1,031 EH/s. This development in manufacturing underscores our potential to execute persistently, whilst mining turns into harder.

As talked about earlier, MARA Holdings follows Technique, the main public firm with the biggest stack of BTC on its stability sheet. Technique continued to extend its BTC stack, buying one other $22 million value of BTC earlier this week, propelling its whole holdings to a mammoth 640,031 BTC, value round $77 billion.

Different public companies that function among the many prime BTC holders embrace the likes of Twenty One (43,514 BTC), Japan-based Metaplanet (30,823 BTC), and Bitcoin Normal Treasury Firm (30,021 BTC).

As well as, well-known companies like Trump Media & Expertise Group Corp., Galaxy Digital Holdings, Coinbase International, Tesla, and Jack Dorsey-backed Block rank among the many prime 15 public firms with the biggest BTC reserves.

Firms Preferring Altcoins For Company Treasury

Whereas Bitcoin nonetheless reigns supreme when it comes to being essentially the most influential cryptocurrency with the very best adoption, altcoins equivalent to Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) are rising as viable competitors to BTC.

As an example, NASDAQ-listed VisionSys AI lately introduced that it plans to launch a Solana-based treasury program, valued at as much as $2 billion. Equally, a newly-created Avalanche-based treasury agency is anticipated to purchase $1 billion value of AVAX tokens in 2026.

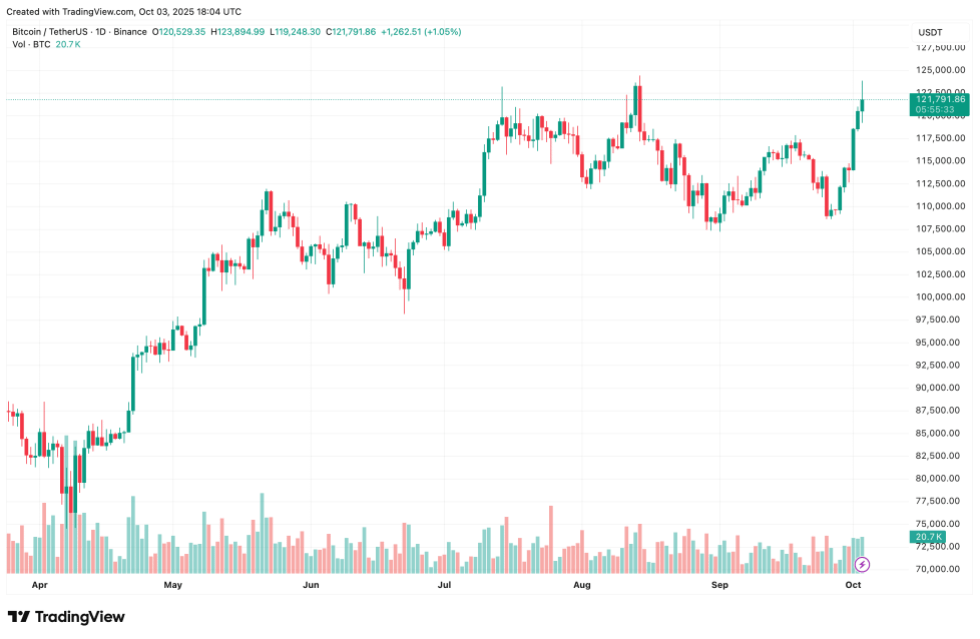

In the meantime, Ethereum treasury agency BitMine purchased 46,225 ETH in September, growing its whole ETH stack to greater than 2.1 million ETH. At press time, BTC trades at $121,791, up 1.7% previously 24 hours.

Featured picture from Unsplash.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

![[LIVE] Crypto News Today, October 16 – Crypto Crash Continues as Bitcoin Stuck Below $112K, XRP Price at $2.42; Coinbase Lists BNB: What’s the Next Crypto To Explode? [LIVE] Crypto News Today, October 16 – Crypto Crash Continues as Bitcoin Stuck Below $112K, XRP Price at $2.42; Coinbase Lists BNB: What’s the Next Crypto To Explode?](https://blockchainbroadcast.net/wp-content/themes/jnews/jnews/assets/img/jeg-empty.png)