Everybody watching crypto in 2025 noticed the headlines about Bitcoin costs and market cap milestones, however the true story was the quiet transformation of yield itself. After years of hypothesis and regulatory uncertainty, crypto began constructing actual bridges to conventional finance (TradFi) as yield returned to digital property—not by dangerous token farms, however by real-world monetary devices like authorities bonds and controlled stablecoin frameworks.

The catalyst for this transformation was U.S. laws referred to as the Guiding and Establishing Nationwide Innovation for U.S. Stablecoins Act of 2025, broadly known as the GENIUS Act. On July 18, 2025, President Trump signed the GENIUS Act into federal legislation, creating the primary complete U.S. regulatory framework for fee stablecoins. This legislation set guidelines requiring U.S.‑greenback‑pegged stablecoins to be backed 100% by liquid property reminiscent of {dollars} or quick‑time period Treasuries and to offer common public disclosures of these reserves.

This was a sport‑changer in crypto regulation as a result of it changed uncertainty with clear guardrails, that are exactly what institutional cash has been asking for. The GENIUS Act gave stablecoins a authorized definition and standing within the U.S., marking a large shift for an asset class that had for years operated in regulatory gray zones.

READ ALSO: Is The GENIUS Act a Sport Changer For US Regulation?

The legislation didn’t make stablecoins excellent or danger‑free; it didn’t permit curiosity funds on to holders, a deliberate alternative by legislators meant to keep away from turning stablecoins into financial institution deposit substitutes. What it did was to create a fertile atmosphere for innovation, notably round how yield may very well be earned with out violating the legislation.The GENIUS Act modified the incentives for innovation in stablecoins and DeFi by requiring full reserve backing and clear audits. The legislation successfully compelled issuers to undertake professional-grade monetary controls, just like these utilized by banks and cash market funds.

Additionally, the legislation accelerated the event of compliant yield merchandise, and since direct curiosity on stablecoins was prohibited, crypto innovators needed to pivot towards other ways to generate returns. This led to a surge in tokenized real-world property (RWAs) like short-term Treasuries, cash market devices, and structured debt merchandise on blockchain networks.

The GENIUS Act additionally standardized disclosure and auditing necessities, which allowed regulators, buyers, and market members to trace stablecoin reserves in actual time. This transparency lowered systemic danger and made stablecoins extra reliable as instruments for funds, settlements, and collateral.

In follow, this meant that stablecoins might now function institutional-grade digital money, usable for buying and selling, lending, and collateralization, whereas concurrently integrating with tokenized Treasuries and different yield-bearing RWAs. Lastly, the legislation signalled to the broader monetary markets that the U.S. was severe about fostering regulated innovation in digital property. Different jurisdictions started seeking to the GENIUS Act as a mannequin for creating authorized certainty for stablecoins, marking 2025 as the beginning of a extra globally coordinated strategy to bridging TradFi and DeFi.

Yield has all the time been the lifeblood of economic markets, and in TradFi, buyers count on returns on their capital, whether or not by curiosity, dividends, or yield curves. For years, crypto struggled to supply a reliable yield system. The early DeFi period was outlined by excessive‑APR farming and short-term liquidity incentives, which had been thrilling however not sustainable or deeply trusted by establishments.In 2025, that modified, and crypto started to supply yield that seemed extra like TradFi however with blockchain benefits. As an alternative of chasing quick‑time period token incentives, buyers and establishments began allocating to tokenized authorities debt, regulated RWA merchandise, and curiosity‑aligned yield devices that match into broader monetary portfolios. Institutional gamers started taking part extra actively, deploying capital into these tokenized merchandise alongside conventional portfolios. They had been interested in options reminiscent of real-time settlement, on-chain collateralization, and the flexibility to programmatically combine property into DeFi lending, borrowing, and structured methods. Even subtle retail buyers started to benefit from these merchandise, accessing yields that had been beforehand restricted to banks or cash market funds.

2025 additionally noticed the emergence of interest-aligned yield devices that bridged the hole between DeFi and TradFi. These merchandise delivered predictable, regulated returns with out the intense volatility of typical DeFi farming. Examples included tokenized cash market devices, Treasury-backed tokens, and structured RWA swimming pools that generated yield whereas remaining compliant underneath U.S. stablecoin legislation.

