Chainlink is a distinguished title in cryptocurrency discussions attributable to its distinctive performance. Based by Sergey Nazarov and Steve Ellis, Chainlink addresses the oracle drawback of integrating real-world information into blockchains. This information explains how Chainlink works, the function of its LINK token, and its future potential.

What’s Chainlink?

Supply: Chainlink Web site

Chainlink is an answer that connects decentralized purposes (DApps) and blockchains to dependable real-world information, guaranteeing sensible contracts have safe entry to exterior info mandatory for correct performance. As a decentralized oracle community, Chainlink ensures that exterior information is queried, verified, and authenticated earlier than being despatched to sensible contracts. This course of makes blockchain purposes extra dependable and safe.

The LINK token powers Chainlink’s ecosystem. It’s used for transaction charges, funds, and rewards. Moreover, customers can stake LINK to assist safe the community’s oracles and earn incentives.

Chainlink additionally permits cross-chain interoperability, permitting information and property to maneuver between totally different blockchains. This makes it a significant part of the blockchain ecosystem.

Chainlink Social:

How does Chainlink work?

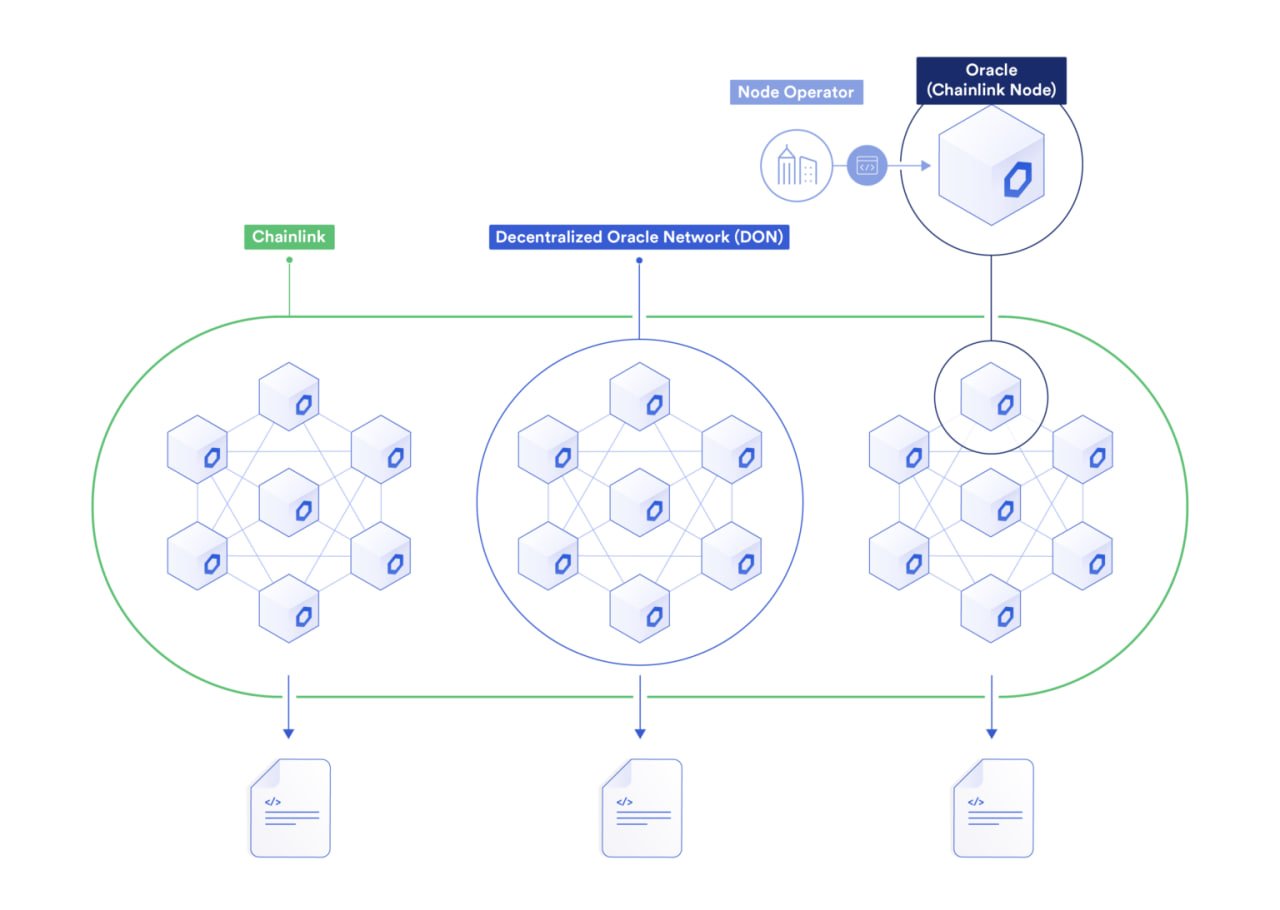

Chainlink operates by 4 principal parts that guarantee safe and dependable information transmission.

Oracles act as bridges between blockchains and exterior information sources. They fetch, confirm, and transmit real-world information to sensible contracts.Nodes are impartial operators that offer information to the community. They assist builders entry important info for decentralized purposes (DApps).Knowledge aggregation collects and organizes info from a number of sources, guaranteeing accuracy and reliability.LINK token powers the ecosystem. Node operators obtain LINK as cost for offering information and sustaining the community.

Key Options of Chainlink

Chainlink goes past fundamental information feeds and interoperability by providing superior options that improve blockchain improvement.

