Michael Saylor’s Technique has introduced a brand new Bitcoin buy to start out off Might. Right here’s how the remainder of the month may go, primarily based on previous sample.

Technique Has Simply Added 1,895 BTC To Its Bitcoin Stack

In a brand new publish on X, Technique chairman and co-founder Michael Saylor has introduced the newest Bitcoin buy by the corporate. In line with the submitting with the SEC, Technique acquired a complete of 1,895 BTC at a median worth of $95,167 between April twenty eighth and Might 4th.

With this $180.3 million buy, the mixed BTC holdings of the agency have risen to 555,450 BTC. In whole, the corporate spent $38.08 billion to accumulate this stack.

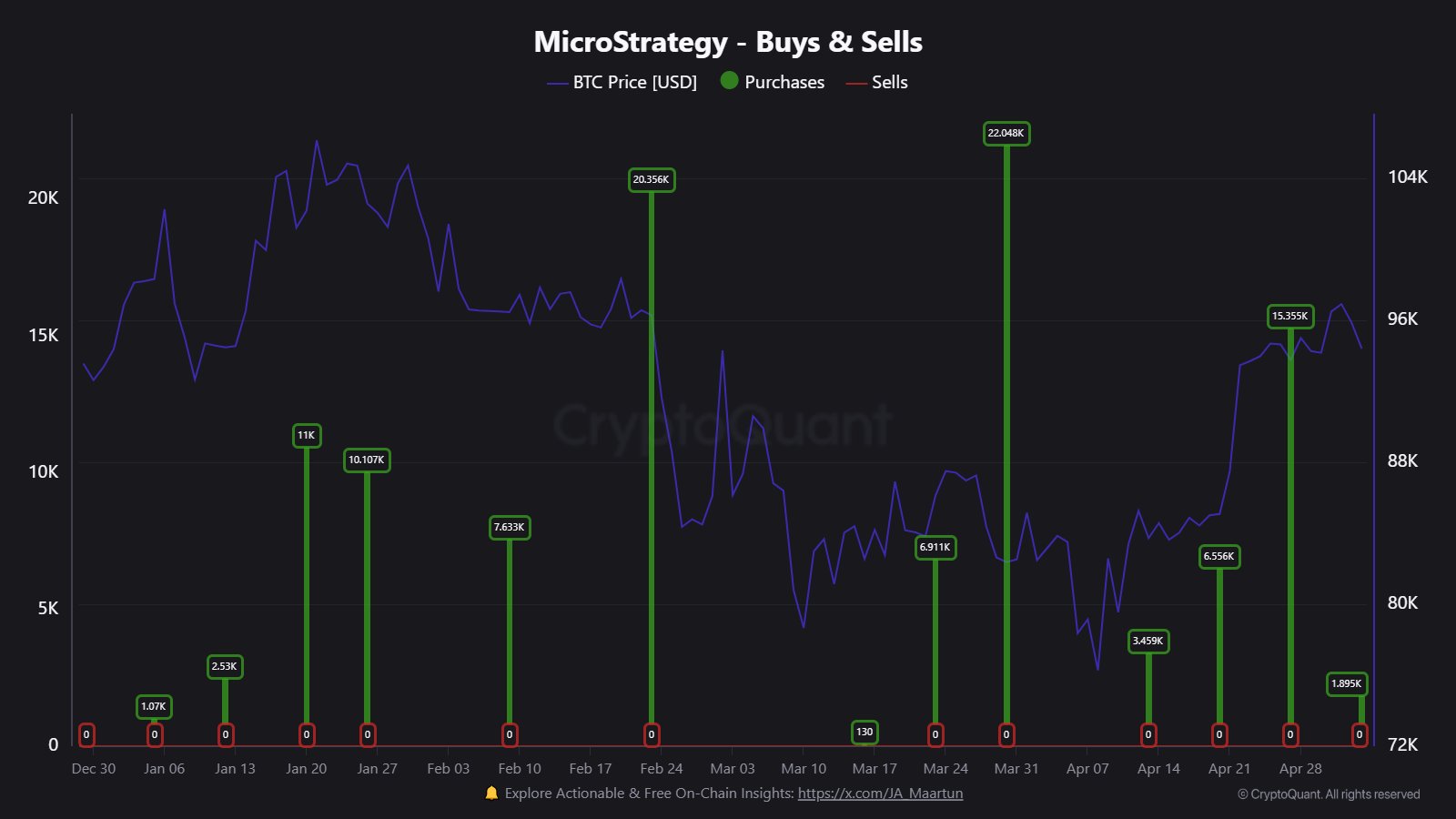

Throughout the previous couple of months, Technique has been energetic with their Bitcoin shopping for and CryptoQuant neighborhood analyst Maartunn has seen an attention-grabbing sample associated to those purchases.

Under is the chart that the analyst has shared.

The timeline of the purchases made by the agency throughout the previous couple of months | Supply: @JA_Maartun on X

“The primary MicroStrategy buy of the month is at all times the smallest. It construct up because the month progresses,” notes the analyst. The newest 1,895 BTC acquisition occurs to be the primary one for the month of Might. As such, it’s attainable that later buys on this month, if any, would contain a bigger quantity than this, if the sample is something to go by.

The Bitcoin reserve of the corporate at present has its price foundation at round $68,550, so on the newest trade price of the cryptocurrency, it might be sitting on a revenue of about 38%. Up to now, it might seem the wager of Saylor’s agency is understanding.

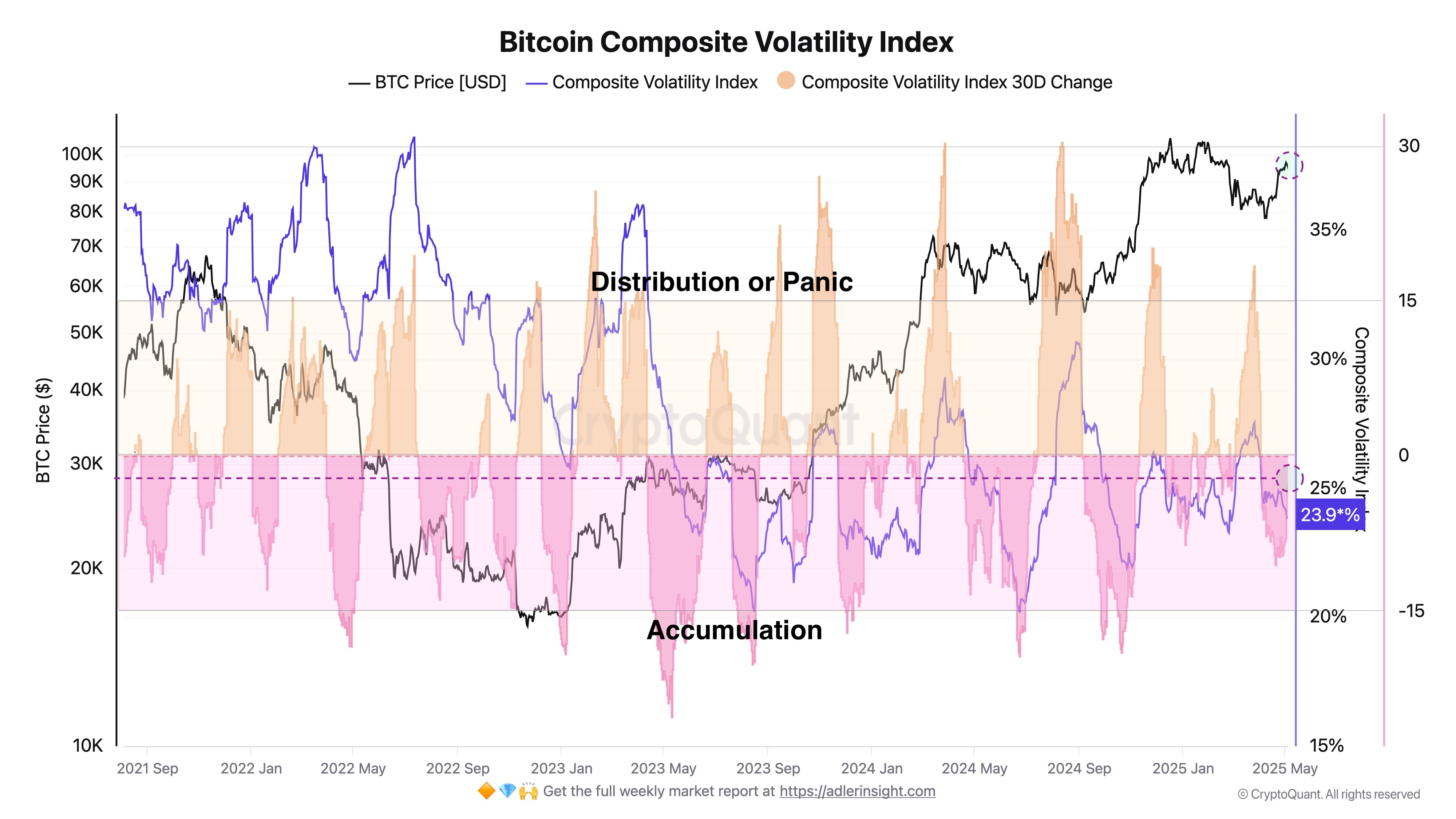

In another information, CryptoQuant writer Axel Adler Jr has shared how BTC is at present wanting from the lens of the Composite Volatility Index devised by the analyst.

“Evaluation of Bitcoin handle exercise, which underpins the Composite Volatility Index and its 30-day change, permits us to determine market macro phases,” notes Adler Jr.

Right here is the chart for the indicator shared by the analyst, which reveals the pattern in its each day worth and 30-day change over the previous couple of years:

Seems to be just like the 30-day change within the metric has been unfavorable in current days | Supply: @AxelAdlerJr on X

In line with Adler Jr, the 30-day change within the Bitcoin Compositive Volatility Index being beneath the 0% mark suggests an accumulation part from the buyers. Equally, it being above 15% signifies a distribution or panic-selling part.

From the above graph, it’s obvious that the 30-day change within the indicator has assumed a unfavorable worth not too long ago. At current, it’s sitting at -3.5%. Subsequently, from the attitude of this indicator at the least, the buyers are accumulating.

BTC Value

Bitcoin noticed a pullback to ranges beneath $94,000 earlier within the day, however it seems the coin has discovered a rebound as its worth is now again at $94,800.

The pattern within the BTC worth over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.