Be part of Our Telegram channel to remain updated on breaking information protection

The Solana worth has surged 7% within the final 24 hours to commerce at $223 as of 4 a.m. on a 26% improve in day by day buying and selling quantity to $9.04 billion.

The SOL worth rise comes as VisionSys introduced a $2 billion Solana treasury plan with Marinade Finance. The corporate will begin with $500 million buy of SOL within the first six months, which might be staked by means of Marinade to make sure safety and compliance.

🚨 NEW: Nasdaq-listed VisionSys AI launches as much as $2B Solana treasury technique with Marinade Finance, aiming to accumulate and stake $500M $SOL inside 6 months. pic.twitter.com/7yS5mZNwGc

— Cointelegraph (@Cointelegraph) October 2, 2025

Information of the plan triggered an preliminary 57% plunge in VisionSys AI shares amid considerations about funding and threat. The inventory pared losses to shut yesterday down 7.3%.

VisionSys AI (VSA) inventory plunged 57% after asserting plans for a $2B Solana treasury, beginning with $500M in SOL buys & staking. A stark reminder of the dangers when public companies dive into crypto. #TOAINews2025 #VisionSysAI #Solana #CryptoMarkets #StockVolatility pic.twitter.com/u6qoK7zrjl

— Instances Of AI (@TimesOfAI_) October 2, 2025

VisionSys stated the transfer will assist strengthen its stability sheet, enhance liquidity, and create long-term worth.

Solana Value Community Exercise Surges, Staking Grows

Solana’s bullish worth motion is backed up by on-chain information. The community reported over $1.25 billion in income to date this yr, with quickly rising exercise and a day by day lively person rely above 2.3 million.

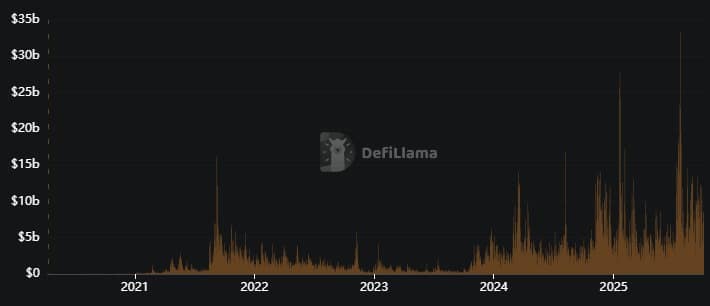

Transaction volumes on Solana’s decentralised exchanges are at file highs, accounting for greater than 81% of all DEX exercise, which suggests buying and selling and liquidity are excessive..

With corporations like VisionSys AI pledging to stake tons of of tens of millions in SOL, community staking participation additionally appears set to climb. Marinade Finance, VisionSys’s accomplice, already delegates greater than 10 million SOL, displaying large gamers are taking long-term positions within the blockchain.

Glassnode and Token Terminal information reveal that extra SOL is being moved off buying and selling platforms and into wallets, signalling confidence and lowering dangers of sudden sell-offs.

The last word driver for Solana could possibly be the approval of spot ETFs within the US. These merchandise would enable institutional buyers to carry SOL simply, fueling one other wave of demand.

Alongside company treasuries adopting SOL, these catalysts might maintain the uptrend scorching so long as technical and help ranges maintain.

Solana Holds Key Ranges: Outlook Turns Bullish

Solana’s worth has rallied strongly, helped by the information of contemporary company demand and robust on-chain exercise. After dropping earlier within the yr, SOL discovered help at $160 after which climbed above its important 50-week easy transferring common (SMA), now sitting at $182.62 based on the most recent chart information.

SOLUSD Evaluation Supply: Tradingview

The 200-week SMA is way beneath present costs at $101.86, displaying the market’s continued power and bullish bias.

SOL worth motion has been marked by a sequence of upper highs and better lows since a breakout in mid-2024. It is a robust technical signal that consumers are in management. Resistance stays robust on the $240 stage, the place the chart signifies earlier promoting strain. But when SOL can break above that zone, analysts see targets at $252, and doubtlessly increased if new consumers step in.

SOL’s RSI (Relative Energy Index) is now at 59.67, suggesting there’s nonetheless room for the worth to climb earlier than reaching overbought ranges. The MACD (Transferring Common Convergence Divergence) indicator is optimistic (5.77 and 16.29), supporting continued bullish sentiment.

The ADX (Common Directional Index) at 17.35 exhibits consumers are gaining power, however the development shouldn’t be exhausted but.

So, merchants are watching the $182–$200 help zone, which has repeatedly introduced in new consumers. So long as SOL stays above these ranges, the uptrend is prone to proceed. If resistance at $240 is cleared, SOL might transfer shortly in the direction of $252–$265. Particularly if large-scale shopping for from new company treasuries and ETFs picks up.

May Solana Value Hit $300–$350?

If momentum retains up and the VisionSys treasury plan goes ahead, there’s a actual likelihood for SOL to retest all-time highs and transfer into the $300–$350 vary.

Elon Musk’s AI prediction device, Grok, highlighted this potential, with progress supported by technological upgrades (Firedancer, Alpenglow), rising institutional adoption, and expectations for spot Solana ETF approval within the US.

With a lot new demand from treasury consumers, technical alerts turning bullish, and ETF information pending, a run in the direction of the higher finish of these estimates is on the desk.

The primary threat stays any sudden drop beneath $182, which might result in a take a look at of decrease helps at $160 and $120.

Solana is proving its power as an institutional-ready blockchain, and it retains gaining reputation as an asset for each treasuries and crypto merchants. If momentum continues and on-chain developments keep robust, Solana might stay one of many top-performing cash this quarter.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection

![[LIVE] Crypto News Today, October 16 – Crypto Crash Continues as Bitcoin Stuck Below $112K, XRP Price at $2.42; Coinbase Lists BNB: What’s the Next Crypto To Explode? [LIVE] Crypto News Today, October 16 – Crypto Crash Continues as Bitcoin Stuck Below $112K, XRP Price at $2.42; Coinbase Lists BNB: What’s the Next Crypto To Explode?](https://blockchainbroadcast.net/wp-content/themes/jnews/jnews/assets/img/jeg-empty.png)