A stablecoin is a token whose worth is backed by steady belongings resembling gold or fiat foreign money. Due to this, their worth normally stays equal to 1 US greenback or an oz of gold, respectively. In a quick and unstable crypto market, the place different cryptocurrencies can shortly rise or fall, stability is very appreciated. However identical to bodily cash, crypto cash aren’t invulnerable. Each occasionally, even stablecoins can depeg.

Realizing what’s depegging and the way it occurs may help you put together and forestall important losses.

What’s a Stablecoin Depeg?

A stablecoin depeg occurs when the coin’s worth drops or rises removed from the worth it’s meant to remain equal to, like when a $1 fiat-backed stablecoin now not stays near $1.

One of many largest causes individuals use stablecoins is that they’re designed to keep up steady worth. So, when a depeg occasion occurs, it might probably trigger critical issues. Buyers could lose cash, and belief within the coin and even the broader crypto market can shortly drop.

A depeg will be momentary or everlasting, relying on what induced it and what kind of stablecoin it’s. For instance, fiat-backed stablecoins would possibly depeg because of banking or liquidity points, whereas crypto-collateralized and algorithmic stablecoins usually wrestle throughout excessive market circumstances or design flaws.

Understanding why a stablecoin depegs is essential. The trigger helps buyers resolve whether or not the coin can recuperate or if it’s safer to promote their digital belongings.

Why do Stablecoins Depeg?

A number of elements could cause the stablecoin worth to fluctuate. They usually rely on the kind of coin and exterior affect. To grasp why do stablecoins depeg, we are going to take a deep dive into the potential dangers.

Market Fluctuations

The cryptocurrency market is very unstable, so sudden modifications in reputation can push stablecoin costs up or down.

Market sentiment (worry or hype) can set off mass shopping for or promoting of digital belongings.

Liquidity points can come up throughout market stress, making it tougher to maintain the peg.

Exterior occasions or hypothesis can affect stability, particularly with algorithmic or fractional-algorithmic stablecoins like FRAX.

Regulatory Actions

Authorities insurance policies or modifications to crypto guidelines can create uncertainty.

Stricter reserve necessities could have an effect on how stablecoins are backed.

Adverse regulatory information can shortly decrease confidence and trigger worth drops, altering the market dynamics.

Technical Vulnerabilities

Good contract bugs or safety breaches can result in lack of funds and exterior assaults.

Platform failures or poor administration can disrupt entry to stablecoins.

Lack of transparency reduces person belief.

Collateral Administration

A pegged cryptocurrency should maintain dependable backing belongings (like money or crypto).

If these belongings are unstable or illiquid, the peg can fail.

Common audits and clear reporting assist construct confidence amongst market individuals.

Market Manipulation

Malicious actors could use techniques like wash buying and selling or spoofing to distort costs.

Weak regulation permits manipulation to occur extra simply, shaking market confidence within the course of.

In decentralized finance, transparency and neighborhood oversight are key to stopping abuse.

How Stablecoins Attempt to Keep the Peg

To operate correctly, stablecoins have to keep up their peg to belongings. To realize that, completely different cash must implement completely different measures. Listed here are a number of examples.

Redemption Mechanism

A redemption mechanism helps preserve the value of an exchange-traded fund near its true worth. When a stablecoin’s market worth strikes above or beneath its precise internet asset worth, licensed individuals (normally massive broker-dealers) step in to revenue from the distinction. They purchase or promote еру stablecoin’s shares and the underlying belongings till costs align once more. This course of, referred to as arbitrage, restores the coin’s honest worth. By including or eradicating shares based mostly on market demand, the redemption mechanism retains stablecoins environment friendly, carefully tied to the asset, and pretty priced for all buyers.

Mint-and-Burn

When a stablecoin is created (minted), the issuer first sends new tokens to its personal pockets, then transfers them to customers. When cash are burned, they’re moved to a particular pockets to allow them to’t be used once more.

Many customers don’t mint new cash straight, they merely purchase or commerce current ones on crypto exchanges, which doesn’t change the whole token provide.

