The DeFi is evolving quick – but one downside stays stubbornly unsolved is capital inefficiency. Billions of {dollars} sit idle in lending swimming pools, whereas lenders earn modest returns and debtors face inflated prices. The market has matured, however the mechanics of DeFi credit score nonetheless resemble its early days.

That’s the place Morpho steps in. In an area crowded with copycats, Morpho stands out for one motive: it isn’t chasing yield – it’s rebuilding how on-chain lending works at its core.

What Is Morpho Crypto?

Morpho is a decentralized lending protocol constructed on Ethereum that redefines how capital flows in DeFi. Morpho features as a sensible optimization layer on prime of present platforms, like Aave and Compound, as an alternative of appearing as one other liquidity pool.

The core thought is straightforward however transformative. Its ecosystem accepts connecting lenders and debtors straight, slightly than routing all the things by means of an middleman pool. This peer-to-peer (P2P) layer sits between customers and present lending markets.

Perceive merely, Morpho helps a borrower looking for the precise liquidity a lender affords – it executes the transaction straight between them. The end result: each events obtain a greater rate of interest. Lenders earn greater than they might within the pool, whereas debtors pay much less. And when no match exists? Morpho robotically reverts liquidity again to the bottom pool (Aave or Compound).

At its core, Morpho doesn’t substitute DeFi lending platforms – it makes issues simple, easy, and with out too many middlemen. It’s not about competitors; it’s about optimization.

All transactions on Morpho are executed through audited sensible contracts and on-chain verification. The protocol inherits the safety ensures of Aave and Compound, that means customers nonetheless profit from their confirmed danger administration methods. Morpho by no means takes custody of funds – it merely routes capital extra intelligently. That design permits it to extend effectivity with out growing systemic danger, a uncommon steadiness in DeFi lending.

How Does It Work?

