Analyst Weekly, June 30, 2025

Industrial energy technology shares have been on a heater these days, however not like the AI chip crowd, they may not be over-owned simply but. Whereas some buyers see a short-term breather coming, long-term tailwinds are solely getting stronger.

AI Ate My Electrical Invoice: First got here EVs, then got here AI, and each are hungry for electrical energy. A single ChatGPT immediate? It may gulp down 10x the vitality of your common Google search. Coaching a mannequin like GPT-3? That’s a yr’s price of energy for 130 US houses. As AI adoption spreads from area of interest instruments to enterprise-wide capabilities (per McKinsey), the demand for information facilities, and the juice to run them, is about to surge.

Infrastructure Meets Intelligence: Knowledge facilities don’t run on vibes. They want actual infrastructure, energy grids, generators, and backup turbines. That’s fueling a quiet growth in industrial energy technology, and buyers are beginning to take discover.

Not Simply AI, Not Simply the West: Rising markets are including demand of their very own, suppose air con, primary electrification, and increasing grids. In the meantime, geopolitical shifts and a probably energy-friendly White Home might sluggish the anti-fossil-fuel push, creating respiratory room for the sector.

Lengthy-Time period Voltage: The AI period is simply warming up, and the facility behind it could nonetheless be under-owned. This is perhaps the early innings of a brand new type of industrial revolution. Deglobalization and digitization could really feel like separate tendencies, however each plug into the identical outlet: demand for extra native, extra dependable, and extra highly effective vitality.

Supply: Census information as of April 30, 2025

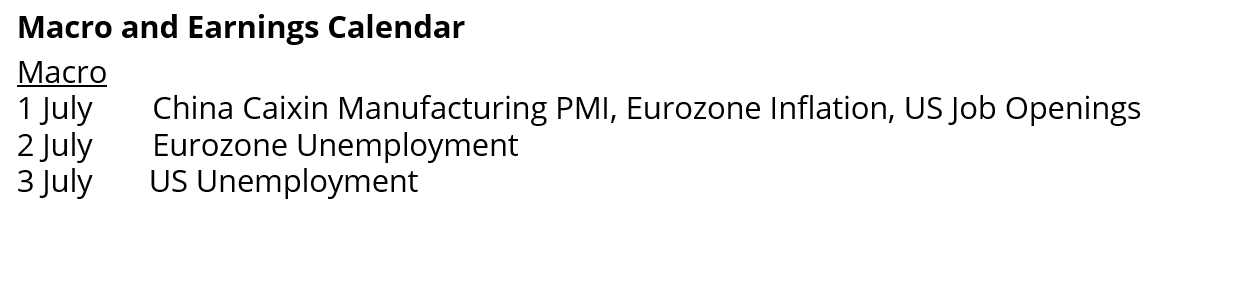

Tariff Revenues Are Quietly Balancing the Books

US customs simply logged one other $20B in tariff income for June, pushing whole tariff revenue $60B larger than this time final yr. That surge is doing greater than defending commerce curiosity, it’s changing into a vital offset to the price of tax cuts transferring by means of Congress.

Deficit Shrinks, Due to Commerce Duties: For 3 straight months, the US price range deficit has narrowed year-over-year. June’s enchancment got here regardless of weak company tax receipts mid-month. That’s partly as a result of tariff revenues are performing as a fiscal cushion. Moody’s flagged tax cuts as a threat in its downgrade projections however didn’t issue within the tariff tailwind. A notable omission.

Authorized Threat on the Horizon: The tariff program isn’t bulletproof. Authorized challenges are in movement, with appeals courtroom hearings set for July 31 and a Supreme Courtroom ruling anticipated within the fall. However the Administration seems prepared with a fallback to maintain income flowing, signaling that eradicating tariffs, even underneath new management in 2028, gained’t be easy. Any unwind might require larger company or private taxes to fill the hole.

Inflation Influence Nonetheless MIA: Fed Chair Powell has warned that tariffs ought to finally present up in inflation metrics however to date, CPI stays unbothered. Whereas some costs on tariffed items have risen, cheaper costs elsewhere (like non-tariffed imports) and stress from oil and housing are preserving general inflation grounded.

