Rheinmetall is using a surge in European protection spending and geopolitical tensions

With many upside catalysts now being priced in, the valuation raises questions

We break down fundamentals, dangers, and upside potential. Does Rheinmetall nonetheless belong in your radar?

“Elevator Pitch” Overview

Rheinmetall is Europe’s go-to provider for NATO-standard protection gear—delivering every thing from ammunition to armored autos. As Germany’s main arms producer, it’s been a significant beneficiary of rising protection budgets and the continent’s renewed give attention to navy readiness. For the reason that begin of the struggle in Ukraine, Rheinmetall’s gross sales have multiplied a number of instances over, using the wave of this structural shift in European protection coverage.

What Does The Firm Truly Do?

Rheinmetall manufactures a variety of ammunition, shells, floor autos, air protection programs, and technological warfare programs. It’s a main pressure in modernizing Europe’s protection business to meet up with fashionable warfare techniques equivalent to digital assaults, drones, and others.

The corporate operates throughout 4 enterprise models. Most of its gross sales come from Car Techniques at 41,3%, adopted by Weapons and Ammunition at 26%. The remaining gross sales are break up between Energy Techniques and Digital Options. The primary two segments are driving margin enchancment and progress, whereas the corporate has been scaling again the latter barely. For a deeper dive into the segments, try my earlier article about Rheinmetall.

