When transacting on Ethereum or executing a sensible contract, you pay a “gasoline payment.” These charges are denominated in Gwei, which could appear odd since Ether (ETH) is Ethereum’s native forex.

Nicely, Gwei is ETH, and technically, it’s a denomination of cryptocurrency.

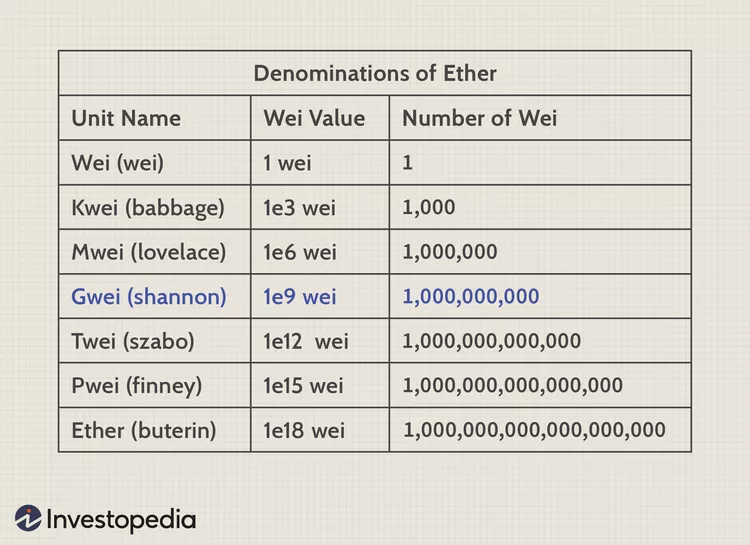

The Ethereum community makes use of a system of items to characterize completely different denominations of ETH. This method permits Ethereum to deal with a wide range of transaction sizes and complexities, guaranteeing environment friendly administration of gasoline charges and operations. On the base is Wei, the smallest unit, the place one Ether equals 1 quintillion Wei. As we transfer up, we get Gwei midway via the dimensions; it equals 1 billion Wei.

Ethereum Wallets, explorers (like Etherscan), and dApps all quote gasoline costs in Gwei as a result of it has grow to be the usual unit for gasoline charges.

Why Use Gwei?

The brief reply: Gwei is a handy center floor. It balances precision with usability.

Ethereum transactions contain dealing with very small fractions of ETH, which might result in unwieldy decimal locations if expressed in full ETH. Gwei, being 1 billionth of an ETH, gives a readable and exact method to deal with gasoline calculations with out extreme decimal locations.

Additionally, gasoline charges fluctuate primarily based on community demand. If charges had been expressed in full ETH, customers must take care of extraordinarily tiny decimal values. As an alternative, utilizing Gwei simplifies the method—it’s simpler to match “30 Gwei” vs “50 Gwei” than “0.000000030 ETH” vs “0.000000050 ETH.”

There isn’t a documented historical past as to when “gwei” grew to become the usual unit for paying gasoline charges on Ethereum. In truth, the Ethereum Whitepaper didn’t make a single point out of the time period “gwei”

How Are Fuel Charges Calculated?

Since Ethereum’s London Improve (August 2021), gasoline charges encompass:

Fuel Restrict – Most gasoline a consumer is keen to spend (e.g., 21,000 items for a primary transaction).

Base Payment – A required quantity that adjusts primarily based on community demand.

Tip (Precedence Payment) – An non-compulsory quantity customers add to hurry up transactions.

Instance Calculation:

If the gasoline restrict is 21,000, the gasoline worth is 100 Gwei, and tip is 10 Gwei:

Whole Value = 21,000 × (100 + 10) = 2,310,000 Gwei = 0.00231 ETH

Gwei and Different the Ethereum Unit System

As earlier talked about , “wei” is the smallest unit of measurement for Ether. There are six extra items except for Gwei.

Ethereum’s unit system is kind of fascinating as a result of it pays tribute to a number of the most influential figures in cryptography, computing, and digital currencies. That is much like how US greenback payments characteristic historic figures: the $100 invoice has Benjamin Franklin, and the £5 word within the UK has Winston Churchill. In Ethereum’s case, its denominations are named after pioneers who helped form the world of blockchain and digital innovation.

