After the 2020–2021 blowout increase, the DeFi panorama skilled a string of tasks blowing up on unsustainable returns. With liquidity being pulled out and reward tokens not being fascinating—customers trying round asking themselves, “What’s subsequent?”—many got here to grasp that DeFi wanted a supply of precise, sustainable yield.

And that’s precisely why OpenEden exists.

What’s OpenEden?

OpenEden is an RWA protocol providing actual yield on U.S. Treasury securities on-chain — enabling establishments, DAOs, and Web3 traders to carry low-risk, high-liquidity property anyplace and at any time, 24/7 on the blockchain.

As an end-to-end tokenization platform, OpenEden permits establishments and DAOs to handle their treasuries with tokens for U.S. Treasury Payments — a number of the most secure and most dependable cash on this planet.

Since its launch in 2023, OpenEden has marked an vital milestone: it was given an “A-bf” fund score by Moody’s, the globe’s inaugural RWA token issuer to obtain a bond fund score from the worldwide credit score company.

OpenEden is not only an on-chain protocol — it’s a fully regulated authorized and monetary framework designed to bridge the hole between conventional finance (TradFi) and DeFi.

A BVI-domiciled funding fund operates by way of a licensed funding supervisor, who invests in U.S. Treasury Payments.

The underlying devices are securely held by third-party custodians licensed for security and compliance.The $TBILL token is issued in portions similar to the underlying U.S. Treasuries, with on-chain proof of possession and proper to yield.This structure makes OpenEden a authentic bridge from blockchain to TradFi with a promise that each one the tokens issued are 1:1 backed by real-world property.

The venture envisions actual financial worth owned and savored by folks on the blockchain — instantly — in a worldwide, permissionless, open, and equitable monetary system, with real-world property and conventional monetary returns on the blockchain.

OpenEden Ecosystem

OpenEden is constructing an infrastructure layer that connects real-world property (RWA) and conventional monetary returns to the blockchain by means of three pillars of labor:

TBILL Vault – a tokenized U.S. Treasury Invoice platform that earns actual yield.USDO Stablecoin – a TBILL-backed stablecoin that mechanically earns curiosity.EDEN Token – the utility and governance token that powers all the community.

TBILL – Tokenized Treasury Vault

On the coronary heart of OpenEden is TBILL, a tokenized U.S. Treasury Vault.