Verifiable Random Perform (VRF): This function gives safe randomness for decentralized purposes, guaranteeing honest random quantity technology for blockchain video games and crypto casinos.Hybrid Sensible Contracts: Builders can mix on-chain logic with off-chain information, permitting sensible contracts to execute robotically based mostly on real-world occasions, resulting in extra complicated use circumstances.Proof of Reserve (PoR): Chainlink’s PoR enhances transparency in DeFi by enabling real-time auditing of collateral property, guaranteeing adequate backing for tokens.

Chainlink’s decentralized oracle platform consists of key highlights akin to:

Decentralized Knowledge Mannequin: A community of impartial oracles delivers correct information to sensible contracts, minimizing dangers and guaranteeing transparency.Offchain Reporting (OCR): This know-how reduces on-chain prices by processing information off-chain, submitting solely a single aggregated transaction on-chain, thus enhancing scalability.Huge Integration: Chainlink helps varied information varieties, making it relevant in sectors like DeFi, insurance coverage, and blockchain gaming.Excessive Safety: Its decentralized structure protects information from manipulation and assaults.

Total, Chainlink bridges the hole between blockchain and the actual world, unlocking new potentialities for sensible contract purposes.

Historical past of Chainlink

Chainlink is a decentralized oracle platform that has achieved quite a few developments in know-how and partnerships since its creation in 2017 by Sergey Nazarov and Steve Ellis, with Ari Juels as a co-author of its foundational whitepaper. Right here’s an outline of its historical past, technological milestones, and collaborations:

Technological Developments

Chainlink 2.0: Launched in a 2021 whitepaper, this model expanded the capabilities of sensible contracts by Decentralized Oracle Networks (DONs), enabling hybrid sensible contracts with enhanced scalability and confidentiality.Offchain Reporting (OCR): This know-how processes information off-chain and submits aggregated outcomes on-chain, considerably lowering transaction prices and enhancing scalability.Verifiable Random Perform (VRF): Supplies provably honest randomness to be used circumstances like gaming and NFTs, guaranteeing transparency and person belief.Cross-Chain Interoperability Protocol (CCIP): Facilitates seamless communication between totally different blockchain networks, enabling cross-chain functionalities.Superior Privateness and Safety: Incorporates cryptographic methods, akin to zero-knowledge proofs, to reinforce information confidentiality whereas sustaining blockchain transparency.

