We see that the emergence of exchange-traded funds (ETFs) tied to crypto belongings has reshaped how institutional and retail buyers have interaction with the market. Following the success of Bitcoin and Ethereum spot ETFs, Solana is poised to develop into the subsequent main blockchain asset to enter the ETF highlight. However past the regulatory milestones, the query stays: what impression might a Solana ETF have on the worth of SOL and the liquidity of its market?

Understanding ETF Dynamics within the Crypto Market

Crypto ETFs permit buyers to realize publicity to digital belongings with out immediately managing wallets, non-public keys, or on-chain transactions. Spot ETFs, particularly, monitor the real-time worth of an underlying asset, with the issuing fund custodian required to carry precise items of the token. This construction introduces new demand from conventional buyers and establishments preferring regulatory safeguards and ease of entry through brokerage accounts.

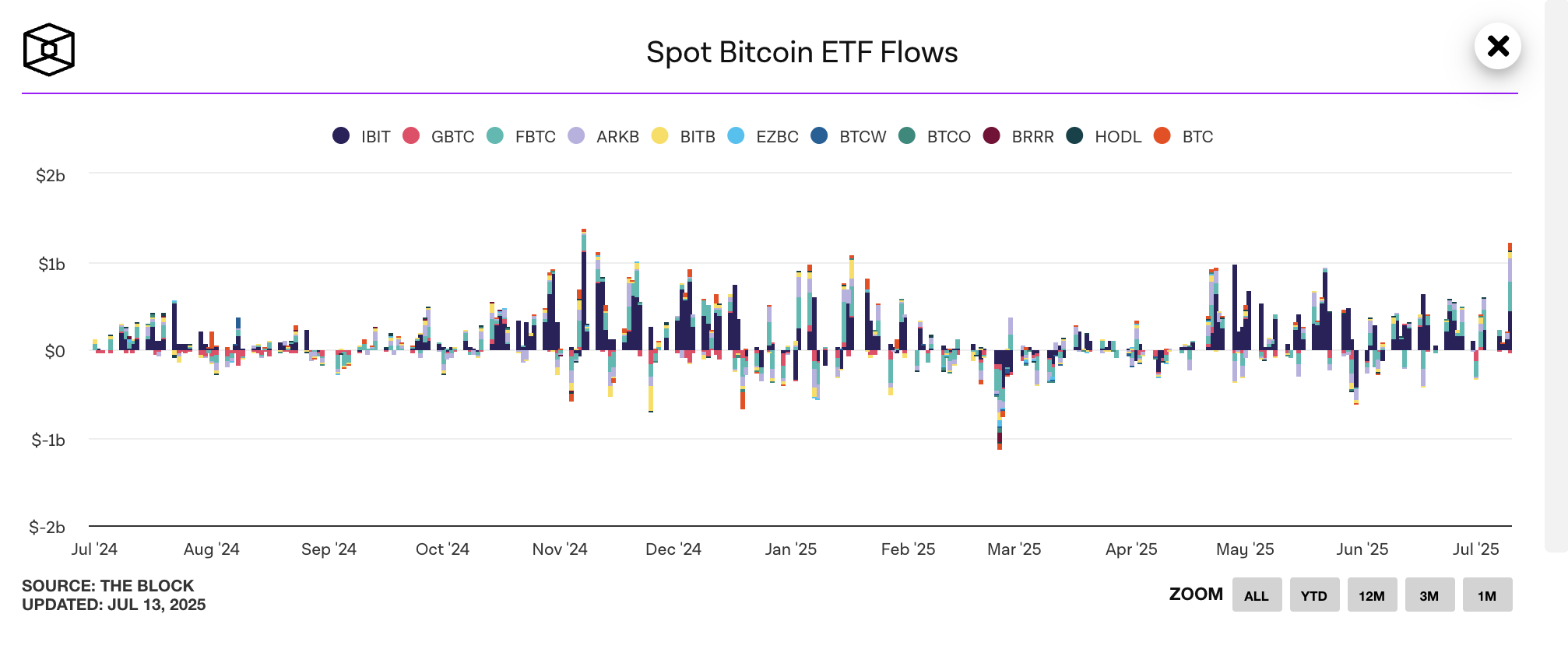

Supply: The Block Analysis

Within the instances of Bitcoin and Ethereum, spot ETF approvals within the U.S. led to vital inflows and fast appreciation in asset costs. For instance, within the month following the January 2024 approval of spot Bitcoin ETFs, BTC noticed over $7 billion in internet inflows and a 40% worth surge. Ethereum adopted an identical sample in Could 2025. Analysts and buyers now count on Solana to expertise an identical trajectory—although the consequences could differ primarily based on structural and ecosystem variations.

For extra: Solana ETF: VanEck, REX-Osprey & the Street Forward

Anticipation and Inflows of Brief-Time period Worth Affect

A key dynamic in ETF markets is the “purchase the rumor, purchase the information” phenomenon. Hypothesis round ETF approval tends to drive worth appreciation earlier than a choice is finalized, with additional upside upon affirmation. In Solana’s case, the submitting of a number of ETF purposes in June and July 2025 has already contributed to a 25% enhance in SOL worth over a two-week interval.

Supply: The Block Analysis

Ought to the SEC formally approve a spot Solana ETF in This fall 2025, most analysts anticipate an instantaneous spike in demand. Bloomberg tasks internet inflows of $1–2 billion within the first month, with SOL probably rallying 30–50% as new capital enters the market. This inflow would come primarily from institutional allocators, wealth managers, and retail buyers who had beforehand been unable or unwilling to carry native SOL tokens.

