In short

Bitcoin has dropped 3.77% on common every September since 2013, with eight month-to-month crashes in 11 years.

Seasonal pressures—from fund rebalancing to Fed coverage jitters—gas risk-off sentiment that spills over from shares into crypto.

This 12 months’s setup provides struggle, sticky inflation, and Fed uncertainty, making $105K the road within the sand for merchants.

Bitcoin is buying and selling sideways as August winds down, and crypto merchants are doing what they do yearly round this time: making ready for ache.

The phenomenon often called “Crimson September,” or “The September Impact,” has haunted markets for almost a century. The S&P 500 has averaged unfavorable returns in September since 1928, making it the index’s solely constantly unfavorable month. Bitcoin’s observe file is worse—the cryptocurrency has fallen a mean of three.77% every September since 2013, crashing eight occasions in accordance with knowledge from Coinglass.

“The sample is predictable: unfavorable social media chatter spikes round August 25, adopted by elevated Bitcoin deposits to exchanges inside 48-72 hours,” Yuri Berg, a marketing consultant on the Swiss-based crypto liquidity supplier FinchTrade, informed Decrypt.

“Crimson September has gone from market anomaly to month-to-month psychology experiment. We’re watching a whole market discuss itself right into a selloff based mostly on historical past fairly than present fundamentals.”

The mechanics behind Crimson September hint again to structural market behaviors that converge every fall. Mutual funds shut their fiscal years in September, triggering tax-loss harvesting and portfolio rebalancing that floods markets with promote orders. Summer season trip season ends, bringing merchants again to desks the place they reassess positions after months of skinny liquidity. Bond issuances surge post-Labor Day, pulling capital from equities and threat property as establishments rotate into fastened revenue.

The Federal Open Market Committee holds its September assembly, creating uncertainty that freezes shopping for till coverage course clarifies. In crypto, these pressures compound: Bitcoin’s 24/7 buying and selling means no circuit breakers when promoting accelerates, and a smaller market cap makes it weak to whale actions in search of to rotate income into altcoins.

The cascade begins in conventional markets and spills into crypto inside days. When the S&P 500 drops, institutional buyers dump Bitcoin first to satisfy margin calls or scale back portfolio threat. Futures markets amplify the injury via liquidation cascades—a 5% spot transfer can set off 20% in derivatives wipeouts. Social sentiment metrics flip unfavorable by late August and merchants promote preemptively to keep away from anticipated losses. Choices sellers hedge their publicity by promoting spot Bitcoin as volatility rises, including mechanical stress no matter fundamentals.

And similar to another markets, some consider this turns into a sample out of pure rational expectation, which is simply one other strategy to say self-fulfilling prophecy.

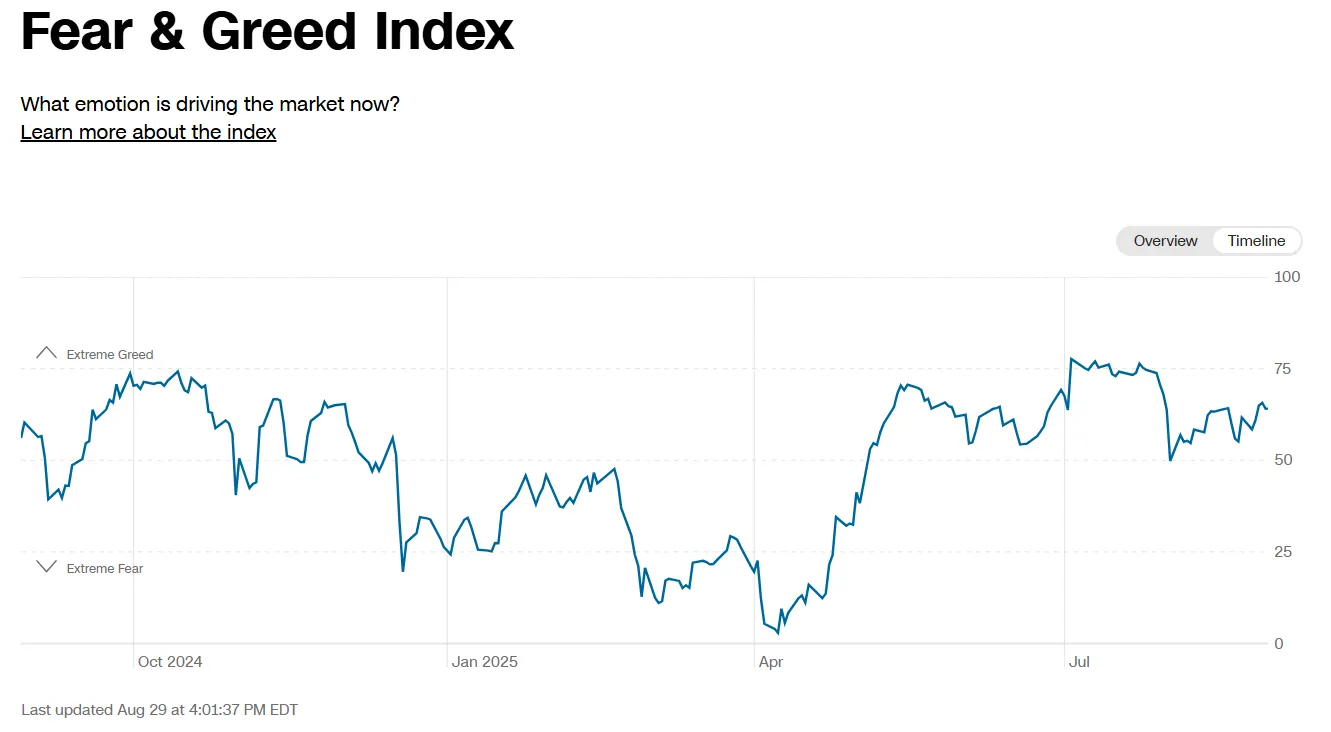

The numbers again up Berg’s commentary. The Crypto Concern and Greed Index has dropped from 74 out of 100 to 52, regardless of the worldwide inventory market exhibiting a extra optimistic view with 64 factors. Borderline impartial however nonetheless within the “greed” zone.

However this September arrives with uncommon crosscurrents. The Federal Reserve has shared optimistic statements, with the market pricing in one other lower for the September 18 assembly. Core inflation stays caught at 3.1%, whereas two lively wars disrupt international provide chains. These circumstances create what Daniel Keller, CEO of InFlux Applied sciences, sees as an ideal storm.

“We’ve two history-defining theaters of fight, one in Europe and one within the Center East, that are disrupting crucial provide chains,” Keller informed Decrypt. “Moreover, the U.S. has initiated a worldwide commerce struggle in opposition to almost all of its main allies. The up to date state of worldwide geopolitics completely positions BTC for a steep decline come September 2025.”

In different phrases, proper now markets don’t see Bitcoin as a hedge, which was the dominant pre-COVID narrative of BTC as an asset. Markets view it way more like a threat asset.

Technical indicators are beginning to paint a scary image for merchants. Bitcoin broke beneath the crucial $110,000 help stage that has anchored the rally since Could. The 50-day transferring common sits at $114,000 and is now performing as resistance with the 200-day EMA offering help close to the $103K worth line.

Technical merchants may be watching $105,000 as the road within the sand. On Myriad, a prediction market developed by Decrypt’s father or mother firm Dastan, merchants presently place the percentages of Bitcoin dipping again right down to $105,000 at almost 75%.

A break beneath $105K would goal sub-100K ranges beneath the 200-day transferring common. Maintain above $110,000 via the primary two weeks of September, and the seasonal curse would possibly lastly break.

The relative power index reads 38, in oversold territory implying no less than some Bitcoin buyers are attempting to do away with their cash ASAP. Quantity stays 30% beneath July averages, typical for late-summer buying and selling however probably problematic if volatility spikes.

However even when issues seem to be merchants are making ready for historical past to repeat itself, some consider Bitcoin’s fundamentals are actually stronger than ever, and that ought to be sufficient for the king of crypto to beat this tough month—or no less than not crash prefer it has prior to now.

“The thought of ‘Crimson September’ is extra delusion than math,” Ben Kurland, CEO at crypto analysis platform DYOR, informed Decrypt. “Traditionally, September has seemed weak due to portfolio rebalancing, fading retail momentum, and macro jitters, however these patterns mattered when Bitcoin was a smaller, thinner market.”

Kurland factors to liquidity as the actual driver now. “Inflation is not gliding decrease, it is proving sticky with core readings nonetheless creeping larger. However even with that headwind, the Fed is beneath stress to ease as development cools, and institutional inflows are deeper than ever.”

Conventional warning indicators are already flashing. The FOMC meets September 17-18, with markets break up on whether or not officers will maintain charges or lower them.

Keller advises watching worry and greed indices intently. “Merchants within the coming weeks ought to monitor worry and greed indices to find out the final market sentiment and whether or not it is higher to carry in case costs bounce or unload as ‘Crimson September’ looms nearer,” he mentioned.

The seasonal sample could also be weakening as crypto matures. Bitcoin’s September losses have moderated from a mean unfavorable 6% within the 2010s to unfavorable 2.55% over the previous 5 years. Institutional adoption via ETFs and company treasuries has added stability. The truth is, within the final two years, Bitcoin has registered optimistic beneficial properties in September.

Berg sees the entire phenomenon as self-reinforcing psychology. “After years of September selloffs, the crypto group has skilled itself to anticipate weak point. This creates a cycle the place worry of the dip turns into the dip itself,” he mentioned.

It the outlook appears bleak, don’t fret: After Crimson September comes October—or “Uptober”—which is traditionally Bitcoin’s finest month of the 12 months.

Disclaimer

The views and opinions expressed by the creator are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Day by day Debrief E-newsletter

Begin day by day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.