Alphabet inventory has strong development expectations and a robust moat. So why is the inventory down a lot this 12 months? The Each day Breakdown dives in.

Friday’s TLDR

GOOG inventory has tumbled

The basics are clear

However what concerning the dangers?

Deep Dive

Let’s name it what it’s: It’s been a troublesome stretch for the Magnificent 7. With simply two periods left in Q1, Meta is the one one which’s greater to this point this quarter. On the subject of pulling again from its 52-week highs, Apple has the finest efficiency with a 14% decline.

Sheesh!

Alphabet stands out given analysts’ expectations for double-digit development and a ahead price-to-earnings of simply 18x — the bottom within the Magazine 7 group and under the S&P 500’s present a number of of 21x. Regardless of this, the inventory is down 13% this quarter and has fallen greater than 21% from its report excessive in early February.

Most of us know Alphabet because the mum or dad firm for Google — the preferred search platform (and web site) on the earth. The corporate additionally owns the second-most standard web site on the earth: YouTube.

Behind search and advert income, the agency additionally has a quickly rising however notably smaller enterprise with Google Cloud, whereas working different key enterprise segments, like Android and Google Play.

The Fundamentals

Over the long run, earnings are typically the principle driver for shares. For Alphabet, analysts anticipate adjusted earnings per share to develop 13.2% this 12 months and 15.3% in 2026. On the income entrance, analysts anticipate 17% development this 12 months, adopted by 11% development in 2026. Right here’s a take a look at earlier income and internet earnings outcomes:

The corporate presently sits with $95.6 billion in money and short-term investments, a determine that’s anticipated to climb in 2025 and 2026 — though its potential acquisition of Wiz for roughly $32 billion continues to be within the combine.

All in all, Alphabet appears to examine loads of bins for long-term buyers. It has proven robust development in income and earnings, analysts predict strong development over the following 12 and 24 months, it has a pile of money, and the valuation is the bottom amongst mega-cap tech.

So what’s weighing on Alphabet inventory?

Dangers Exists

Final quarter, Google’s Cloud unit grew 30% 12 months over 12 months and generated income of $11.96 billion, barely lacking expectations of $12.19 billion. That miss could appear small, notably as the corporate generated total income of $96.5 billion that quarter. Nevertheless, buyers are taking a look at Google Cloud to be a significant contributor to future development. Plus, the agency is investing a big quantity into this unit and buyers need to see that these investments are translating to stronger development.

Different dangers loom too.

Regulatory worries nonetheless swirl over Alphabet, as buyers concern that federal businesses will proceed to scrutinize the agency’s enterprise practices and hand out penalties or lawsuits for what’s deemed as unfair enterprise practices. The corporate faces financial dangers too, as current macro uncertainty may drive companies to drag again on advert spend, impacting Alphabet’s companies and reducing development expectations.

Lastly, competitors stays fierce, not simply in promoting, but additionally within the cloud the place Google contends with different juggernauts, like Microsoft Azure and Amazon Internet Companies.

Need to obtain these insights straight to your inbox?

Join right here

The setup — Alphabet

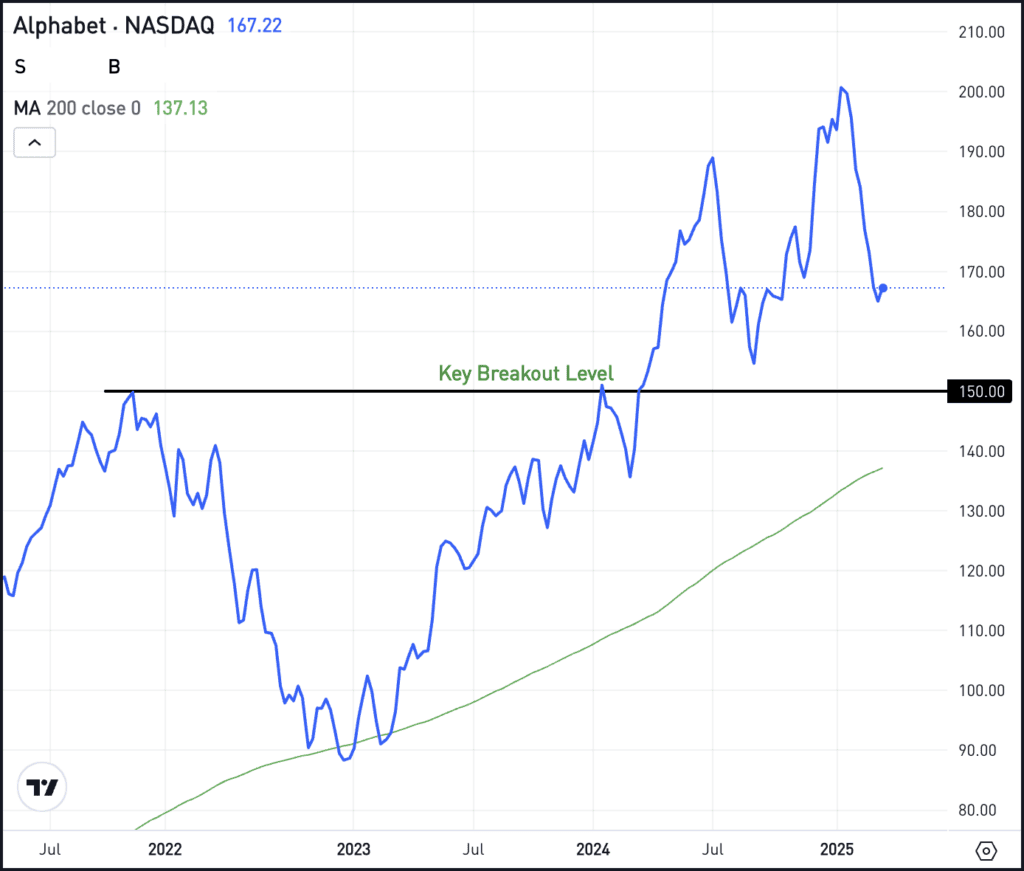

Presently buying and selling within the mid-$160s, Alphabet shares have fallen notably from the current highs.

Nevertheless, it’s nonetheless buying and selling above the important thing breakout space close to $150, in addition to its 200-week transferring common, which has been a long-term degree of assist for GOOG and is presently close to $137 and rising.

In keeping with Bloomberg’s Analyst Suggestions, analysts have a mean 12-month value goal of about $219, implying about 35% upside. In fact, simply because that’s the common goal, doesn’t imply the inventory will get there.

For buyers who like fundamentals, they could discover the present 20% pullback as a pretty entry level and one which correctly accounts for all the inventory’s present dangers. For others although, they could view the basics as enticing, however require a bigger pullback to correctly account for the dangers.

Ought to shares pull again much more, buyers will need to maintain a detailed eye on the areas talked about above: The $150 breakout degree and the rising 200-week transferring common.

And lastly, some buyers could not really feel that Alphabet has the aggressive benefit that might justify an funding, both at present ranges or decrease, and that’s okay too.

Choices

Shopping for calls or name spreads could also be one solution to make the most of a pullback. For name consumers, it could be advantageous to have enough time till the choice’s expiration.

For those who aren’t feeling so bullish or who’re searching for a deeper pullback, places or put spreads could possibly be one solution to take benefit. They can be used to hedge towards additional declines.

To be taught extra about choices, take into account visiting the eToro Academy.