Minting and burning preserve the circulating provide equal to the issuer’s money reserves, making certain stability. Nevertheless, errors can occur, like in October, 2025, when Paxos unintentionally minted $300 trillion in PayPal’s PYUSD because of a technical error.

Arbitrage

Arbitrage is a key concept that helps stablecoins keep near their 1 US greenback worth. If a stablecoin drops to $0.98, merchants purchase it cheaply and redeem it for $1 in collateral, lowering the variety of cash in circulation. If it rises to $1.02, merchants mint new cash and promote them for a small revenue, growing provide. These actions shortly push the value again towards $1. This course of makes use of pure market incentives to maintain stablecoins steady. In brief, merchants’ rational habits robotically balances provide and demand, serving to the coin preserve its peg over time.

How you can Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero value

Rebase Mechanism

A rebase mechanism is a system usually utilized by algorithmic stablecoins. It robotically modifications the variety of stablecoins in circulation to maintain the value near 1 US greenback. As a substitute of being backed by actual belongings, it makes use of algorithms and good contracts to regulate provide.

If the value goes above 1 US greenback, the system creates (mints) extra cash and provides them to holders’ wallets, growing provide and pushing the value down. If the value falls beneath $1, it removes (burns) some cash from circulation, lowering provide and lifting the value. This course of helps steadiness provide and demand, protecting the stablecoin steady.

Seigniorage

In conventional finance, seigniorage is the distinction between the worth of cash and the price to supply it. For stablecoins, it’s the revenue an algorithmic stablecoin system makes when it points new tokens to maintain its change price steady. Good contracts automate this course of by adjusting provide. For instance, when demand is excessive and the value goes above $1, the system mints extra tokens to decrease it. When it drops and the speed falls beneath $1, it burns tokens to scale back provide. This two-token mannequin (stablecoin and bond token) retains the value balanced towards cryptocurrency market dynamics and generates revenue for the protocol.