Earnings Taking the Hit? If shoppers aren’t absorbing the fee and inflation information isn’t reflecting it, it raises a key risk: corporations could also be swallowing the tariffs themselves. That will imply tariffs are quietly pressuring revenue margins, making them deflationary, not inflationary.

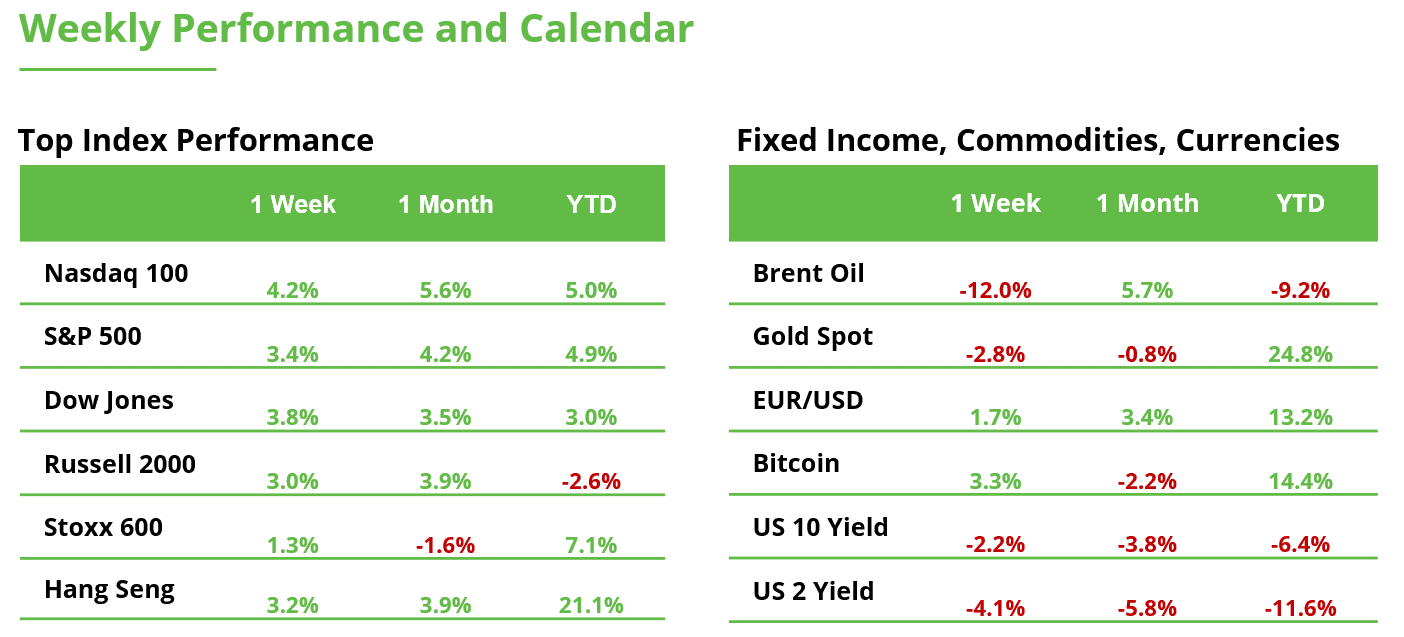

Tech is again – however totally different: These are the top-performing shares of 2025

The Nasdaq 100 grew to become the primary U.S. inventory index to succeed in a brand new all-time excessive final week. Tech is again – however in a brand new kind. Beneath the floor, a shift in market dynamics is changing into obvious. Just one inventory among the many ten most beneficial corporations is at the moment a prime performer in 2025, and that’s the streaming supplier Netflix.

Nasdaq 100 within the each day chart: The index has been rising for six consecutive buying and selling days. From a technical perspective, a continuation of the long-term uptrend seems almost certainly. Within the occasion of pullbacks, the 2 honest worth gaps created throughout the latest rally might function key worth zones: 22,326 to 22,379 factors and 21,874 to 22,163 factors. The previous all-time excessive is marked with the blue line.

Supply: eToro

Selective Inventory Choosing: Breadth inside the tech sector is rising. Buyers are now not targeted solely on the most important mega-caps. Over the previous two years, Nvidia, Microsoft, and Apple had been the important thing drivers of Nasdaq 100 efficiency on account of their heavy index weighting. Current developments point out a structurally more healthy rally. Selective inventory selecting is gaining significance, a constructive sign for lively buyers and lively administration.

