The most recent crypto high-profile platform to be focused by the dangerous guys is Metawin. In accordance with stories, hackers broke into the withdrawal system of the crypto website and stole greater than $4 million value of digital belongings.

Metawin’s CEO has confirmed the safety breach because the on line casino instantly stopped all its fee requests.

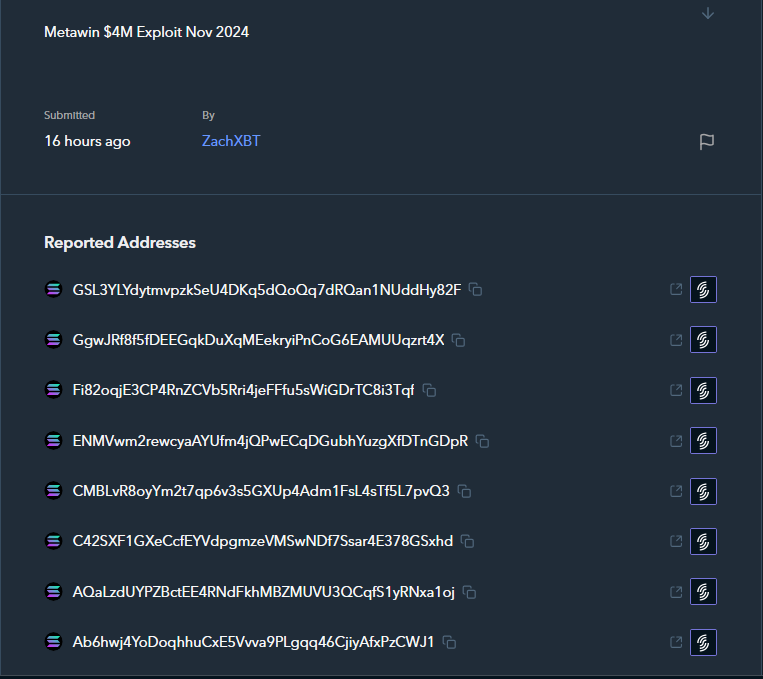

One crypto person reported that the hacker has moved funds to the HitBTC nested service and KuCoin. The person additionally came upon that there are roughly 115 crypto addresses related with the hacking incident.

Withdrawals are again on-line after the on line casino’s newest assertion in regards to the hacking incident, the place 95% of its customers presently entry this service.

A Collection Of Pricey Crypto Hacks This October

The incident was reported on Telegram by on-chain investigator ZachXBT, who wrote, “It seems that the cryptocurrency on line casino Metawin was exploited for $4M+ on Ether and SOL earlier as we speak.”

🚨 MetaWin On line casino Loses $4M in Hack as Crypto Scams Surge

On-line on line casino @metawincom misplaced round $4 million in a hack on November 3, focusing on its sizzling wallets by a flaw in its withdrawal system, in response to CEO Skel.

Withdrawals had been halted however have since been restored… pic.twitter.com/KT28cS3UCs

— VERITAS PROTOCOL (@veritas_web3) November 3, 2024

Metawin’s hacking is the newest in high-profile hacking and on-line thefts focusing on the DeFI sector. October is among the costliest months for cryptocurrency safety breaches. The month noticed 20 hacks, costing crypto corporations round $88 million. These hacking incidents underscore the present safety weaknesses of crypto websites, significantly these in DeFI.

A screenshot of eight of the 115+ theft addresses linked to the hacker. Supply: ZachXBT

Primarily based on business monitoring, Radiant Capital was the worst-hit crypto agency this October.

Final October seventeenth, hackers exploited the weak factors of the platform’s sensible contracts, efficiently stealing $53 million.

The hackers used cross-chain protocols to switch the digital belongings to Ethereum, making it tough to hint the belongings. Then, now we have a US authorities pockets compromised for $20 million. Curiously, the “hacker” returned a lot of the funds, however $700k continues to be lacking.

One other attention-grabbing hacking case focused EigenLayer and The Tapioca Basis. On October 4th, EigenLayer misplaced $5.7 million to theft, and The Tapioca Basis additionally misplaced $4.7 million.

As of Nov. 4, 2024, the market cap of cryptocurrencies stood at $2.25 trillion. Chart: TradingView

Losses Pile Up As Extra Crypto Websites Endure Hacks

Many are involved with hacking in addition to safety breaches into DeFi. To this point this 12 months, hacker exercise has brought on $1.7 billion in losses. This consists of 179 incidents. Whereas there have already been a number of breaches which have occurred this 12 months, the numbers are way more important than what occurred final 12 months. In different phrases, stakes are a lot larger for block chain builders because the charges simply maintain going larger.

Analysts say hacking incidents within the third quarter value corporations round $750 million. Every hack averaged $5.93 million in digital belongings. These losses from hacking recommend a rising crypto drawback that the business should deal with.

Featured picture from Dall-E, chart from TradingView