Maybe the most important story of 2025 on this house was the explosive development in tokenized U.S. Treasury property.

Based on CoinGecko’s 2025 RWA Report, the market cap of tokenized Treasury property climbed from just about nothing to $5.6 billion by April 2025, representing a 544% enhance year-over-year. This made tokenized treasuries the fastest-growing class of RWA property in crypto throughout that interval.

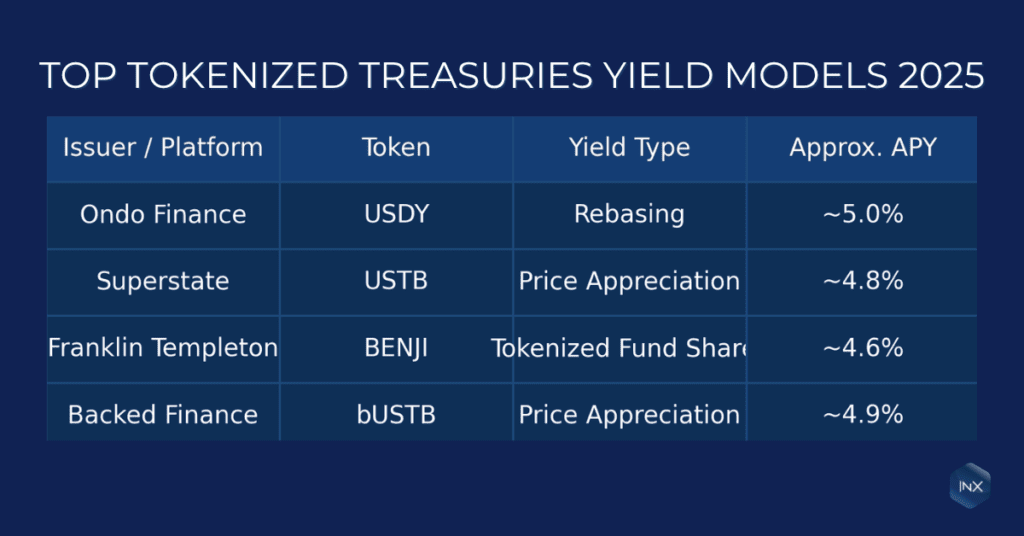

BlackRock’s BUIDL fund emerged because the dominant participant, holding roughly 44% of the tokenized Treasuries market cap by April 2025 after rising considerably throughout the yr. Different main gamers, together with Ondo Finance, Franklin Templeton, and Superstate, additionally helped broaden the class, bringing larger selection and depth to those on-chain monetary devices.

Why does this matter? U.S. Treasuries are the bedrock of worldwide finance. Tokenizing them means you’ll be able to:

Maintain, commerce, and settle Treasury publicity straight on blockchainsUse them as collateral in DeFi functionsCombine them into good contracts for lending, borrowing, and liquidity provisioning

That offers crypto customers actual yield that’s tied to the very core of worldwide markets.

READ ALSO: 5 Highly effective Charts, 25 Sector Drivers That Outlined Crypto’s $4Trillion Yr

The GENIUS Act prohibited stablecoins from paying curiosity on to holders underneath its fee guidelines. In follow, the restriction redirected creativity fairly than suppressing it, pushing builders towards different yield paths that had been each law-abiding and institutionally credible.

As an alternative of yield-bearing stablecoins, the market started to embrace yield-linked devices that sit adjoining to stablecoins fairly than contained in the fee stablecoin class:

Tokenized Treasury payments and short-term debt tokensTokenized cash market fundsStructured RWA merchandise that generate return exterior the stablecoin fee framework

These devices operate like yield-bearing stablecoins in impact, however they’re structured in a different way in order that they adjust to the brand new regulatory framework.

Tokenized Treasury payments and short-term debt tokens grew to become one of the vital essential substitutes. These tokens signify claims on authorities securities that already pay yield in conventional markets, and by bringing them onchain, customers might earn returns tied to risk-free or low-risk devices whereas nonetheless benefiting from blockchain settlement, programmability, and composability.