Let’s break down the importance of every unit and the legendary figures behind them:

That is the smallest unit of Ethereum (1 ETH = 10¹⁸ Wei). It’s named after Wei Dai, a cryptographer finest recognized for “B-money”, a theoretical digital forex that launched key concepts later utilized in Bitcoin and Ethereum. Dai’s ideas of decentralized cash with out authorities management laid the groundwork for as we speak’s cryptocurrencies.

Notably, no matter their magnitude, all upward items even have one other title that carries the “Wei” suffix, with completely different prefixes indicating their scale. This naming conference follows the metric system, the place prefixes like kilo-, mega-, and giga- assist outline multiples and subdivisions of a unit.

This unit is called after Charles Babbage, an English mathematician and inventor. He developed the primary computerized computing engines within the 1800s, which laid the muse for contemporary computer systems. As a decentralized computing community, Ethereum honours him for his visionary concepts.

That is named after Ada Lovelace, who is usually known as the world’s first programmer. She was the daughter of the poet Lord Byron and a superb mathematician. Lovelace wrote the first-ever algorithm for a computing machine, predicting that computer systems might do extra than simply crunch numbers, an concept that straight ties into good contracts on Ethereum.

Named after Claude Shannon, the daddy of knowledge idea. His work in cryptography and digital communication types the spine of contemporary computing and blockchain encryption. Gwei being broadly used for gasoline charges on Ethereum makes his contribution much more related to customers as we speak.

Named after Nick Szabo, the person who invented the idea of good contracts. Lengthy earlier than Ethereum existed, Szabo theorized digital contracts that would execute robotically, identical to as we speak’s Ethereum good contracts. Many additionally consider he might be Bitcoin’s mysterious creator, Satoshi Nakamoto.

Named after Hal Finney, one of many earliest Bitcoin builders. He was the primary individual to obtain Bitcoin from Satoshi Nakamoto and performed a key position in refining blockchain know-how. By naming a unit after him, Ethereum acknowledges his groundbreaking contributions to cryptocurrency.

Lastly, the bottom unit of Ethereum, Ether (ETH), is called after Vitalik Buterin, Ethereum’s creator. He constructed Ethereum as a extra versatile and programmable blockchain, enabling good contracts, DeFi, and NFTs. Buterin’s work has remodeled the blockchain panorama past simply digital forex.

Why This Naming System Is Distinctive

Ethereum’s naming conference isn’t only for present; it displays the historical past of computing, cryptography, and digital cash. It reminds customers that Ethereum isn’t only a monetary device however a revolutionary computing platform constructed on the concepts of visionaries, mathematicians, and cryptographers.

So, subsequent time you see Gwei in gasoline charges or hear about Wei in good contracts, you’ll know that these aren’t simply random names; they’re a part of a deeper historical past that introduced Ethereum to life.

Gwei and ETH’s Position in Ethereum’s Future

Ethereum is consistently evolving, and because it scales to fulfill rising adoption, gasoline charges and Ether (ETH) and due to this fact, Gwei’s position might change considerably.

Ethereum’s latest transition to Proof of Stake (PoS) with Ethereum 2.0 has already introduced noticeable enhancements. Enhanced scalability and lowered community congestion have led to extra secure gasoline costs and a smoother consumer expertise. Future upgrades, which Vitalik Buterin has hinted would give attention to Layer 2 options, are anticipated to additional optimize transaction processing and doubtlessly drive gasoline charges even decrease.

Gwei gives a versatile system to maintain transaction prices manageable, however in a world of ultra-low charges, Ethereum-based providers would possibly begin quoting costs in even smaller items, shifting decimals the best way fiat currencies generally do throughout inflation or deflation.

There may be additionally the intriguing risk that future technological breakthroughs might cut back and even eradicate the necessity for gasoline charges altogether. Ought to that happen, the excellence between ETH and its subunits would possibly grow to be much less essential.

Ethereum’s roadmap is filled with upgrades round safety, effectivity, and sustainability, and the way customers work together with transaction prices might essentially change. So, the concept of Gwei turning into isn’t one thing we will 100% rule out.

Nonetheless, till such a paradigm shift is realized, Gwei stays a key a part of Ethereum’s usability. And so long as gasoline charges exist, Gwei (or one thing prefer it) will seemingly stick round.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. At all times conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”