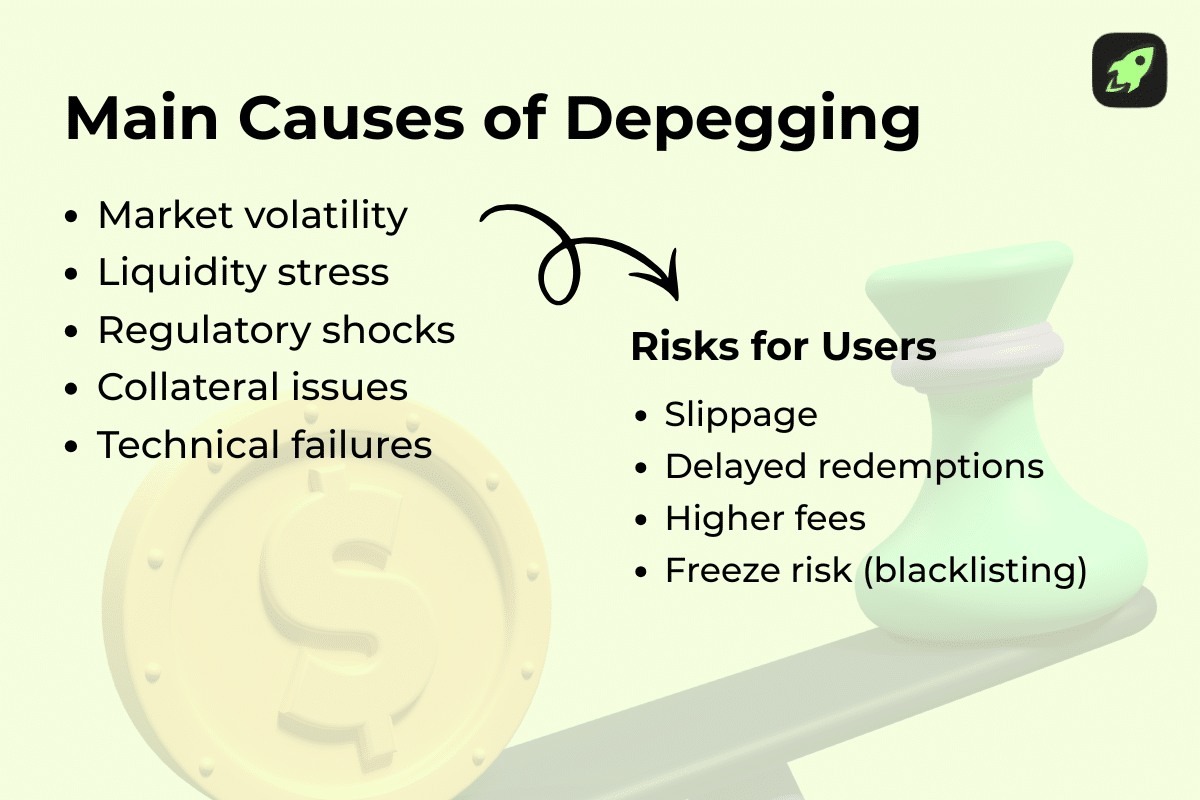

Widespread Causes of Depegging

There are a number of frequent causes for stablecoins to depeg. A few of them will be anticipated, and on this case, analytics warn customers of the likelihood.

Financial institution Run

A financial institution run is a sudden rush of customers panic promoting—attempting to withdraw or redeem their stablecoins without delay. If the challenge doesn’t have sufficient liquid reserves or fiat foreign money to cowl all redemptions, the stablecoin’s worth can fall beneath its peg.

Oracle Failure

Oracles present real-world worth knowledge to blockchains. In the event that they ship incorrect or delayed info, the system could misjudge the stablecoin’s actual worth, inflicting worth swings or lack of the peg.

Business Paper (Opaque Reserves)

When a stablecoin’s reserves embody unclear or dangerous belongings like business paper (short-term company debt), it creates uncertainty about whether or not every coin is actually backed 1:1, resulting in lack of belief and depegging.

Custodian Financial institution

Stablecoins usually depend on banks to carry their reserves. If a custodian financial institution faces monetary hassle, freezes belongings, or delays withdrawals, it might probably stop redemptions and set off depegging.

Dangers to Customers

Depegging is usually a harmful occasion that impacts the market as a complete and common customers. Primary dangers embody slippage, redemption queue, redemption charges, and blacklisting operate.

Slippage

This occurs when the stablecoin’s market worth modifications between the time you begin a commerce and when it’s accomplished. In a depeg, charges can transfer quick, altering the market dynamics, so that you would possibly obtain much less worth than anticipated when promoting or swapping.

Redemption Queue

Throughout excessive demand or panic, stablecoin issuers could restrict how shortly customers can redeem cash for actual belongings. Customers are positioned in a ready line (queue), that means withdrawals will be delayed.

Redemption Payment

Some stablecoins cost a small payment whenever you change tokens for money or collateral. These charges can improve throughout market stress, lowering the quantity you get again.

Blacklisting Perform (Freeze Danger)

Many centralized stablecoins can freeze or block sure pockets addresses if required by authorities or because of suspicious exercise. This implies customers may lose entry to their funds if their handle is blacklisted.

Terra UST and USDC Instances

Depegging isn’t a uncommon prevalence. The 2 most well-known events within the final 5 years occurred with Terra UST and USDC cash.

In Could 2022, TerraUSD (UST), the third-largest stablecoin, collapsed, dropping its $1 peg and wiping out round $60 billion in market worth. In contrast to stablecoins backed by actual belongings, UST relied on an algorithm and its sister token LUNA, to keep up stability. When confidence dropped, this method failed, triggering a spiral the place LUNA’s provide exploded from 342 million to six.5 trillion, destroying its worth.

UST’s collapse affected the broader crypto market, prompting regulatory scrutiny and highlighting potential dangers in algorithmic stablecoins.

USDC suffered from a special challenge. In March 2023, Circle’s USD Coin (USDC), a stablecoin meant to remain at $1, fell beneath 87 cents. This occurred after the information that just about 8% of its $40 billion reserves had been tied to the collapsed Silicon Valley Financial institution. The financial institution’s sudden failure induced large withdrawals and liquidity points. USDC worth drop confirmed that the majority stablecoins, like banks, will be susceptible to “runs” if buyers lose confidence. Circle nonetheless has $3.3 billion at SVB and plans to observe regulators’ steering.

How you can Consider a Stablecoin Earlier than Utilizing It

Earlier than utilizing a stablecoin, take time to evaluate it fastidiously.

Begin by checking reputation and market cap—select cash broadly used and trusted, particularly fiat-backed ones in case you’re new.

Take a look at their change price historical past to see in the event that they keep steady.

Subsequent, examine the regulatory framework—who points the coin, the place it’s based mostly, and whether or not it’s correctly supervised.

Then evaluate the underlying belongings—make sure that dependable auditors confirm that reserves actually exist. Assess safety—learn audit experiences and keep away from cash that conceal or alter them.

Lastly, contemplate adoption and ecosystem—cash used throughout a number of platforms with good liquidity and powerful communities are usually safer decisions.

How you can Handle Danger Associated to Stablecoin Depegging

To handle the danger of stablecoin depegging, don’t preserve all of your cash in a single coin. Unfold your funds throughout a number of stablecoins to scale back losses if one fails or falls sufferer to market manipulation. Select cash backed by actual belongings and frequently audited by respected corporations. Verify whether or not the stablecoin issuer is clear about reserves and regulation. Keep away from algorithmic stablecoins in case you’re new, as they are often extra unstable. Maintain a portion of your funds in different protected belongings like fiat foreign money or Bitcoin (4 to 5 cryptocurrencies ought to do effective). Lastly, keep up to date on information and market circumstances so you’ll be able to act shortly if a stablecoin begins dropping its peg.

FAQ

Why can stablecoins commerce above peg?

Stablecoins can commerce above their peg when demand is increased than provide. This usually occurs throughout market stress, when buyers rush to purchase stablecoins as a protected guess. Restricted liquidity or delays in creating new cash may push the worth briefly above the goal.

What occurs if the collateral ratio falls?

If a stablecoin’s collateral ratio falls, it means there’s much less backing for every coin. This may make buyers lose confidence and begin promoting, pushing the value beneath the stablecoin’s peg. To repair this, issuers could add extra collateral, restrict redemptions, or liquidate belongings to revive stability.

Why do some stablecoins recuperate from small depegs whereas others collapse fully?

Some stablecoins recuperate from a small depeg occasion as a result of they’ve sturdy collateral, clear reserves, and fast responses from issuers. Others collapse when confidence disappears, reserves are weak, or methods fail below strain. Restoration relies on belief, liquidity, and the way nicely the challenge manages provide and demand throughout market stress.

How can I examine in actual time if a stablecoin is beginning to depeg?

You possibly can examine if a stablecoin is beginning to depeg by watching its charges on main exchanges or monitoring websites. For instance, if the value of a US dollar-pegged coin strikes away from $1, even barely, it may sign strain. Additionally, monitor buying and selling quantity, redemption exercise, and social media alerts.

Can I lose all my cash in a depeg, or is the loss normally solely partial?

Sure, it’s attainable to lose all of the investments in a depeg occasion. In extreme circumstances, particularly with weak or algorithmic stablecoins, the worth can crash fully. Restoration relies on the challenge’s backing, transparency, and skill to revive the peg.

How do stablecoin depegs have an effect on the broader crypto market — like Bitcoin or Ethereum costs?

When a stablecoin depegs, it might probably shake confidence throughout the crypto market. Buyers could promote different belongings like Bitcoin or Ethereum to maneuver into money, inflicting costs to drop. Liquidity additionally decreases as merchants rush to safer cash, creating panic and excessive volatility all through your complete crypto ecosystem.

Disclaimer: Please be aware that the contents of this text usually are not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.