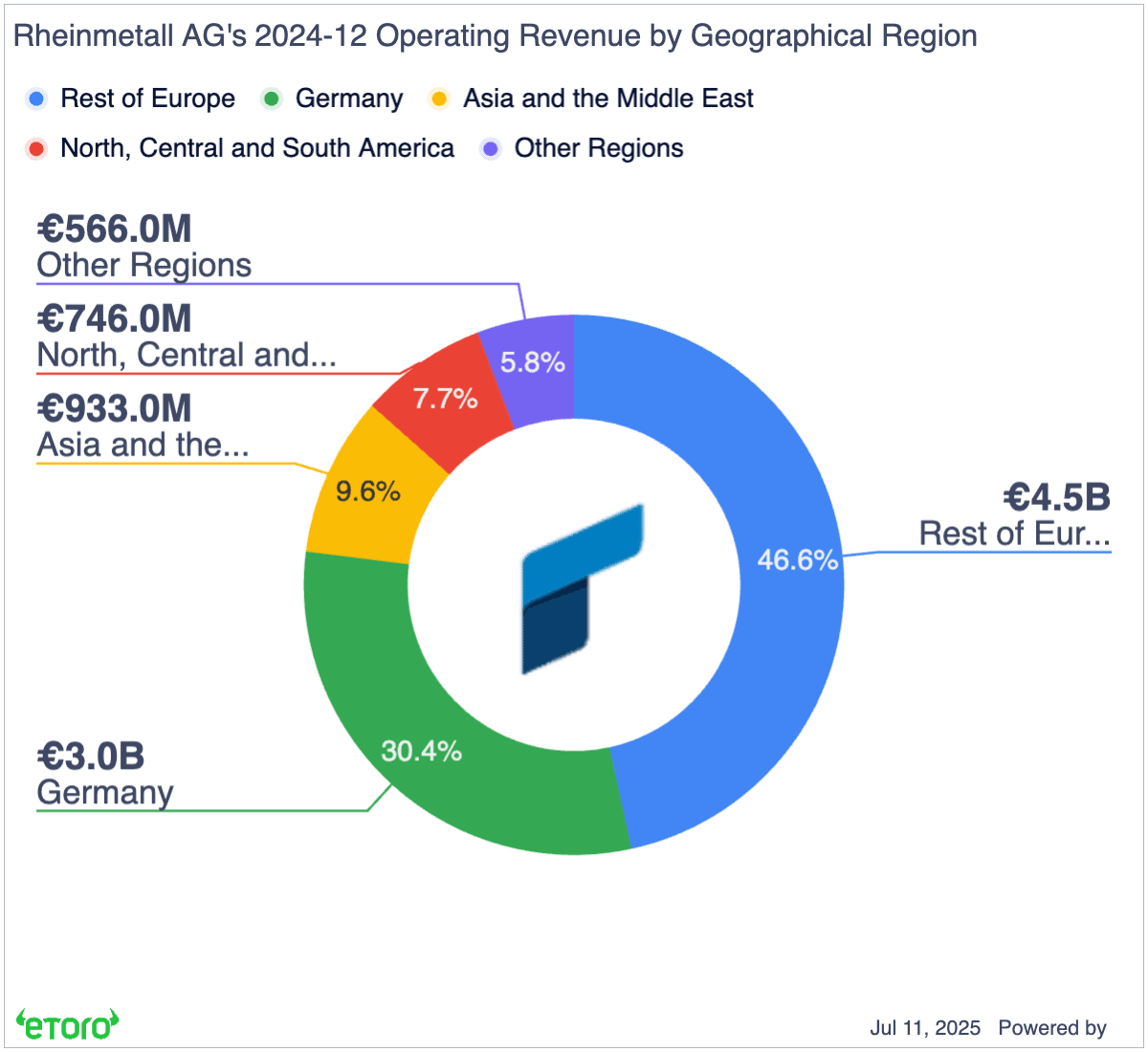

Unsurprisingly, Germany is Rheinmetall’s largest buyer, accounting for 30.4% of 2024 gross sales. However the firm’s attain extends effectively past its residence nation. Practically half of its gross sales come from different NATO allies throughout Europe.

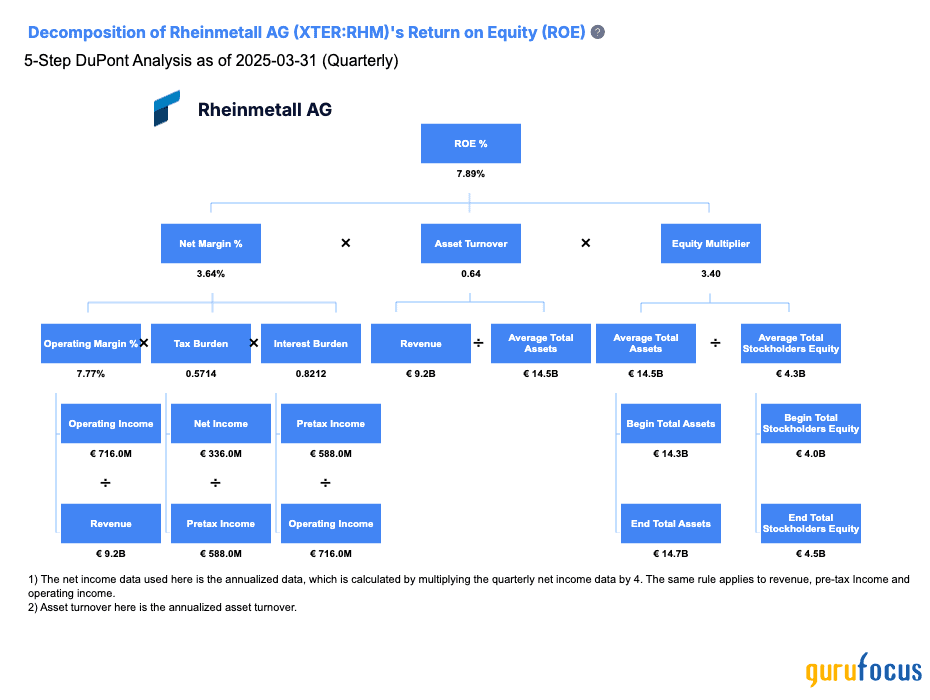

It’s price noting that arms manufacturing is a capital-intensive enterprise with historically low single-digit internet margins. Which means scaling manufacturing isn’t straightforward with out sturdy visibility on future revenues—mirrored in Rheinmetall’s comparatively modest working and internet margins.