Tokenized cash market funds additionally gained traction; these merchandise pool capital into diversified short-duration property like Treasury payments and repurchase agreements, then subject on-chain tokens representing possession within the fund. For the principle motive that they’re structured as funding merchandise fairly than fee stablecoins, they fall exterior the GENIUS Act’s curiosity prohibition whereas nonetheless delivering a predictable yield.

Structured RWA merchandise expanded alongside these developments, together with on-chain autos that bundle Treasuries, cash-like devices, or personal credit score into clear swimming pools designed to generate yield with out functioning as circulating cash.

Knowledge reveals that these yield-linked RWA devices grew quickly all through 2025 as customers and establishments adjusted to the brand new regulatory atmosphere. This allowed DeFi to faucet into macroeconomic yield with out counting on speculative token incentives.

Extra importantly, this shift helped separate cash from yield in crypto, whereas stablecoins grew to become what regulators needed them to be: dependable, boring, payment-focused digital money. Yield moved into clearly outlined funding merchandise constructed on high of that money layer. This separation mirrors TradFi, the place checking accounts don’t pay yield, however cash market funds and Treasury merchandise do.

The result’s a extra mature monetary stack, the place regulators get clearer boundaries, and builders acquire room to innovate responsibly.

The regulatory requirement for stablecoins to carry high-quality liquid property to again their tokens has turned stablecoin reserves into vital holders of U.S. Treasuries.

A market evaluation in 2025 estimated that stablecoins collectively processed greater than $33 trillion in transaction quantity globally. The identical evaluation identified that stablecoin issuers already held tens of billions of {dollars} in U.S. Treasuries as a part of their reserve backing.

This dynamic turns stablecoin issuers into main institutional patrons of presidency debt, with implications past crypto:

Extra demand for Treasuries can affect yields and liquidity in world bond markets.It ties digital cash issuance to sovereign debt, which deepens the connection between crypto and macroeconomics.It alerts that stablecoins have matured from area of interest fee tokens into core monetary infrastructure that may drive world capital markets.

Tokenized Treasuries had been solely the start, and the broader real-world asset tokenization market, i.e. property past stablecoins, additionally noticed sturdy demand and fast enlargement.

Excluding stablecoins, the RWA market grew from roughly $5.5 billion on the finish of 2024 to roughly $18.1 billion by late 2025, in line with a Cointelegraph report, a 229% rise in lower than a yr. This consists of tokenized Treasuries but additionally personal credit score, structured finance devices, and different yield-related tokens.

CoinShares and different analysts count on 2026 to be one other breakout yr for tokenized RWA development, with U.S. Treasury merchandise as soon as once more main the cost as blockchain settlement and issuance know-how matures.

The GENIUS Act isn’t the one signal that authorities are taking crypto yield markets critically. A current coverage report reviewing world developments in 2025 discovered that over 70% of jurisdictions with main crypto publicity had been advancing stablecoin regulation, which in flip created incentives for institutional market entry.

This broader regulatory emphasis has helped de‑danger sure elements of the blockchain financial system, making yield‑linked merchandise extra enticing to banks, asset managers, and institutional buyers.

On the identical time, monetary trade teams reminiscent of SIFMA have formally weighed in on how regulators ought to implement the GENIUS Act in a means that protects buyers whereas permitting innovation in tokenized property and stablecoin markets. The result’s a market‑pleasant atmosphere the place compliance and capital can coexist.

Right here’s how merchants, builders, and coverage watchers can act on this story:

For merchants

Watch the yield curves of tokenized RWA merchandise, not simply token costs.Use Treasury‑backed tokens as collateral in diversified methods.Monitor regulatory developments that have an effect on how stablecoin reserves are managed.

For builders

Give attention to compliant yield merchandise that align with regulatory frameworks just like the GENIUS Act.Construct interoperability layers between tokenized property and TradFi methods.Educate customers on yield mechanisms and danger profiles to deepen belief and adoption.

For Coverage Watchers

Research how stablecoin reserve necessities affect Treasury markets and financial coverage.Encourage harmonized world frameworks to help institutional participation.Monitor how improvements like tokenized debt reshape monetary markets.

READ ALSO: 5 Highly effective Charts, 25 Sector Drivers That Outlined Crypto’s $4Trillion Yr

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. All the time conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”