Nature and Product Construction

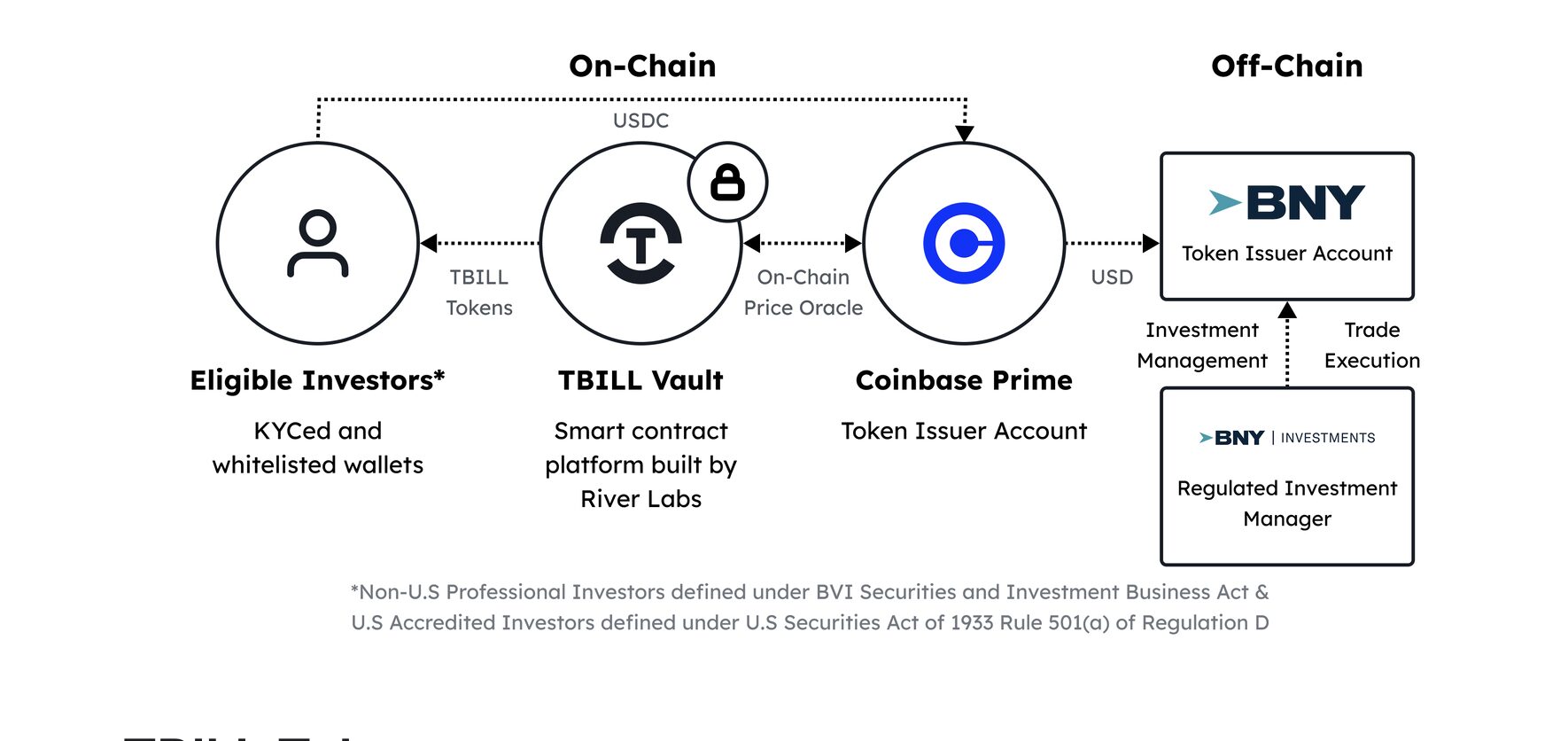

Nature and Product Construction – Supply: OpenEden Whitepaper

TBILL Token is a consultant of the financial advantage of the EIP-20 contribution of the Investor within the Fund. Buyers deposit USDC to mint TBILL Token, the investor can have the authorized proper to the change worth of the online property held by the Fund.

At present, the minting of TBILL is totally by means of the TBILL Vault by the examples within the whitepaper and has accomplished all of the KYC/KYB steps.

OpenEden has established a powerful inner management system to keep up the protection of TBILL Vault. To make sure security, consensus, and to make operations straightforward, quick, and handy.

The TBILL Vault operates as a permissioned protocol, accessible solely to verified, certified traders.

Investor Onboarding Course of

To carry TBILL, traders should meet the next standards:

“Skilled Investor” as outlined by the British Virgin Islands Securities and Funding Enterprise Act (SIBA) 2010.“Accredited Investor” in america as outlined by Rule 501(a) of Regulation D below the Securities Act.

Investor Onboarding Course of – Supply: OpenEden Whitepaper

The onboarding course of is straightforward:

Registration: Buyers begin taking part by means of the official OpenEden onboarding portal.Verification: The compliance staff conducts KYC (identification verification) and KYT (pockets screening) checks.Activation: If permitted, you may be whitelisted by the venture.The venture will then ship a affirmation electronic mail, and you can begin your auto-registration.

Use Instances and Composability

Whereas TBILL presently operates inside a whitelisted surroundings, its composability is increasing by means of integrations and partnerships that reach its on-chain utility:

Secondary buying and selling on regulated marketplaces.Collateral utilization in lending and structured monetary merchandise.Cross-chain interoperability to bridge TBILL throughout blockchain networks.

By means of these integrations, TBILL is evolving right into a foundational constructing block of the on-chain Actual-World Asset (RWA) ecosystem, connecting conventional yield sources with decentralized liquidity.

TBILL = Actual Yield, Actual Regulation, Actual Belief.

USDO – Yield-Bearing Stablecoin

If TBILL is the inspiration of actual yield, then USDO is the bridge that makes it accessible to everybody.

USDO is a next-generation yield-bearing stablecoin totally backed by tokenized U.S. Treasuries (TBILL Vault), designed to mix the steadiness of the U.S. greenback with the actual yield generated from conventional monetary property.

Use Instances and Integrations

USDO acts as a bridge between TradFi yield and on-chain liquidity. Institutional treasuries and DAOs can maintain USDO to earn yield and it’s after all protected.

As well as, utilizing USDO as collateral for lending, borrowing and derivatives.

Could be developed and become a multi-chain steady asset (Ethereum, BNB Chain, Solana, Kaia, Plume, and many others.).

USDO = Stability + Actual Yield + Compliance.

EDEN – Governance & Incentive Token

If TBILL represents the inspiration of actual yield and USDO brings that yield to everybody, then EDEN is the token that ties all of it collectively — the financial, incentive, and governance layer of the OpenEden ecosystem.

Designed because the native utility and governance token, EDEN empowers customers to take part in decision-making, earn a share of ecosystem worth, and assist long-term community development.

In contrast to many governance tokens that rely purely on hypothesis, EDEN’s worth is instantly tied to the productiveness of actual property inside the OpenEden ecosystem.

Because the adoption of TBILL and USDO expands, extra charges and actual yield circulation by means of the system — parts of which will be redistributed to EDEN stakers or used for ecosystem incentives.

This creates a closed financial loop:

Financial Loop – Supply: NFTEvening

EDEN successfully transforms passive yield infrastructure right into a community-governed, token-driven economic system — the place contributors, holders, and establishments all share in its enlargement.