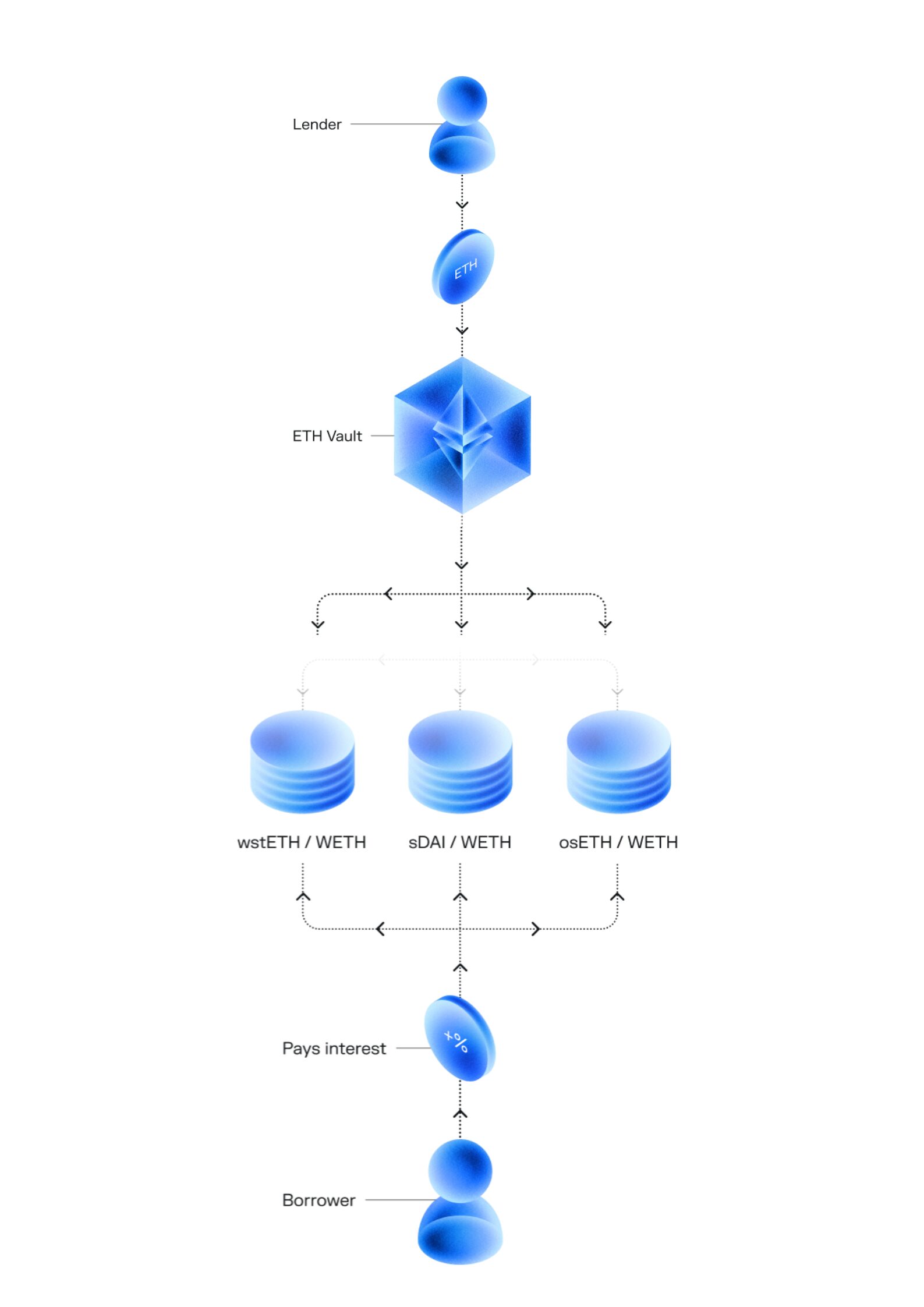

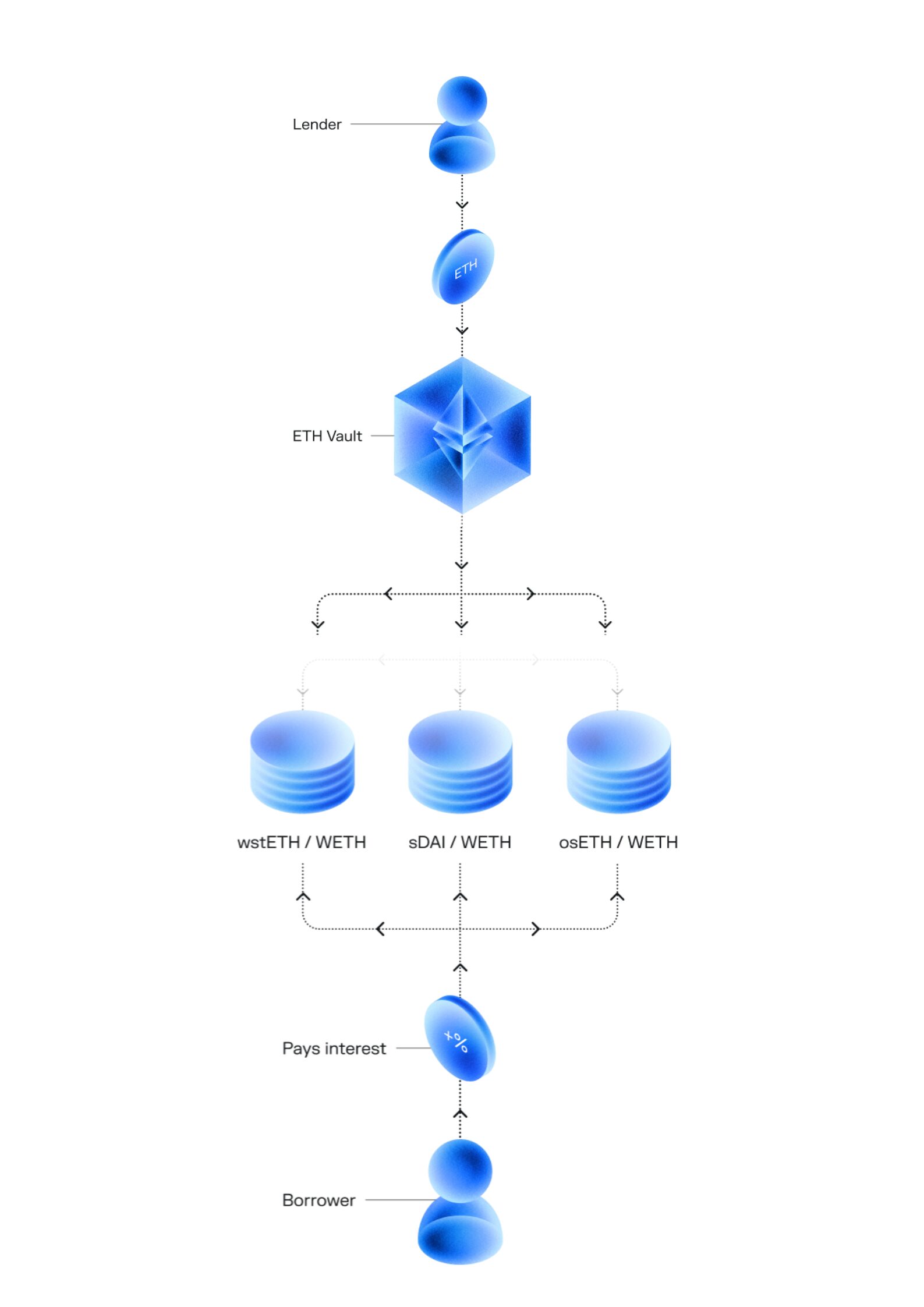

Morpho is greater than a protocol – it’s a modular layer for DeFi credit score, bridging the hole between liquidity suppliers and debtors in a wiser, extra clear method. By two principal merchandise – Morpho Earn and Morpho Borrow – the protocol powers a brand new period of capital effectivity constructed solely on Morpho Blue, its permissionless lending infrastructure.

Morpho Earn – Put Your Crypto to Work

Morpho Earn Put Your Crypto to Work – Supply: Morpho

Morpho Earn is the entry level for customers who need to generate yield passively and securely. As a substitute of being based mostly on a corporation or a single lending pool, customers deposit belongings into Morpho Vaults-automated sensible contracts that allocate funds throughout varied Morpho Markets to optimize returns. Every vault is curated with an outlined danger profile and allocation technique, usually managed by a curator (a person, DAO, or protocol). This implies customers can choose their publicity stage – from conservative stablecoin vaults to higher-yield markets with unstable collateral.

How It Works

Deposit: The person provides an asset (e.g., USDC or ETH) right into a Morpho Vault. The protocol points ERC-4626 vault shares representing their proportional possession.Yield Technology: The Vault allocates funds throughout Morpho Markets in line with its technique. Debtors in these markets pay curiosity, which accrues to the vault, growing the share worth over time.Withdraw: At any second, customers can redeem their shares to obtain their preliminary deposit plus accrued yield (minus any efficiency payment).

Morpho Earn Put Your Crypto to Work – Supply: WhitepaperMorpho

Many vaults additionally distribute additional incentives or rewards, reminiscent of governance tokens or liquidity mining bonuses – all claimable by means of Morpho’s Rewards API.

Morpho Borrow

Morpho Borrow permits customers to provide collateral and borrow belongings straight from remoted Morpho Markets. Every market represents a definite lending pair – for instance, wstETH/WETH or DAI/USDC and comes with its personal parameters, reminiscent of collateral sort, curiosity mannequin, liquidation threshold, and oracle feed.

This design ensures that dangers stay remoted: if one market faces an issue (like volatility in collateral), it doesn’t have an effect on the solvency of others.

How It Works

Provide Collateral: The person locks a supported asset (e.g., wstETH) into a selected market.Borrow: They borrow one other asset (e.g., WETH) from that market. The borrowing energy relies upon in the marketplace’s Liquidation Mortgage-to-Worth (LLTV) primarily, the protected borrowing ratio between collateral and mortgage.Repay: The borrower can repay anytime, lowering curiosity accrual and bettering their Well being Issue (security buffer earlier than liquidation).Withdrawal: After reimbursement, debtors can withdraw half or all the collateral. If the debt just isn’t absolutely paid, you possibly can solely withdraw the collateral comparable to the portion of the debt you paid. In the event that they repay the debt, they will withdraw the complete collateral.

Debtors pay curiosity on excellent debt, which is transferred to Morpho Vaults – incomes earnings for the lender. All positions are tracked on-line with real-time knowledge on well being elements, LTV, and danger ranges. Morpho Borrow combines flexibility with security – permissionless market, clear danger and higher rates of interest by means of algorithmic effectivity.

Each Earn and Borrow are designed round capital effectivity – each deposited greenback works more durable, with out growing systemic danger.

Morpho Blue

Beneath Morpho’s merchandise lies its strongest innovation: Morpho Blue – a permissionless, modular lending layer that redefines how credit score markets are constructed and linked on-chain. Moderately than counting on a single monolithic protocol, Morpho Blue permits anybody – people, DAOs, or establishments to create customized lending markets with absolutely outlined parameters, together with:

Collateral and Mortgage belongings (e.g., ETH/USDC, wBTC/DAI)Oracle feeds for worth knowledgeRate of interest fashions (IRM)Liquidation thresholds (LLTV)

Morpho Blue helps every market function in isolation – that means danger in a single market by no means spills into one other. Consider Morpho Blue because the Ethereum of lending, that is isolation blockchain which a safe base layer the place any credit score logic could be deployed.

How Morpho Blue Powers Earn and Borrow

Morpho Earn sits on prime of Morpho Blue by means of Vaults, which allocate deposited liquidity to chose Markets that provide one of the best yield-to-risk ratio. The Vaults inherit Blue’s isolation and transparency, making every yield technique absolutely auditable.Morpho Borrow operates straight inside Blue’s Markets, the place debtors can open positions backed by collateral, with all parameters – from oracle knowledge to liquidation logic — enforced by Blue’s sensible contracts.

This structure separates the protocol layer (Blue) from the product layer (Earn & Borrow), permitting builders to innovate with out compromising security or composability. Morpho Blue is extra than simply an improve – it’s a brand new blueprint for a way decentralized credit score can scale safely.

By separating the infrastructure (lending logic) from the product (Earn & Borrow), it creates a really open, decentralized credit score ecosystem – the place builders, DAOs, and establishments can construct credit score methods as simply as builders deploy dApps on Ethereum.

Morpho Tokenomics

MORPHO token not solely acts as a governance token but in addition as a coordination layer that allows the complete ecosystem to function autonomously – from the DAO, the neighborhood, to builders and customers.

Complete Provide: 1,000,000,000 MORPHOCirculating Provide: ~338.8M MORPHO

Token Allocation – Supply: Morpho

Morpho DAO: 35.4% Customers & Launch Swimming pools: 4.9% Morpho Affiliation: 6.3% Reserve for Contributors: 5.8% Strategic Companions: 27.5% Founders: 15.2% Early Contributors: 4.9%

Why Select Morpho?

DeFi’s best problem has at all times been a paradox – the pursuit of effectivity with out compromising safety. Most protocols have chosen one facet: both maximize yield at the price of danger, or keep protected however stagnant. Morpho stands out as a result of it does each – and does it cleanly.

By merging capital optimization with on-chain transparency, the protocol delivers what conventional finance has lengthy struggled to attain. It is a credit score market that’s environment friendly, composable, and trustless.

Its design solves three long-standing ache factors in DeFi lending:

Inefficient Capital Use – billions of {dollars} sit idle in overcollateralized swimming pools; Morpho’s P2P engine and Vault construction preserve each greenback working by means of dynamic allocation.Centralized Danger Fashions – most DeFi protocols use world parameters; Morpho isolates danger on the market stage, stopping systemic contagion.Inflexible Infrastructure – legacy lending methods are arduous to increase; Morpho Blue’s modularity makes it simple for DAOs, establishments, or dApps to deploy their very own credit score methods.

The result’s a brand new layer of programmable credit score, the place cash doesn’t simply circulation – it learns.

FAQ

What’s Morpho?

Morpho is a decentralized lending protocol constructed on Ethereum that connects lenders and debtors extra effectively by means of a modular structure that’s easy, clear, and dependency-free.

How is Morpho Totally different from Aave or Compound?

Whereas Aave and Compound use a pooled lending mannequin (the place all deposits share danger and curiosity), Morpho introduces a peer-to-peer optimization layer known as Morpho Blue. It connects lenders and debtors extra straight, providing higher rates of interest and minimizing the inefficiencies and dangers distinctive to every market. Primarily, it’s a new infrastructure – not simply one other protocol.

How does Morpho Generate Earnings for Customers?

Earnings come from curiosity paid by debtors and potential incentives from companion protocols. Morpho Vaults robotically allocate capital to markets that provide one of the best risk-reward ratio. Over time, as vaults accumulate curiosity, the worth of customers’ holdings will increase in proportion to their participation.

Easy methods to Purchase MORPHO?

You should buy MORPHO straight on Uniswap (Ethereum Mainnet) or supported exchanges. Merely join your Pockets, make sure you’re on the Ethereum community, and swap ETH or USDC for MORPHO utilizing the official contract tackle from Morpho.

For higher safety, retailer your tokens in a self-custodial or {hardware} pockets after buy.