Early Historical past

Chainlink formally launched in 2019, following its creation in 2017. In 2018, it built-in “City Crier,” an oracle answer utilizing trusted execution environments. Later in 2020, it included DECO, a privacy-enhancing protocol based mostly on zero-knowledge proofs.

With its revolutionary know-how, constant developments, and increasing ecosystem of partnerships, Chainlink continues to revolutionize the mixing of sensible contracts with real-world information.

The Counterparty Threat

Counterparty threat refers back to the risk that one social gathering in a monetary contract could fail to meet their obligations, leading to potential losses for the opposite social gathering. This threat is especially related in transactions involving a number of events, akin to loans, trades, and different monetary agreements. In conventional techniques, customers usually depend on intermediaries, like banks or cost processors, to mitigate this threat. Nevertheless, these intermediaries introduce their very own vulnerabilities, making the general system much less safe.

How Does Chainlink Resolve Counterparty Threat?

Supply: Chainlink

Chainlink successfully mitigates counterparty threat by its decentralized oracle community. By using a community of impartial oracles, Chainlink collects and verifies information from a number of sources, guaranteeing that sensible contracts execute reliably based mostly on correct info. This decentralized method eliminates single factors of failure, enhancing the safety and trustworthiness of sensible contracts. Chainlink’s system permits for clear and automatic transactions with out the necessity for central authorities, empowering customers to have interaction in safe agreements with confidence.

Chainlink vs Ethereum

Each Chainlink and Ethereum play important roles within the cryptocurrency market. Chainlink focuses on offering real-world information to sensible contracts, whereas Ethereum serves as a platform for decentralized purposes. Every has vital potential for long-term funding and buying and selling.

Technological Variations and Use Instances

Chainlink connects real-world information to sensible contracts by a community of nodes, using the LINK token to make sure safety and reliability. It primarily facilitates the creation of decentralized finance (DeFi) purposes, akin to exchanges and prediction markets, by delivering correct information for sensible contracts to execute on-chain actions.

In distinction, Ethereum capabilities as a decentralized platform for purposes and sensible contracts, using the Solidity programming language and utilizing ETH for transaction funds. It helps a variety of use circumstances, together with id verification, provide chain administration, gaming, and preliminary coin choices (ICOs).

Strengths, Weaknesses, and Market Efficiency

Chainlink implements varied safety measures, together with two-factor authentication and SSL encryption, together with scaling options like sharding and state channels to reinforce efficiency. The worth prediction for Chainlink in 2024 stands round $16.82, following its peak at $50.07.

Then again, Ethereum adopts related safety protocols however makes use of the Proof-of-Work (PoW) consensus algorithm, dealing with challenges associated to scalability attributable to excessive transaction charges and community congestion. The estimated worth for Ethereum in 2024 is roughly $3,541, having beforehand reached $376.36 after the break up into Ethereum and Ethereum Basic.

Neighborhood Help and Future Prospects

Chainlink boasts a rising group of customers and builders who recognize its means to hyperlink sensible contracts with real-world occasions. Ethereum enjoys one of many largest and most energetic communities within the trade, with quite a few builders creating purposes on its platform.

Regardless of Chainlink’s heavy reliance on Ethereum, it has appreciable progress potential attributable to its concentrate on safe and dependable information provision. In the meantime, Ethereum maintains the next market capitalization, supporting extra decentralized purposes and providing elevated utility. As each initiatives evolve, they promise thrilling alternatives within the cryptocurrency panorama.

Use Instances of Chainlink

Decentralized Finance (DeFi)

Chainlink’s oracle community is integral to decentralized finance by securely connecting sensible contracts to correct and tamper-proof information feeds. It permits DeFi protocols akin to lending platforms, stablecoins, and automatic market makers to entry real-world information from a number of sources, together with worth feeds and rates of interest, guaranteeing seamless and safe operations on blockchain networks.

Insurance coverage

With its blockchain-agnostic oracle nodes, Chainlink empowers parametric insurance coverage by permitting sensible contracts to entry real-world information from exterior information sources like climate APIs or IoT sensors. This ensures that off-chain information triggers automated payouts in a tamper-proof method, revolutionizing the insurance coverage trade with decentralized oracle networks.

Gaming

Chainlink VRF (Verifiable Random Perform) gives provably honest and tamper-proof randomness for blockchain purposes, akin to gaming and NFTs. By integrating Chainlink’s blockchain oracle community, builders can create hybrid sensible contracts that securely connect with real-world info and improve person belief in decentralized gaming ecosystems.

Conventional Techniques

Chainlink permits the mixing of conventional enterprise techniques with blockchain know-how. Via its decentralized community of oracle nodes and information suppliers, Chainlink connects sensible contracts to exterior APIs and cost techniques, bridging the hole between on-chain and off-chain information. This innovation facilitates cross-chain interoperability and enhances the performance of blockchain purposes throughout varied industries.

The LINK token

Key Details about $GPS Token

Token Identify: ChainlinkSymbol: LINKBlockchain: Ethereum, BSC, Fantom, Solana, Avax…Contract Tackle: 0x514910771af9ca656af840dff83e8264ecf986caTotal Provide: 1,000,000,000 LINKCirculating Provide: 638,100,000 LINK (Supply: Cryptorank.io)

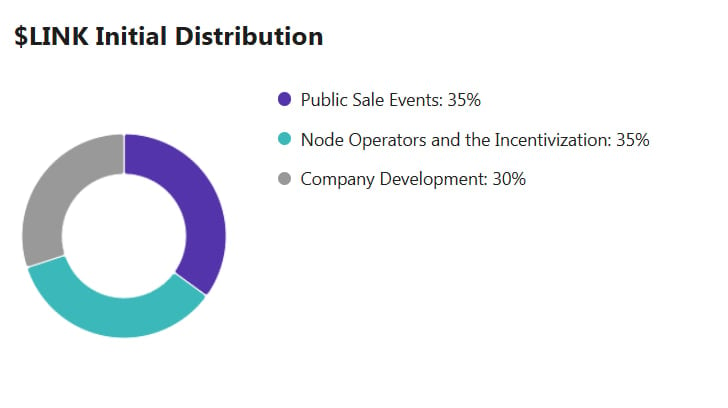

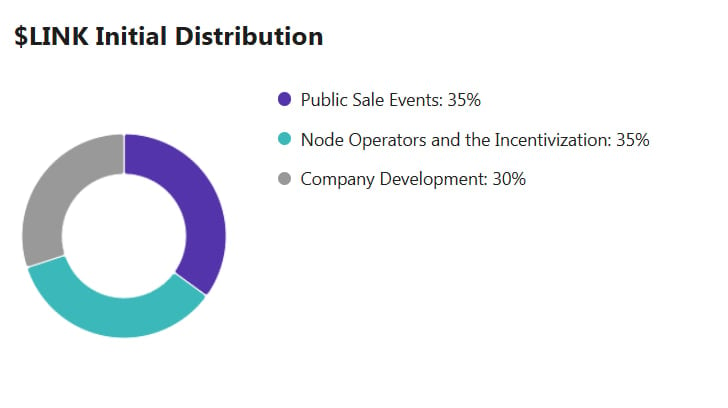

LINK Tokenomics

Supply: tokeninsight.com

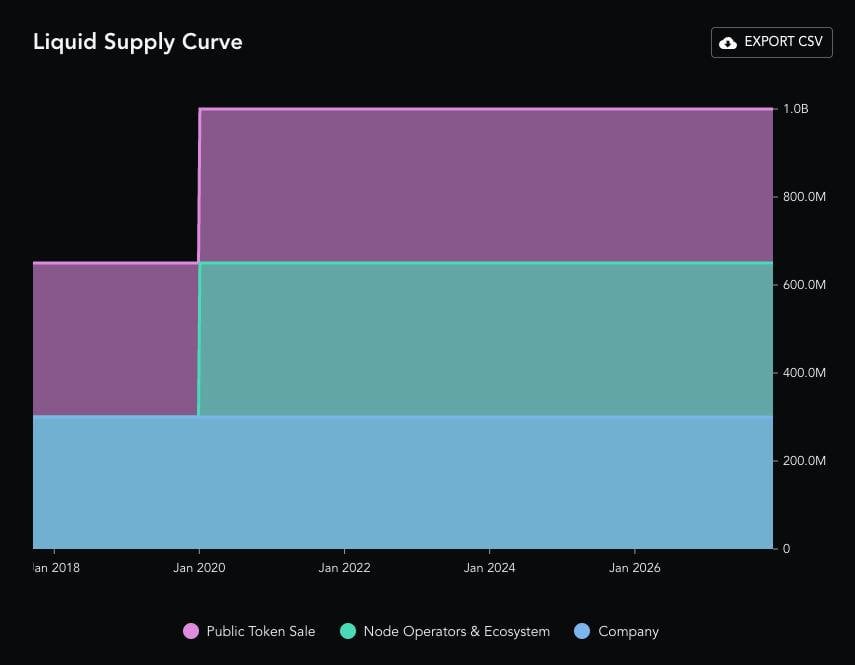

LINK Vesting Schedule

Supply: tokeninsight.com

LINK Utility

Throughout downturns, blockchain initiatives pause, lowering demand for information feeds and reducing oracle revenues. Fewer node operators and LINK gross sales create provide stress. To deal with this, Chainlink Economics 2.0 enhances cross-chain interoperability, secures real-world connections, and expands hybrid sensible contracts, guaranteeing LINK’s sustainability.

Abstract of LINK’s Utility:

Cost: LINK serves because the native cryptocurrency within the Chainlink ecosystem, rewarding node operators for offering correct information.Staking: Oracle nodes stake LINK to entry information feeds and guarantee trustworthy habits.Increasing DeFi & Web3: LINK connects sensible contracts with exterior information sources, supporting DeFi protocols and enterprise techniques in accessing real-world information securely.Multi-Chain Integration: Chainlink works throughout varied blockchain networks, enabling cross-chain interoperability and on-chain finance.

Methods to purchase Chainlink (LINK)

Create an Account: Join free on Binance by way of the app or web site. Confirm your id to begin buying and selling.Choose Buy Technique: Select the way you need to purchase Chainlink (LINK) on Binance. You should buy Chainlink on Binance utilizing Debit/Credit score Card, Google Pay/Apple Pay, or Third-Get together Cost choices. Merely choose your cost methodology, affirm the order, and your LINK might be deposited into your Spot Pockets.Verify Cost: Evaluate charges and ensure your order inside 1 minute to lock within the present worth.Retailer or Commerce: Preserve your LINK in Binance, commerce it for different crypto, or stake it for passive earnings. For decentralized exchanges, you should utilize Belief Pockets.

Is Chainlink funding?