In contrast to Bitcoin, which is commonly held as digital gold, or Ethereum, which is central to DeFi infrastructure, Solana additionally has sturdy narratives round high-speed shopper purposes. A spot ETF would supply broader validation for these narratives and appeal to investor courses targeted on progress and scalability performs.

For extra: Altcoin ETFs After Solana – XRP, ADA, AVAX Subsequent in Line

Liquidity Growth from Crypto Natives to Conventional Finance

ETF approval has broader implications for market liquidity. By changing off-chain demand into on-chain custodial flows, ETFs tighten the connection between TradFi and crypto markets. The fund issuer (e.g., VanEck or Constancy) should purchase actual SOL tokens to again issued shares, sometimes sourcing from exchanges or OTC desks. This will increase baseline demand and reduces obtainable float.

We might see that when making use of an ETF on any varieties of belongings, it encourages extra environment friendly arbitrage throughout venues. Market makers and approved individuals (APs) steadiness worth discrepancies between ETF shares and the underlying SOL spot worth, smoothing volatility and enhancing depth. On the core, ETF infrastructure creates an extra layer of liquidity routing that connects U.S. capital markets to decentralized buying and selling ecosystems.

Supply: DefiLlama

Furthermore, as ETF buying and selling scales, it could actually not directly impression decentralized exchanges (DEXs) and DeFi protocols constructed on Solana. Protocols like Jupiter, Orca, and Drift might see larger volumes as on-chain exercise will increase in response to broader market participation. Equally, staking participation may fluctuate if ETF issuers provide yield-inclusive merchandise that affect provide dynamics.

For extra: Tokenized Shares vs ETFs: Which One Wins within the Lengthy Run?

Solana’s Distinctive Liquidity Profile

We see the explanation why Solana stands out within the altcoin panorama is predicated on its distinctive liquidity traits, that are each seen on centralized and decentralized platforms. As of July 2025, Solana maintains a median day by day buying and selling quantity exceeding $5.7 billion, positioning it because the third most liquid cryptocurrency after Bitcoin and Ethereum. This liquidity is distributed throughout main centralized exchanges comparable to Binance, Coinbase, and OKX, but in addition closely represented on-chain by means of DEXs like Jupiter, Orca, and Raydium, the place Solana persistently leads in Layer 1 on-chain buying and selling quantity.