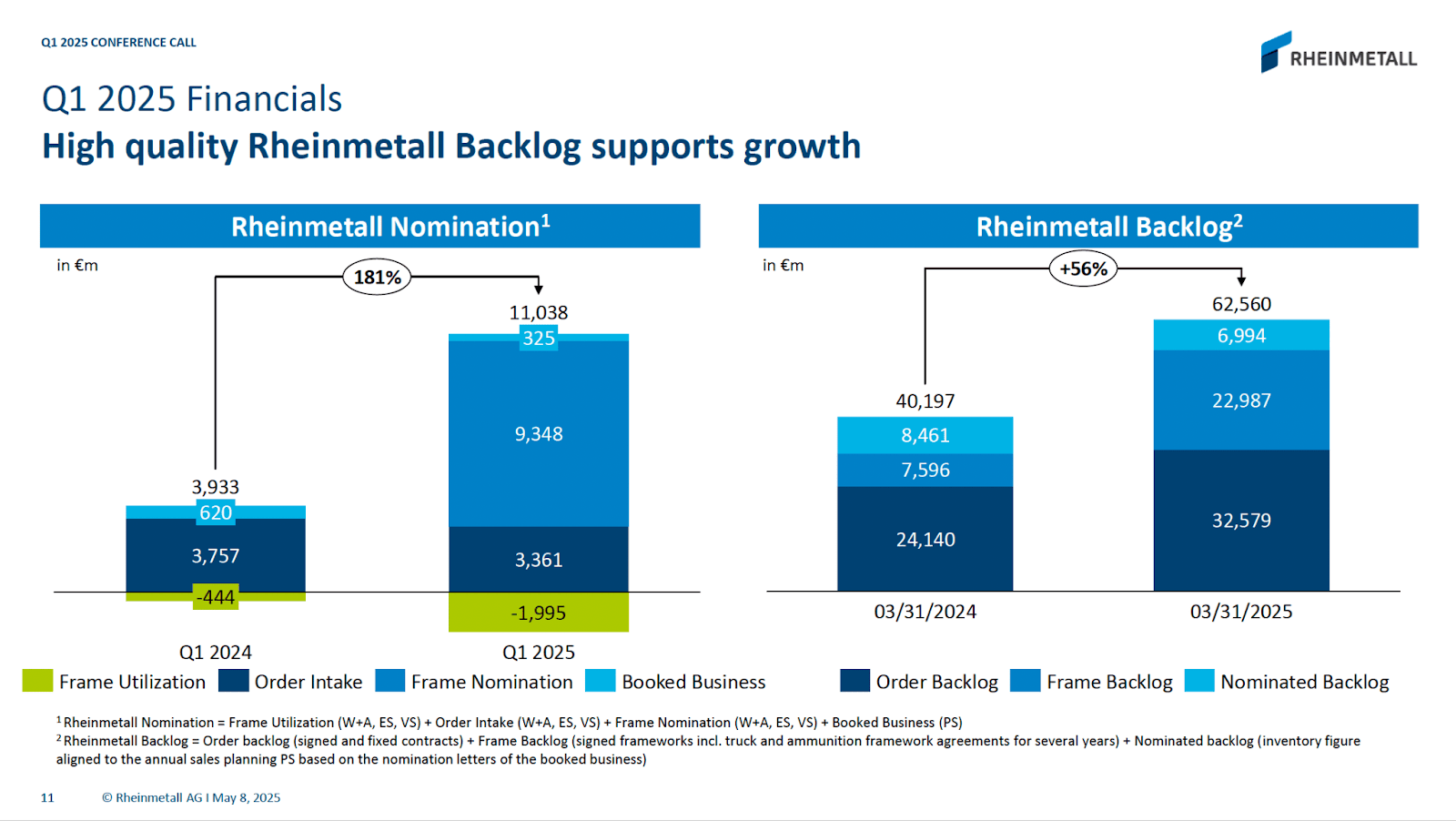

A lot of Rheinmetall’s contracts are long-term in nature, typically structured as framework agreements—primarily, open-ended offers that may be drawn upon over time. Consider it as: “We might buy as much as €1 billion price of ammunition from you over the following 5 years.”

For Rheinmetall, a key metric to observe is the order backlog—the overall worth of signed contracts. In the meanwhile, this stands at greater than six instances the corporate’s 2024 gross sales, with over half already confirmed as precise orders. Going ahead, the most important problem to progress gained’t be demand, however manufacturing capability.

Why Ought to Traders Watch Out Now?

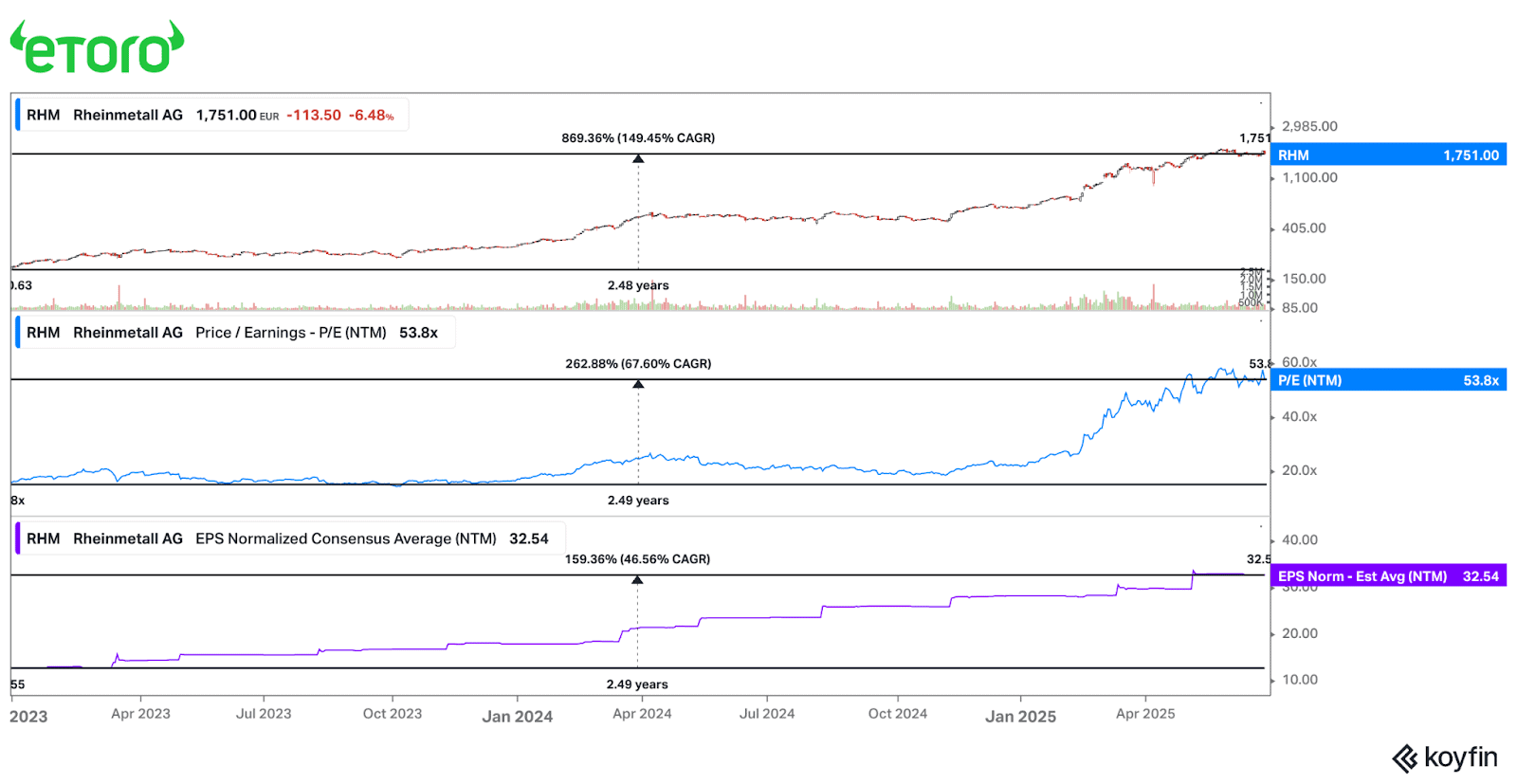

Rising NATO budgets has powered the business’s progress over the previous few years. The battle in Ukraine served as a wake-up name for European governments, prompting a surge in navy spending. On high of that, Donald Trump’s strain on NATO allies to extend their protection spending additional fueled the rally—Rheinmetall shares have climbed over 230% since his election.