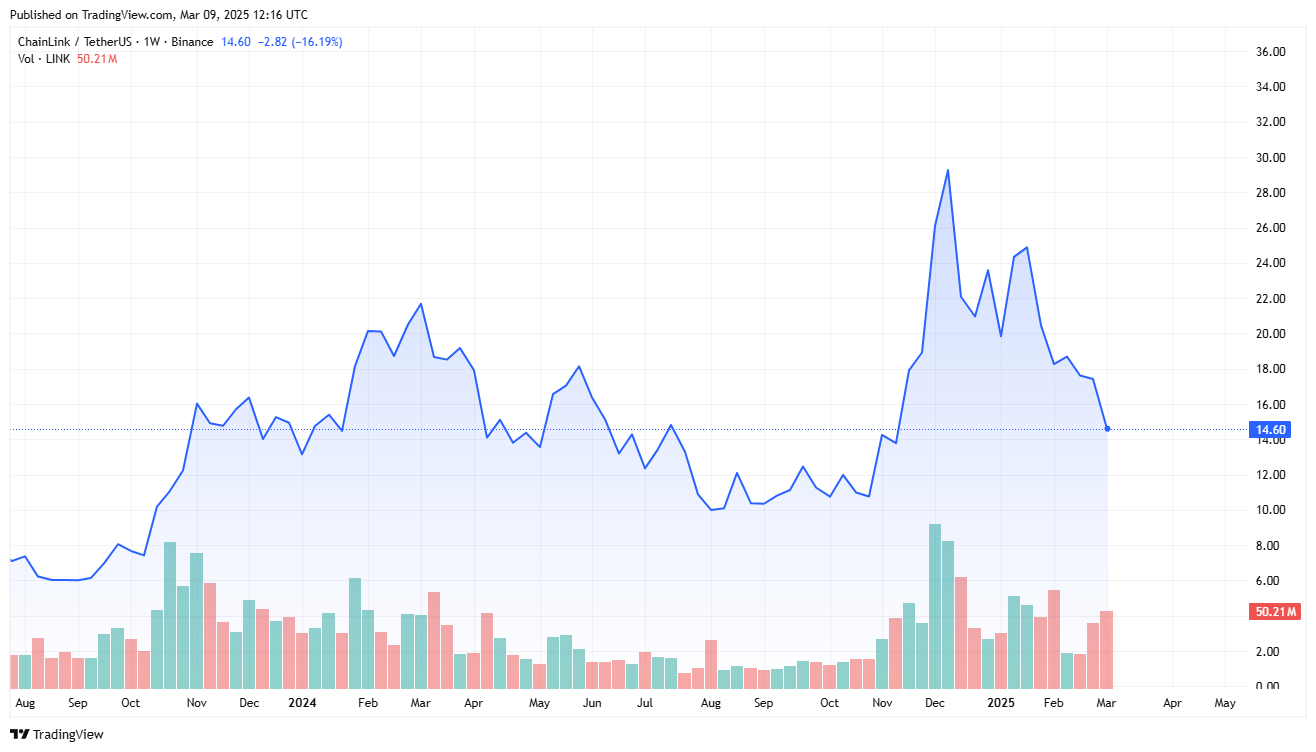

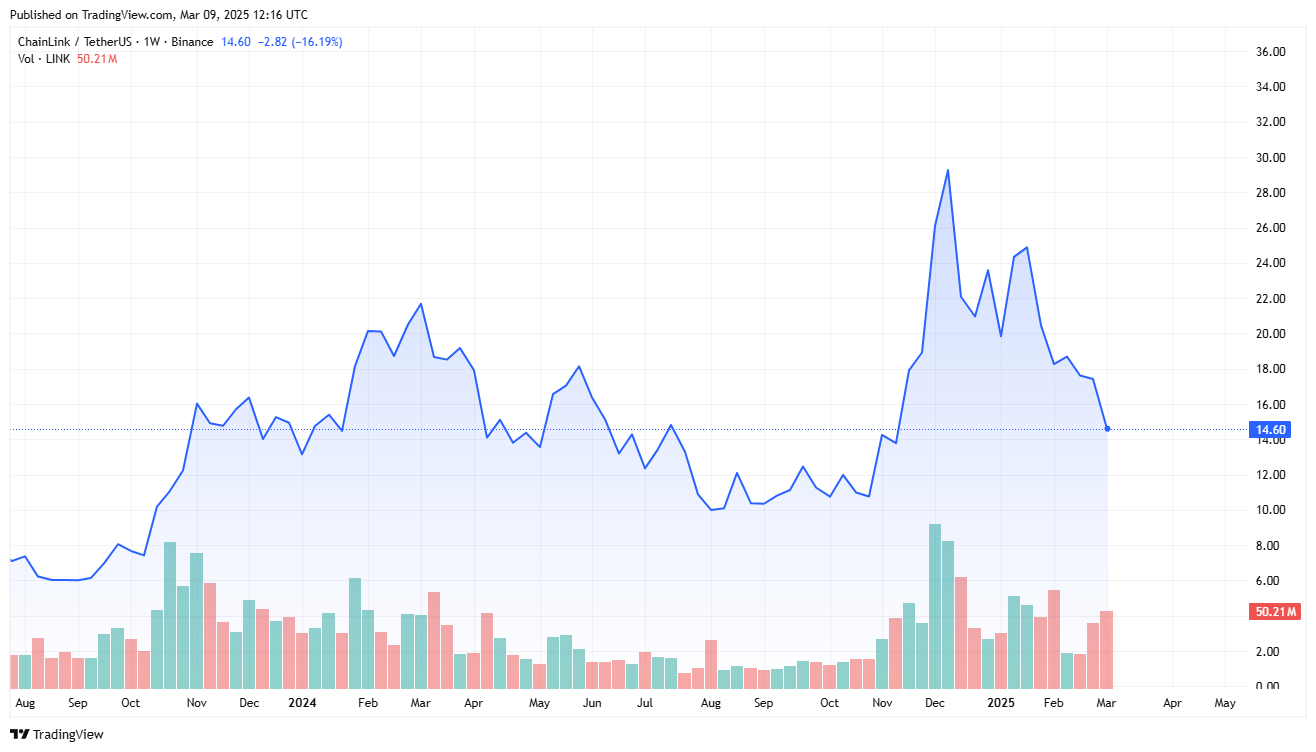

Supply: Tradingview.com

Chainlink (LINK) is a decentralized oracle community that connects sensible contracts on blockchains with real-world information, APIs, and off-chain cost techniques. This enables blockchain purposes to securely entry exterior information, increasing the capabilities of the Web3 ecosystem.

Key partnerships of Chainlink embody Google Cloud, which facilitates sensible contract integration with its cloud companies, and SWIFT, which showcases cross-chain interoperability for world monetary establishments. Main DeFi initiatives like Aave, Synthetix, and Compound make the most of Chainlink for worth feeds. Moreover, conventional enterprises akin to AccuWeather, T-Techniques, and the Related Press leverage Chainlink to attach blockchain with real-world information. The Cross-Chain Interoperability Protocol (CCIP) permits seamless communication between blockchains.

With a most provide of 1,000,000,000 LINK and roughly 631,099,972 LINK in circulation, Chainlink has demonstrated robust resilience in bear markets. As of March 9, 2025, LINK is priced at $14.5, making it a pretty long-term funding.

The Way forward for Chainlink

Chainlink continues to evolve as a vital infrastructure for blockchain purposes, with ongoing developments in oracle know-how, cross-chain interoperability, and decentralized finance (DeFi). The introduction of Chainlink Economics 2.0 goals to reinforce sustainability by staking mechanisms and incentivized information accuracy. With key improvements like hybrid sensible contracts, Proof of Reserve (PoR), and Verifiable Random Perform (VRF), Chainlink is about to broaden its function in DeFi, gaming, and enterprise integrations. As blockchain adoption grows, Chainlink community will stay a significant bridge between real-world information and sensible contracts, driving the subsequent wave of Web3 innovation.

FAQs

Can I make passive earnings with Chainlink?

Sure, you possibly can earn passive earnings with Chainlink by staking LINK tokens and working a Chainlink node.

Can Chainlink attain $100?

Chainlink might attain $100 if adoption grows, however its worth relies on market tendencies and investor demand.

Is Chainlink a coin or token?

Chainlink is a token, not a coin, as a result of it runs on the Ethereum blockchain as an ERC-20 asset.

What’s Chainlink worth?

The present worth of Chainlink is round LINK in keeping with information from CoinGeeko.