Supply: Coinmarketcap

Its quick finality, roughly at 400ms block occasions and low transaction charges allow high-frequency buying and selling and arbitrage throughout venues. Apart from, it additionally improves worth discovery — a core metric regulators use when evaluating ETF readiness.

Furthermore, the distinctive structure of Solana blockchain permits for order book-based DEXs (like Phoenix and OpenBook), providing a buying and selling expertise similar to conventional finance whereas sustaining decentralization. This composability and deep liquidity throughout a number of venues not solely strengthen the case for a Solana ETF but in addition set a benchmark for different altcoins aspiring to observe its path.

Supply: DefiLlama

Comparative Classes from BTC and ETH ETFs

Let’s take Bitcoin and Ethereum as examples to obviously take into account Solana. these historic information, ETF approval has each an impression on price-driven and narrative-driven. Launched in January 2024, Bitcoin spot ETFs noticed $10 billion in belongings beneath administration (AUM) inside six weeks. Ethereum, upon approval in Could 2025, shortly absorbed over $3.5 billion in inflows.

SOL, with a present market cap of ~$65 billion and day by day volumes averaging $5.7 billion, might take in ETF-driven inflows whereas sustaining worth stability, particularly if launched throughout a bullish macro cycle. Analysts forecast that if SOL ETFs observe comparable adoption curves, SOL might attain $250–$300 in early 2026 from its present ~$140 base, assuming 2–3% of complete U.S. crypto AUM shifts towards Solana.

Nevertheless, volatility stays an element. Each BTC and ETH skilled momentary drawdowns after their ETF launches resulting from profit-taking, broader market circumstances, or regulatory headlines. Solana just isn’t resistant to such corrections, notably given its smaller measurement and historic community outages, which might resurface as investor issues.

Dangers and Issues

Whereas a Solana ETF opens the door to broader capital flows and mainstream recognition, it clearly exhibits some vary of structural and regulatory dangers that require cautious examination.

The one and foremost concern is regulatory overhang. Though Solana has averted classification as a safety up to now, the SEC’s place stays fluid. In 2023, the SEC named SOL as a possible safety in lawsuits towards Coinbase and Binance, elevating the spectre of post-ETF enforcement or reclassification. Ought to regulatory sentiment shift, the ETF might face sudden delistings or compelled divestments.

Moreover, centralization critiques persist. As of mid-2025, greater than 32% of Solana’s staked tokens are delegated to the highest 10 validators, with a number of linked to giant infrastructure suppliers. This focus contrasts with Ethereum’s broader validator set and raises questions on Solana’s resilience beneath stress. The Solana community additionally skilled two main outages in 2022 and downtime incidents in early 2024, highlighting operational dangers that establishments could weigh closely.

Supply: Helius

Moreover, overheating stays an actual chance. Historic precedent exhibits that belongings receiving ETF approval usually expertise a pointy pre-listing rally adopted by a post-launch selloff. For instance, the Bitcoin spot ETF in January 2024 noticed BTC surge to $48K earlier than retracing 20% inside two weeks. If SOL’s market cap spikes from ETF inflows with out corresponding natural progress, liquidity squeezes or volatility could observe.

Lastly, ETF design could alter staking dynamics. If giant institutional ETFs just like the VanEck Solana ETF select to not stake tokens resulting from authorized or operational constraints, the general staking ratio (at the moment ~64%) might drop. This not solely reduces community safety but in addition impacts the common staking yield, which has hovered round 6.8% APR. A decline in yield or validator participation might reverberate throughout DeFi protocols depending on staked SOL.

In brief, whereas ETF approval is a bullish milestone, the downstream results introduce each market dangers and systemic questions that require shut monitoring.