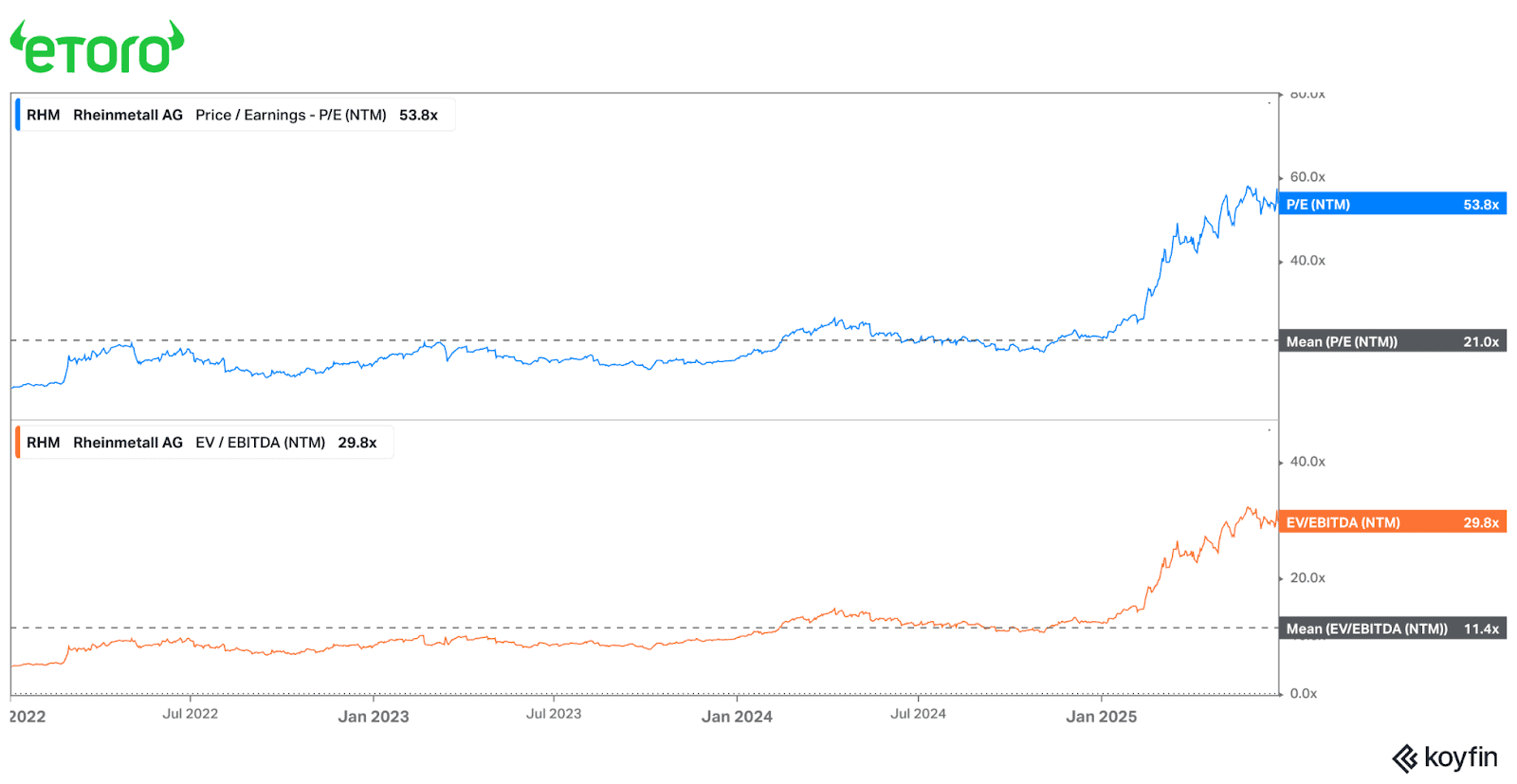

However once we break down that progress, a distinct image emerges: whereas the enterprise has expanded, a good portion of the inventory’s features comes from a number of growth, not simply earnings progress. That’s a pink flag. It suggests the market has moved forward of fundamentals, pricing in excessive expectations the corporate hasn’t but delivered on.

Whereas rising investor sentiment has pushed multiples larger, not a lot has modified to make the corporate’s earnings that rather more useful. Margins are rising, however slowly. New factories in Germany, Latvia, and Hungary are within the works, and Rheinmetall has been lively on the M&A entrance, equivalent to its acquisition of Loc Efficiency within the U.S. and several other joint ventures.

Whereas these steps are strategically sound and help rising returns on invested capital, they don’t dramatically change the expansion trajectory. Factories take years to finish, and the best way I see it, an increasing number of expectations are being baked in with little optimistic catalysts within the close to future to help them.

A few of the margin increase comes from a extra favorable product combine—Rheinmetall is shifting from lower-margin automotive elements to higher-margin munitions and armored autos. The corporate additionally advantages from elevated pricing energy because of the pressing must replenish ammunition stockpiles. Nonetheless, these are cyclical tailwinds, not structural shifts. As soon as inventories are rebuilt and demand normalizes, pricing energy and volume-driven efficiencies might taper off.

Trying forward, additional upside appears to be like restricted:

NATO budgets have largely been set and are unlikely to rise meaningfully from right here.

Trump has softened his rhetoric round NATO and supported a joint assertion reaffirming Article 5.

EU-level protection funding has been agreed upon—however further will increase are unlikely within the close to time period.

Except the battle in Ukraine escalates additional, there’s little to justify additional upside. Quite the opposite, dangers are piling up:

Funds constraints might sluggish deliberate navy spending.

Political fragmentation—equivalent to Spain’s current opposition to elevated NATO funding—might create headwinds.

Capability growth might face rising prices or longer lead instances than anticipated.

And any signal of de-escalation in Ukraine might set off a pointy reversal in sentiment, particularly given Rheinmetall’s reputation amongst retail buyers.

Briefly, Rheinmetall’s fundamentals stay sturdy, however with the inventory priced for perfection, the chance/reward steadiness is tilting the flawed approach. Upside appears to be like capped, whereas draw back dangers—each geopolitical and operational—have gotten tougher to disregard.