In an ecosystem the place yield is actual, property are clear, and governance is decentralized, EDEN stands because the token that anchors all of it.

It bridges the technical, monetary, and group layers of OpenEden — turning the venture from a yield platform right into a self-sustaining, token-governed economic system.

EDEN = Energy, Participation, and Actual Worth.

Tokenomics

The EDEN tokenomics mannequin is designed for long-term sustainability, aligning incentives round actual yield flows generated by OpenEden’s ecosystem. It emphasizes worth seize from actual financial exercise — not speculative emissions.

Token Overview

Ticker: $EDEN Whole Provide: 1,000,000,000 EDEN

Token Distribution

Token Allocation – Supply: ChainBroker

The preliminary allocation is structured to make sure balanced development and long-term alignment between the group, contributors, and traders.

Payments Airdrop (7.5%) Ecosystem & Neighborhood (41.22%) Early Adopters (6%) Basis (10%) Buyers (15.28%) Group & Advisors (20%)

Token Utility: Governance, Rewards, and Actual Yield

EDEN’s utility consists of 4 essential use circumstances, instantly linking the token to the platform’s efficiency:

Staking Rewards – EDEN holders can stake to obtain a portion of the returns and costs from the TBILL and USDO vaults.Governance – EDEN is the inspiration of OpenEden’s DAO-like governance, empowering token holders.Development Incentives – A portion of the EDEN provide is devoted to issuance and reward packages to incentivize continued innovation.Rebates & Premium Entry – Holding or staking EDEN can unlock reductions and rebates on minting or redemption charges.

In essence, EDEN’s tokenomics represents a shift in innovation that prioritizes true worth creation whereas making certain that worth is transparently transmitted between merchandise, protocols, and communities

Roadmap & Imaginative and prescient

By means of the edits, OpenEden doesn’t presently publish a set “roadmap”, or have particular timelines for every milestone.

That is comprehensible when working below a managed funding construction, the place each new product or function should undergo a authorized and compliance approval course of earlier than being introduced.

Nonetheless, primarily based on the official paperwork revealed by OpenEden, we are able to speculate that the precise improvement roadmap of the venture is as follows:

Highway Map – Supply: NFTEvening

FAQ

What’s OpenEden?

OpenEden is a Actual-World Asset (RWA) tokenization platform that bridges conventional finance (TradFi) and decentralized finance (DeFi). It allows traders, DAOs, and establishments to entry actual yield from regulated property akin to U.S. Treasury Payments, bringing the steadiness of conventional markets to blockchain infrastructure.

How does OpenEden work?

OpenEden operates by means of a regulated funding construction, combining authorized compliance with blockchain transparency. Its ecosystem contains:

TBILL Vault – a tokenized fund representing short-term U.S. Treasuries.USDO – a yield-bearing stablecoin backed by TBILL.EDEN Token – the governance and utility token powering the ecosystem.

All property are 1:1 backed by real-world devices, held by licensed custodians, and verified by means of Proof-of-Reserve.

What makes OpenEden totally different from different RWA tasks?

Regulated construction: Operates as a licensed fund, not a DeFi experiment.Moody’s rated: First tokenized bond fund on this planet with a Moody’s “A-bf” fund score.Institutional-grade compliance: Follows KYC/KYB, AML, and whitelisting for all contributors.Actual yield, not inflationary rewards: Returns are derived from real curiosity earned on U.S. Treasuries, not token emissions.

Who can put money into OpenEden’s merchandise?

At present, OpenEden merchandise are accessible solely to:

Skilled Buyers below BVI SIBA 2010;Accredited Buyers below U.S. Regulation D (Rule 501(a)). Every participant should full KYC/KYB verification and have their pockets whitelisted earlier than interacting with TBILL or USDO.

How does OpenEden guarantee transparency and security?

All underlying property are held by licensed custodians.Proof-of-Reserve supplies on-chain verification of collateral.The fund’s authorized construction and NAV are recurrently audited.Sensible contracts are externally audited by respected corporations.

Tips on how to Purchase OpenEden Token (EDEN)

You should purchase $EDEN, the native token of the OpenEden ecosystem, on Binance or different supported exchanges as soon as it turns into obtainable.Right here’s learn how to get began safely and simply:

Create or log in to your Binance account.Deposit USDT or one other supported stablecoin to your Binance pockets.Seek for the buying and selling pair — EDEN/USDT, EDEN/BNB.Place your order and ensure the acquisition.Retailer your tokens securely in your Binance account or switch them to a non-custodial pockets for long-term holding.

OpenEden’s $EDEN token performs a key position in ecosystem governance, liquidity incentives, and future enlargement throughout RWA and DeFi integrations — making it a cornerstone asset for customers who imagine in tokenized actual yield.

Commerce $EDEN on Binance at this time: