The decentralized finance (DeFi) panorama is consistently evolving, with new Layer-1 blockchains vying for market share. These platforms promise enhanced scalability, safety, and consumer expertise. Sui, a permissionless blockchain, emerged as a promising entrant. Launched in Might 2023 by Mysten Labs, based by former Meta engineers, Sui rapidly carved out a major area of interest. It leverages a singular object-centric knowledge mannequin and the Transfer programming language. This positions Sui as a formidable participant within the DeFi area.

This text delves into Sui’s fast ecosystem development. Particularly, it explores its growth inside Decentralized Finance (DeFi), gaming, and Non-Fungible Tokens (NFTs). This development is evidenced by vital Complete Worth Locked (TVL) and increasing consumer adoption. Moreover, the community’s strategic positioning is solidified by key partnerships with institutional gamers and a transparent roadmap for future growth.

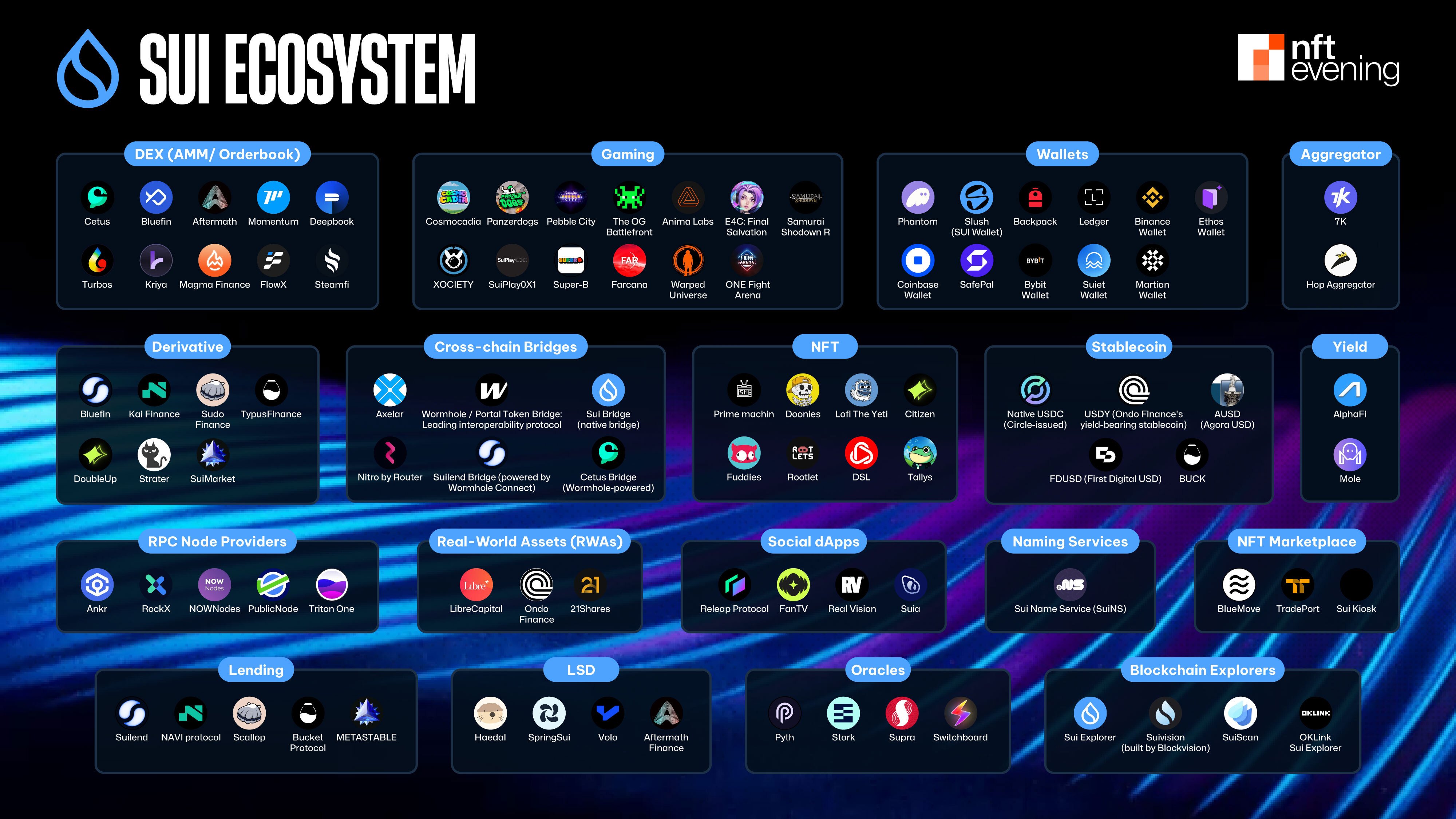

Sui – A Flourishing DeFi Ecosystem

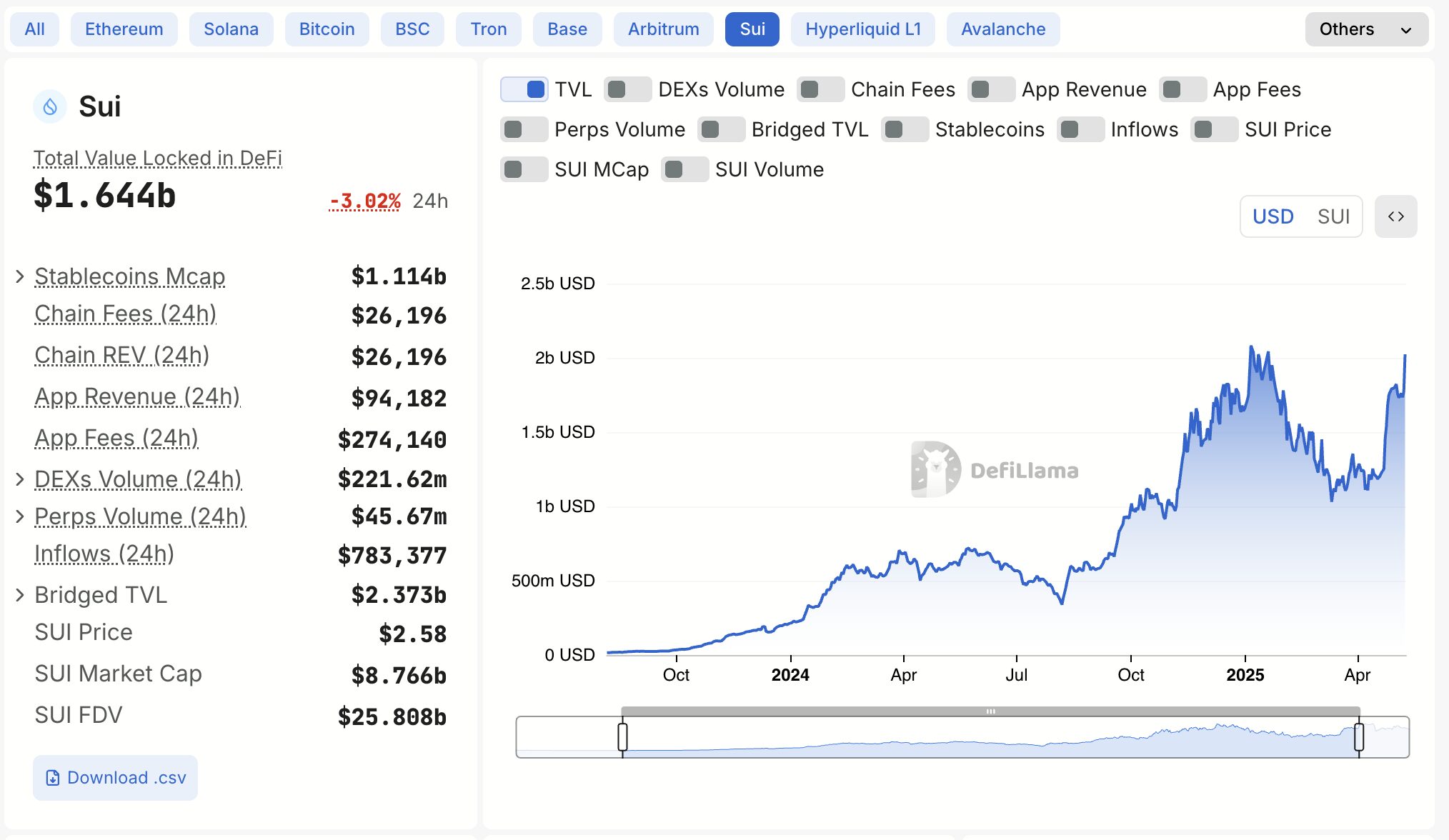

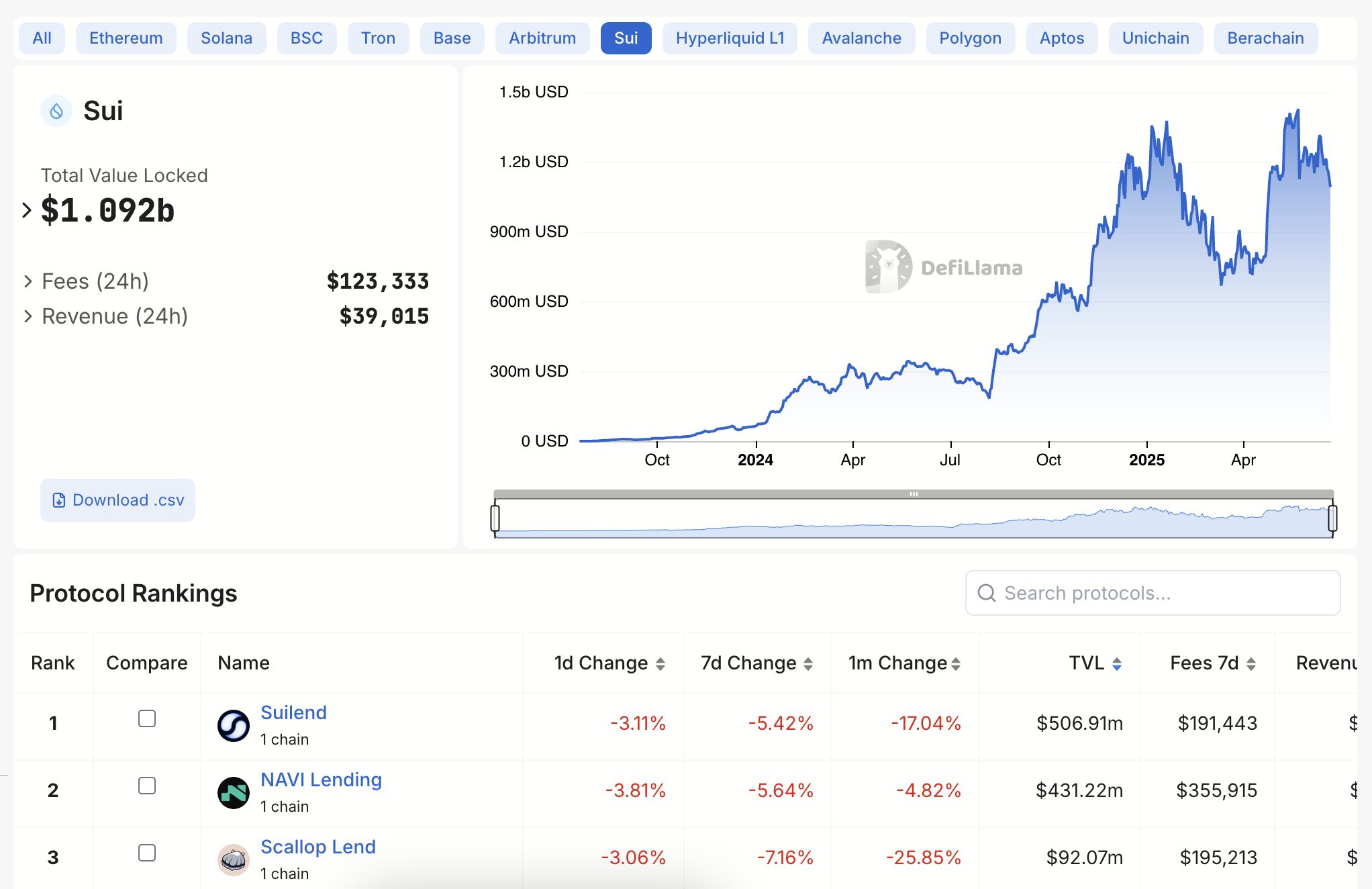

Sui‘s structure allows high-speed lending, buying and selling, and staking platforms. The community has demonstrated vital development in its DeFi sector, with Complete Worth Locked (TVL) surging from roughly $25 million at launch to over $2 billion by Might 2025, positioning Sui because the third-largest non-EVM chain by TVL.

Supply: DefiLlama

By June 2025, its DeFi TVL exceeded $1.7 billion, surpassing extra historic tasks like Avalanche or Polygon. Stablecoin quantity on Sui has additionally seen explosive development, leaping from $400 million in January to just about $1.2 billion by Might 2025, with month-to-month stablecoin switch quantity exceeding $70 billion.

The cumulative complete DEX quantity on Sui has surpassed $110 billion, with a mean 24-hour DEX quantity of roughly $250 million, indicating substantial buying and selling exercise.

Sui’s DeFi sector is powerful, characterised by high-speed transactions and capital effectivity, making it excellent for varied monetary actions.

For extra: Sui Deep Dive: A Complete Evaluation

Supply: DefiLlama

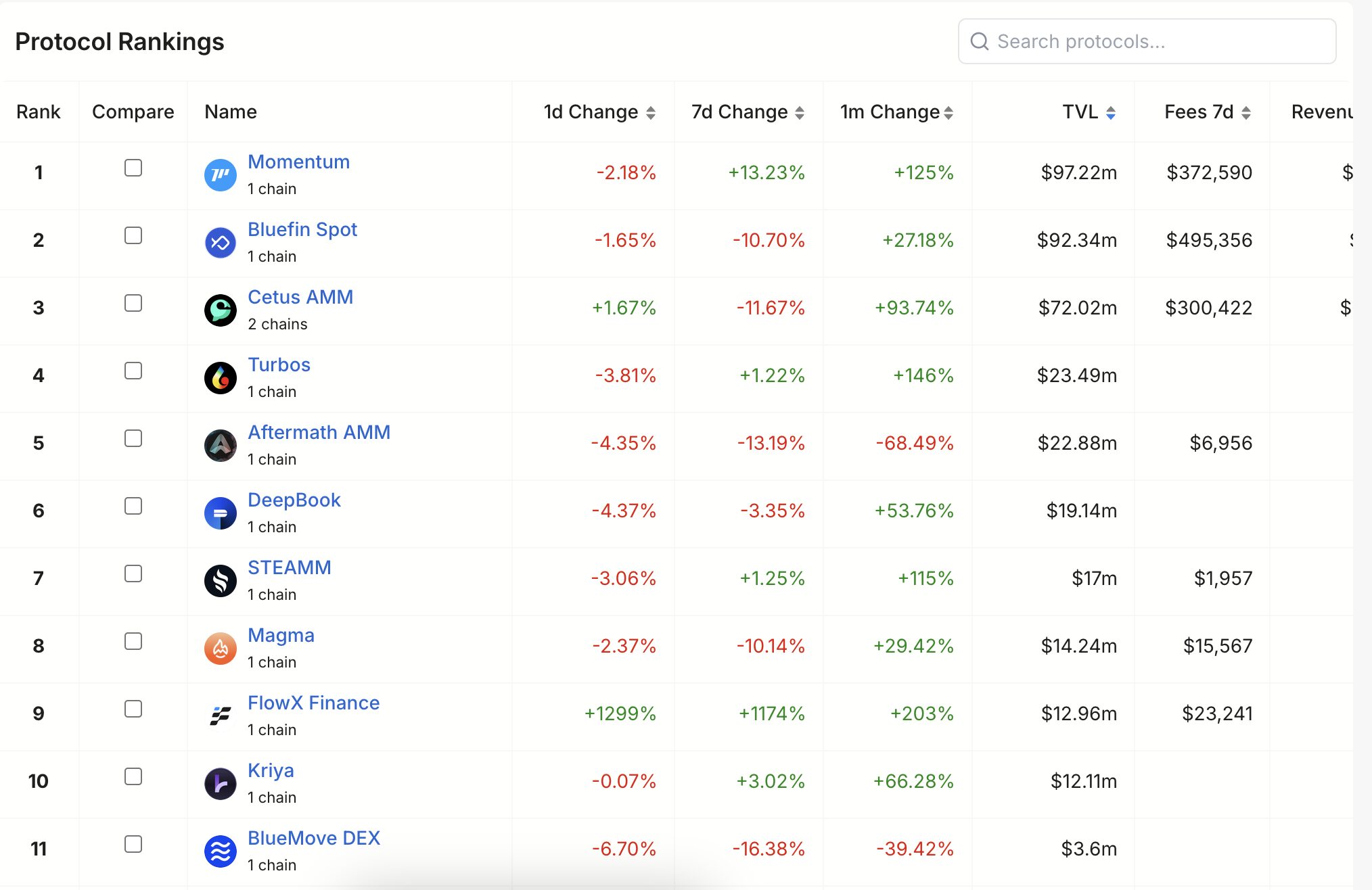

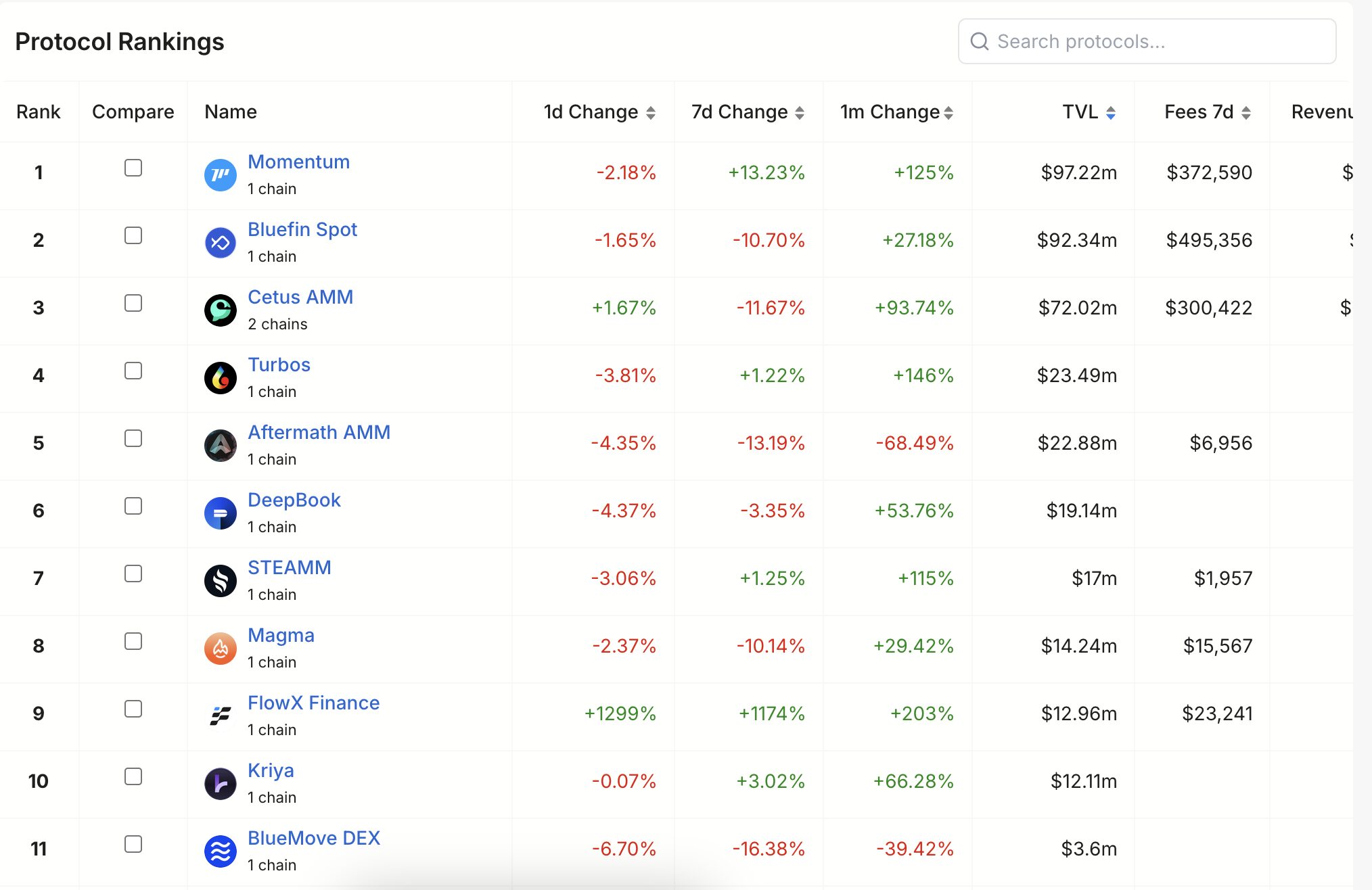

Decentralized Exchanges (DEXs)

Cetus Protocol (CETUS)

A number one DEX on Sui (and Aptos) using a Concentrated Liquidity Market Maker (CLMM) mannequin, much like Uniswap V3. This permits liquidity suppliers to allocate belongings inside particular worth ranges, considerably enhancing capital effectivity and lowering slippage for merchants. Cetus additionally incorporates a “Tremendous Aggregator” to supply the perfect costs throughout the Sui community and provides a developer SDK for simple integration.

Turbos Finance (TURBOS)

A distinguished DEX identified for its sturdy development and powerful help for meme tokens throughout the Sui ecosystem. Turbos emphasizes progressive buying and selling mechanisms and complete listings, positioning itself as a key liquidity supplier and a catalyst for the meme coin market on Sui. It was notably unaffected by the Cetus exploit as a result of its impartial and safe codebase.

Aftermath Finance (AF)

A decentralized buying and selling and DeFi platform aiming to offer a CEX-like consumer expertise absolutely on-chain. Aftermath provides multi-asset liquidity swimming pools, a smart-order router for environment friendly buying and selling, and liquid staking derivatives (afSUI). It integrates varied DeFi merchandise like a DEX aggregator, yield farming, and even a cross-chain bridge, striving to be a “one-stop-shop” for Sui DeFi.

Momentum DEX (MMT)

The primary ve(3,3) decentralized trade mixed with a token launch platform on Sui. Momentum’s ve(3,3) tokenomics mannequin goals to align incentives completely amongst liquidity suppliers, merchants, and protocols, with 100% of emissions, buying and selling charges, and rewards flowing on to customers. It additionally performs a key function in minting stablecoins on Sui, positioning itself as a crucial infrastructure participant.

KriyaDEX (KDX)

A complete DeFi protocol providing a spread of functionalities together with AMM, restrict orders, leveraged perpetual contracts, and technique Vaults. Kriya focuses on offering quick, environment friendly, and low-cost transaction companies, supporting skilled merchants with options like as much as 20x leverage on perpetuals and on-chain dollar-cost averaging (DCA).

Supply: DefiLlama

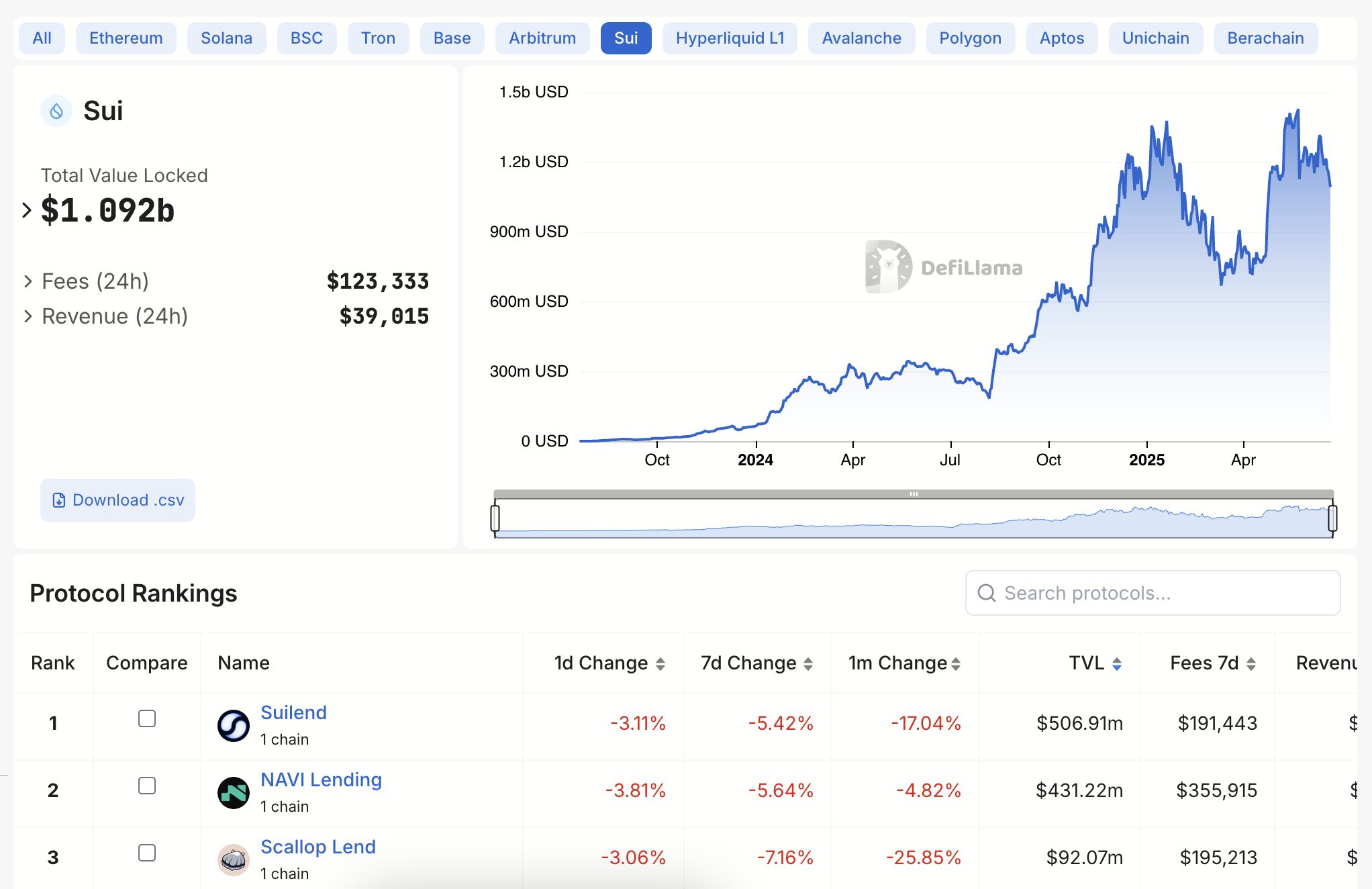

Lending & Borrowing Protocols

Suilend (SEND)

Suilend provides a unified platform integrating varied important DeFi companies, making it a “one-stop-shop” for customers. This consists of:

Lending & Borrowing: Customers can deposit supported crypto belongings to earn curiosity or borrow towards their holdings with collateral, all powered by Sui’s high-speed, low-fee blockchain.Liquid Staking (SpringSui): This can be a key characteristic the place customers can stake their SUI tokens and obtain sSUI, a yield-bearing liquid staking token. sSUI can then be utilized in different DeFi actions, and SpringSui is especially notable for providing on the spot unstaking, offering vital liquidity and security.Token Swapping (STEAMM): Suilend options its personal Superfluid AMM referred to as STEAMM, permitting customers to effectively swap tokens instantly throughout the platform. This built-in swap performance helps cut back transaction charges and simplifies the consumer expertise.Cross-Chain Bridging: Powered by Wormhole, Suilend facilitates the seamless switch of belongings throughout main blockchains like Ethereum, Solana, and Polygon, enabling customers to convey belongings into the Sui ecosystem to be used throughout the platform.

NAVI Protocol (NAVX)

The primary native liquidity protocol within the Sui ecosystem, providing a one-stop answer for lending, borrowing, and leveraged yield farming. NAVI helps varied mainstream belongings (WBTC, WETH, SUI) and goals to be a user-friendly decentralized financial institution on Sui, identified for its capital-efficient and dynamic lending curiosity modes.

Scallop (SCA)

A number one decentralized finance (DeFi) protocol designed for peer-to-peer lending and borrowing. Scallop provides a complete cash market with high-interest lending and low-fee borrowing. It was the primary DeFi protocol to obtain an official grant from the Sui Basis, underscoring its institutional-grade high quality and safety. Scallop prioritizes institutional-grade safety and regulatory compliance.

Supply: DefiLlama

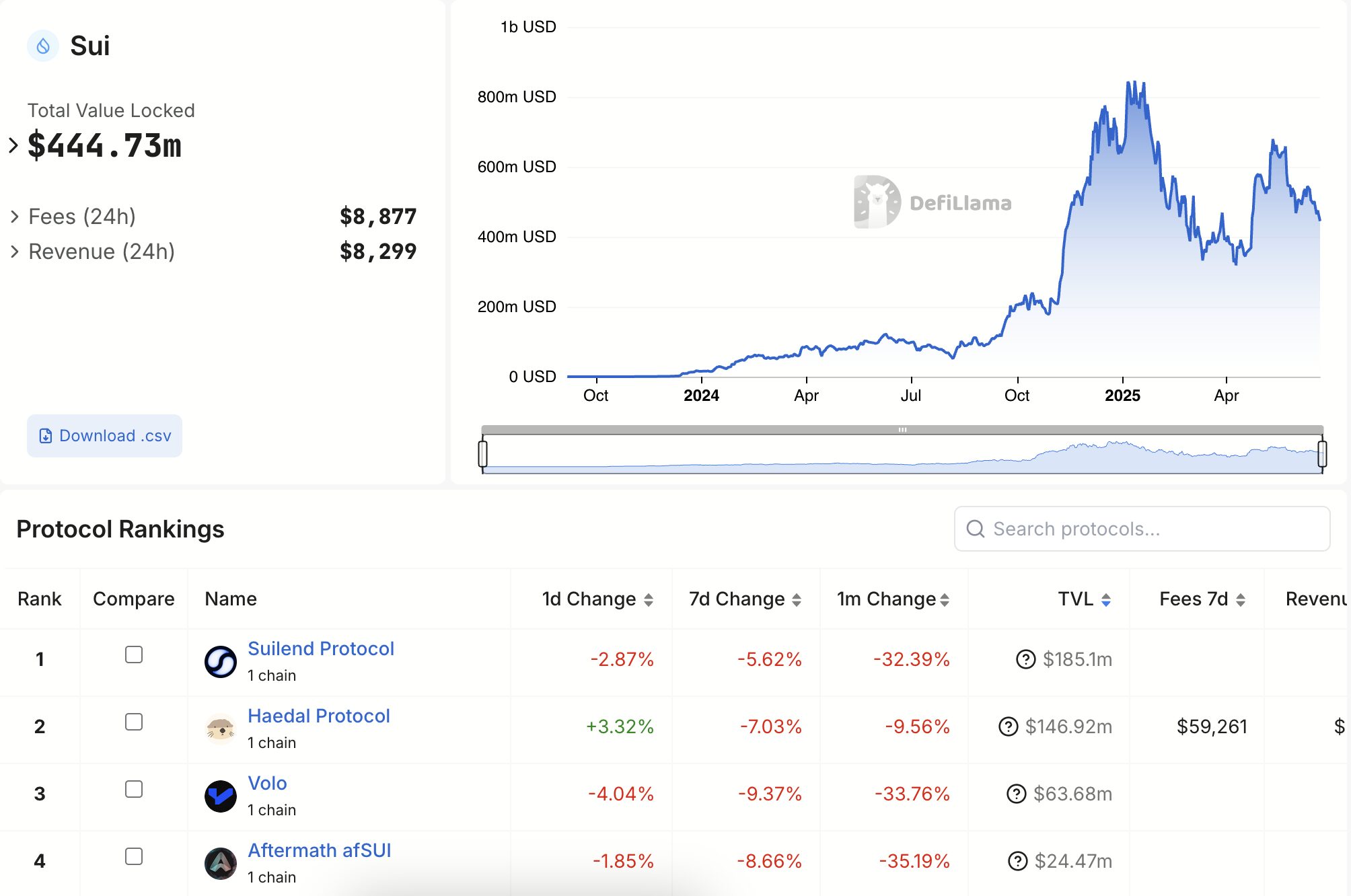

Liquid Staking Derivatives (LSDs)

A number of protocols are facilitating liquid staking on Sui:

SpringSui (by Suilend): Affords sSUI, notable for its on the spot unstaking characteristic, offering vital liquidity and security by lowering depegging danger.Aftermath Finance: Supplies afSUI and integrates liquid staking into its broader DeFi platform.Volo: Affords vSUI as its liquid staking spinoff.Haedal Protocol: The primary liquid staking answer constructed on Sui, offering haSUI and actively increasing its integration throughout main exchanges and DeFi platforms.

Supply: DefiLlama

Stablecoin Integration

Sui has a various and rising portfolio of stablecoins, together with native USDC, USDY (yield-bearing), AUSD, and FDUSD, which collectively signify a good portion of the community’s stablecoin market cap. This variety enhances liquidity for DeFi and helps in-game economies.

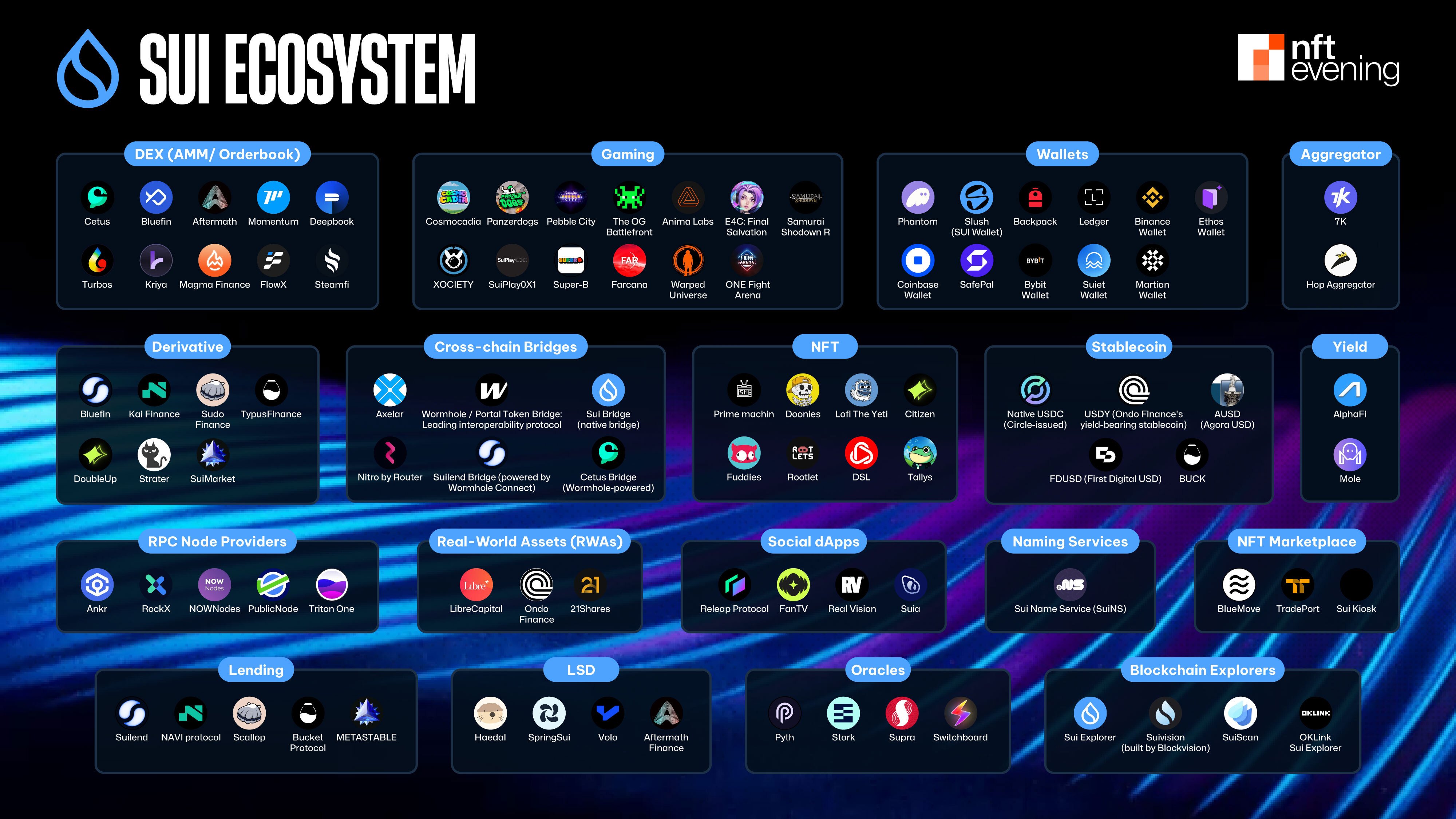

Different Purposes and Infrastructure

Sui’s versatile structure helps a big selection of purposes past DeFi and gaming:

Social dApps: Initiatives like Releap Protocol (a completely decentralized social graph), FanTV, and Actual Imaginative and prescient (integrating Sui for tokenized consumer rewards to foster interactive neighborhood engagement) exemplifies Sui’s attain into social purposes. Wallets: A wide range of wallets help the Sui ecosystem, together with Phantom, Slush (SUI Pockets), Backpack, Ledger, Binance Pockets, Coinbase Pockets, SafePal, Bybit Pockets, Suiet Pockets, Martian Pockets, and Ethos Pockets. Cross-chain Bridges: Crucial for interoperability, Sui integrates with Axelar and Wormhole, a number one interoperability protocol facilitating worth and knowledge switch throughout quite a few blockchains, together with Ethereum and Solana. Oracles: Companies connecting on-chain good contracts with off-chain knowledge, equivalent to Pyth, Stork, Supra, and Switchboard, can be found for the Sui community. RPC Node Suppliers: Infrastructure suppliers like Ankr, RockX, NOWNodes, PublicNode, and Triton One supply RPC companies for Sui, essential for dApp growth and operation. Developer Instruments and SDKs: Sui offers a complete developer-friendly surroundings, together with the Sui CLI, Sui VSCode extension, Sui JS (TypeScript SDK), intensive documentation, guides, tutorials, pattern code, a developer discussion board, weekly workplace hours, and a Telegram channel for help. Blockchain Explorers: Instruments like Sui Explorer and Suivision (constructed by Blockvision) permit customers to view community exercise, monitor belongings, and debug good contracts. Sui Identify Service (SuiNS): This decentralized naming protocol permits customers to register human-readable names (e.g., yourname.sui) that map to advanced pockets addresses and good contracts.

Strategic Progress: Partnerships, UX, and Future Imaginative and prescient

Sui’s dedication to broad adoption and long-term sustainability is clear in its strategic strategy to partnerships, consumer expertise, and a transparent future roadmap.

Strategic Partnerships and Institutional Integration

Sui’s development is considerably fueled by strategic partnerships and institutional integrations, signaling sturdy confidence and a path for large-scale capital. These collaborations are essential for embedding Sui inside conventional finance (TradFi) and mainstream Web3 infrastructure.

Institutional Custody & Entry: Collaborations with Fireblocks improve institutional-grade custody and DeFi entry.RWA Tokenization: Partnerships like 21Shares (a number one crypto ETP supplier) purpose to develop monetary merchandise, speed up Actual-World Asset (RWA) tokenization, and supply institutional and retail entry.Cross-Chain Liquidity: Integrations with Wormhole and OKX Pockets are crucial for reinforcing cross-chain liquidity and consumer engagement.Safe Self-Custody: Ledger integration offers safe self-custody and staking choices for SUI.TradFi Bridges: Initiatives like Ondo Finance are launching tokenized U.S. Treasuries on Sui, whereas ATHEX Alternate explores on-chain fundraising through Sui, demonstrating a concerted effort to bridge TradFi with Web3. Notably, a current partnership with Microsoft additionally positions Sui for deeper blockchain integration inside enterprise purposes.

This concentrate on established gamers and interoperability de-risks the platform, attracting capital and legitimizing Sui’s place within the international digital asset panorama.

Consumer Expertise (UX) and Developer Enablement

Sui’s core design philosophy prioritizes a seamless consumer expertise (UX) and a developer-friendly surroundings to drive adoption past crypto natives.

Simplified Onboarding: Initiatives like ZK Login permit customers to entry dApps with acquainted internet credentials, considerably decreasing the barrier to entry for mainstream audiences.Sturdy Developer Help: Sui provides complete instruments, libraries, tailor-made SDKs, and powerful neighborhood help (workplace hours, boards, Telegram, hackathons like Sui Overflow, and developer grants). The “Transfer Accelerator” program additional helps builders in mastering the Transfer programming language.

This dedication reduces friction for each customers and builders, fostering a “virtuous cycle of development” important for mass adoption and positioning Sui as a platform for on a regular basis purposes.

Supply: Sui Ecosystem

Future Roadmap and Improvement Plans

Sui’s future roadmap emphasizes steady ecosystem growth and refinement. That is guided by a number of strategic priorities.

First, deepening DeFi is a key focus. Plans embrace exploring synthetics, Actual-World Belongings (RWAs), and steady yield alternatives. The Sui Basis’s multi-million greenback DeFi Ecosystem Progress Fund goals to help builders. Furthermore, it seeks to boost liquidity and drive long-term protocol adoption.

Second, scaling GameFi and creator platforms stays essential. The anticipated launch of the SuiPlay 0X1 gaming gadget is predicted as a significant catalyst. Consequently, it can create demand for brand new play-to-earn video games. This might additionally entice diversifications of well-liked blockchain video games to Sui.

For extra: The Progress Potential of Sui?

Moreover, technical enhancements are underway. Plans embrace Layer 2 enhancements leveraging Zero-Information (ZK) know-how. This goals to allow sooner and cheaper transactions. Alongside this, ongoing enhancements to the core community, like Mysticeti v2, are deliberate.

Lastly, neighborhood and institutional focus continues. Efforts persist to draw institutional capital and enterprise options. Certainly, lively neighborhood engagement by way of hackathons, academic packages, and neighborhood hubs helps this.

Analysts typically anticipate SUI worth will increase by 2029-2030. Some forecasts place it between $6 and $12, pushed by its velocity, scalability, and low charges. General, the long-term outlook stays bullish. This positions Sui as a possible chief in rising AI-related niches. It may additionally problem established Layer-1s by the last decade’s finish.