Monetary Well being Verify

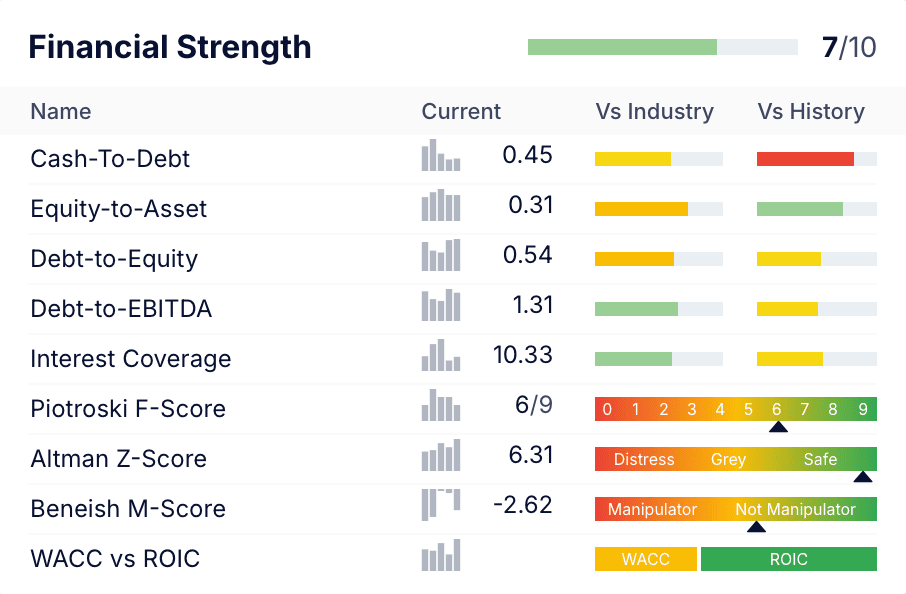

Monetary well being is a bit like insurance coverage—you barely give it some thought when issues are going effectively, however you’ll want you had it when bother hits. Luckily, Rheinmetall doesn’t have to fret. The corporate is in a powerful monetary place, backed by an investment-grade credit standing and stable money flows.

The fairness to asset ratio presently sits at 0,31, reflecting a comparatively excessive stage of leverage that has elevated over the previous two years. Nonetheless, Rheinmetall’s sturdy curiosity protection and wholesome money technology recommend that the debt load stays manageable.

With a debt-to-EBITDA ratio of 1.31, the corporate seems to be utilizing its monetary place strategically—leveraging its progress to fund additional growth with out tipping into overleveraged territory.

Nonetheless, as leverage rises, it’s essential for buyers to control the steadiness sheet. Any indicators of weakening money stream or problem assembly obligations might shift the story shortly.

Moat Evaluation

The moat, or aggressive benefit, is the important thing to sustained compounding over the long run.

Rheinmetall’s moat is stable however not impenetrable. It rests totally on its strategic geographic location and authorities relationships. However the firm nonetheless faces stiff competitors exterior its residence market. Its technological edge, notably in car and air protection programs, provides an essential layer of safety.

Moat pillar

Breakdown

Regulatory benefit

Authorities protection contracts are extremely regulated and require intensive lobbying, lengthy approval cycles, and established relationships. Rheinmetall’s deep ties with the German authorities give it a transparent edge in securing home contracts.

Capital-intensity benefit

Constructing protection manufacturing amenities requires huge upfront funding and lengthy lead instances. Whereas this deters new entrants, Rheinmetall nonetheless faces stiff competitors from different established European protection corporations.

Geographic benefit

European allies will spend extra on protection, however want to maintain nearly all of investments inside their borders. As a German firm, Rheinmetall will profit from one of many largest budgets within the area.

Technological benefit

As fashionable warfare shifts in the direction of digital and cyber capabilities, Rheinmetall’s investments in car automation and battlefield tech (like air protection and digital warfare programs) maintain it forward of the curve.

Rheinmetall has a stable, however not impenetrable moat. Its location inside Germany supplies a powerful home-field benefit, particularly as protection spending turns into extra localized.

Trade & Aggressive Panorama

The protection business is extremely aggressive and fragmented, which limits pricing energy for many gamers. That stated, Rheinmetall has carved out a powerful place—notably in superior weapons programs and navy autos—giving it a transparent edge in a number of key segments.

Right here’s a fast have a look at a few of its foremost opponents:

BAE Techniques (UK) – A key rival in autos and artillery

Leonardo (Italy) – Robust in electronics and land fight programs

Thales (France) – Makes a speciality of sensors and battlefield electronics

Saab (Sweden) – Competes in rockets, sensors, and ammunition

Rolls-Royce – Centered on propulsion programs

Numerous smaller ammunition producers compete at decrease scale and worth factors

US protection contractors stay extremely aggressive globally, however they face growing strain because of the deteriorating relationship between the USA and the EU, so I’m not itemizing them.

Presently, geography performs a essential position. NATO allies are ramping up protection spending, aiming for five% of GDP by 2035. With Germany being Europe’s largest financial system, this interprets into a whole lot of billions in new investments, and Rheinmetall is well-positioned to be a major beneficiary.

Furthermore, Rheinmetall’s capability to produce NATO-standard gear offers it a bonus throughout allied nations.

Capital return to shareholders

Rheinmetall is now in aggressive progress mode. Subsequently, it pays a tiny dividend of 0,41% and isn’t shopping for again its inventory nor paying down debt. This capital allocation technique makes numerous sense for the present stage of the business cycle.

Valuation & Road View

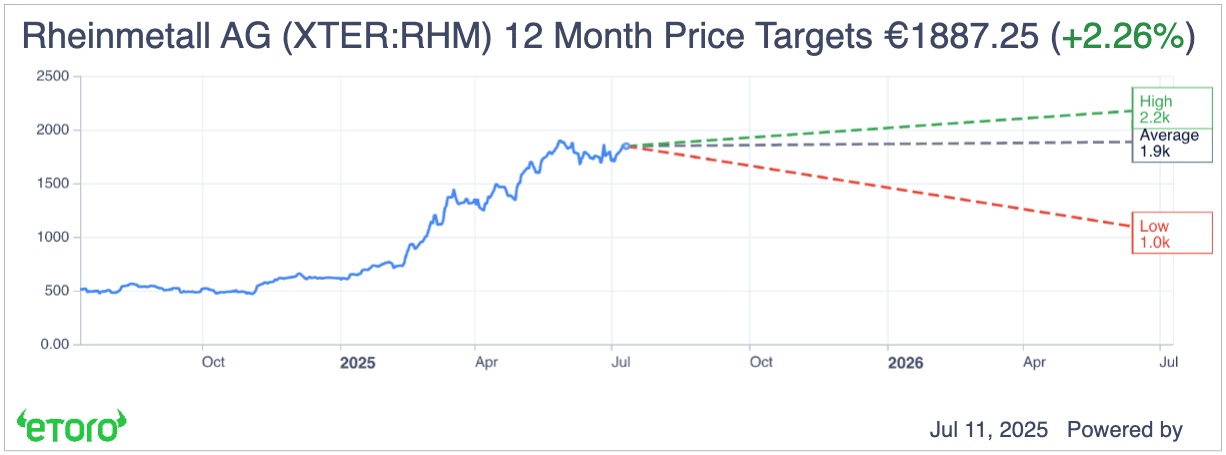

The inventory just isn’t low-cost by any means. After greater than tripling within the wake of the Ukraine battle, shares have surged one other 230%+ since Donald Trump’s election victory. Even when evaluating to the already excessive multiples from 2022, the inventory is now buying and selling at greater than twice its historic imply. Whereas this valuation is backed by actual enterprise developments, the sturdiness of these enhancements is what worries me.

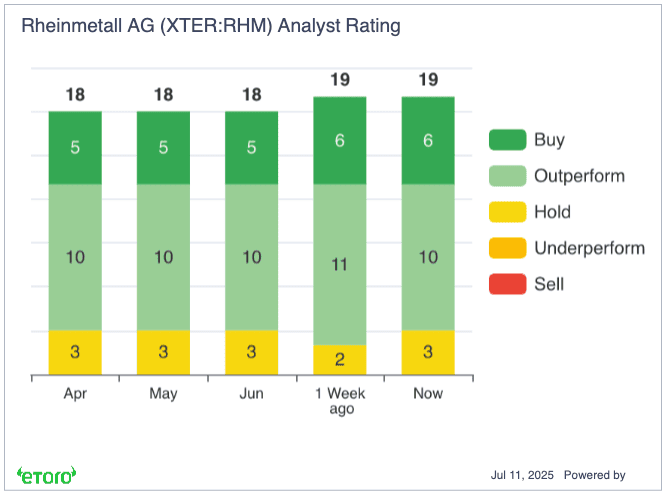

That stated, you’d have a tough time in search of a clearer progress story than Rheinmetall at this second. It’s no shock that 16 Wall Road analysts fee the inventory a “Purchase,” with simply three recommending to “Maintain.”

However the optimistic valuation leaves little room for error, because the inventory is buying and selling above its 12-month goal worth. To justify additional upside, buyers would wish to see new catalysts—both a major soar in margins or a quicker ramp-up in manufacturing capability.

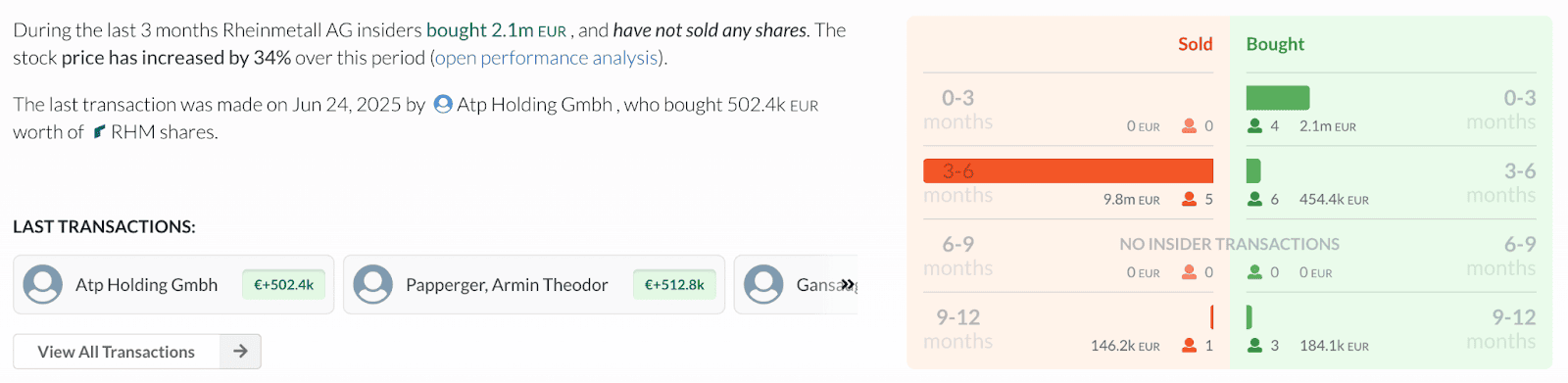

Insider Buying and selling

Supply: alphaspread.com

As we are able to see, insiders, together with CEO Armin Papperger, have been actively shopping for Rheinmetall shares, typically making the most of short-term dips. That’s sometimes a bullish sign. In spite of everything, whereas insiders might promote for any variety of private causes, they normally purchase for only one: they consider the inventory will go up.

Nonetheless, it’s price noting that total promoting quantity nonetheless outweighs shopping for, suggesting a extra cautious image.

Upcoming catalysts

Rheinmetall’s upcoming earnings might provide contemporary catalysts—equivalent to updates on joint ventures or new growth tasks. Whereas further demand information is all the time welcome, the corporate already has six years’ price of gross sales in its backlog, so the extra essential half is capability growth and how briskly the enterprise can ship in booked enterprise.

Key areas to observe in administration’s commentary:

Margin tendencies – Is there room for additional enchancment?

Manufacturing volumes – Can capability scale quick sufficient to fulfill demand?

Pricing energy – Is the corporate in a position to preserve or enhance pricing?

Section combine – Are high-margin divisions (like munitions and autos) gaining share?

Bull vs Bear case

View

Key factors

Upside / Draw back

Bull case

If the upper protection spending budgets come via with out a lot political opposition and Rheinmetall is ready to seize a big share, we are able to anticipate margin progress to proceed, capability growth to be justified by larger demand and contribute to progress. The important thing right here will probably be order progress and Rheinmetall’s capability to translate that progress into income. The entire bullish thesis rests on the idea that geopolitical tensions stay unchanged or escalate, which isn’t a great scenario.

If nothing materially adjustments, on the present elevated multiples, the inventory is unlikely to develop rather more than its earnings progress, which is excessive at 25%.

Bear case

There are lots of issues that would go flawed with Rheinmetall. Geopolitical tensions shift repeatedly, capability growth would possibly get delayed, orders might not translate to income as quick as anticipated or extra competitors might come up. If the expansion story exhibits any cracks, anticipate a number of compression.

A reversal to the already elevated 3-year common P/E might imply greater than 50% draw back.

Backside-line Wrap

To sum it up, Rheinmetall has been a powerhouse within the European protection area lately. That stated, a lot of the anticipated progress already appears priced into the inventory. For my part, the draw back dangers overshadow upside potential.

For growth-focused buyers, Rheinmetall stays a powerful compounder with stable momentum—assuming the geopolitical backdrop holds regular. However for value-oriented buyers, the practice might have left the station a while in the past.

What do you consider Rheinmetall? Do you personal the inventory? Tag me utilizing “@thedividendfund” on eToro and let me know!

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.