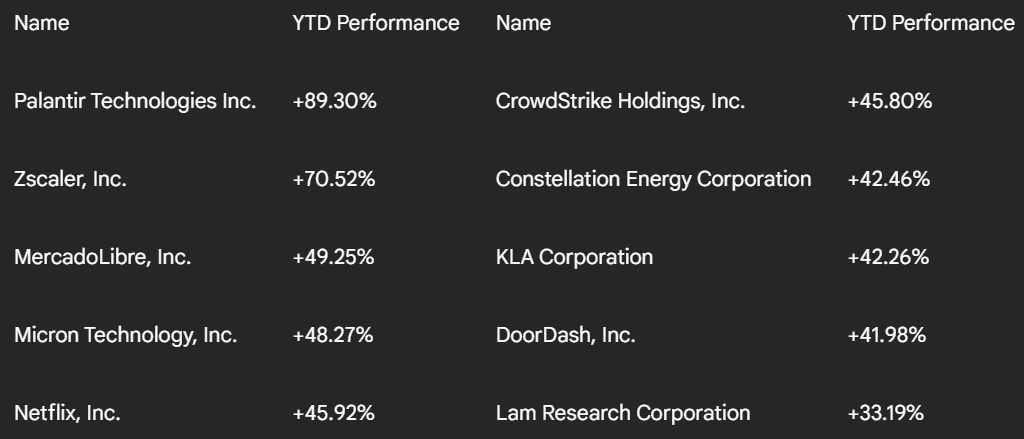

These Are the Outperformers: The checklist of the highest 10 best-performing shares year-to-date will be grouped into broader classes:

Palantir Applied sciences, Zscaler, and CrowdStrike characterize investor curiosity in software program, synthetic intelligence, and large information.

The semiconductor and semiconductor gear phase can be in focus, with Micron Know-how, KLA, and Lam Analysis among the many most sought-after names.

In e-commerce and web companies, MercadoLibre, DoorDash, and Netflix are seeing robust demand.

Constellation Vitality is the one vitality inventory within the prime 10.

Prime 10 performers within the Nasdaq 100 year-to-date. Supply: TradingView, Gemini

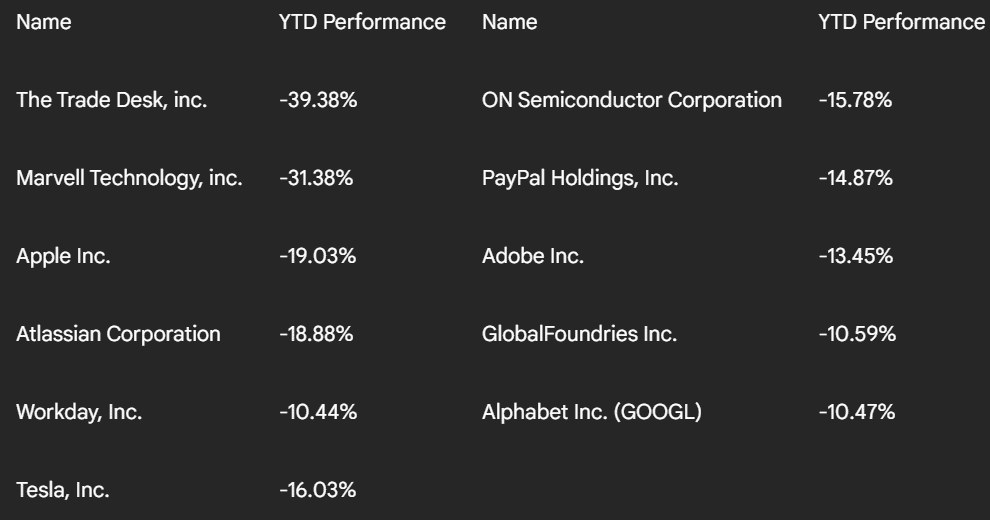

These Are the Underperformers: 11 of the 20 worst-performing shares year-to-date come from the know-how sector. Regardless of the broader tech rally, there are important weaknesses inside the sector. Even heavyweights are among the many laggards. Apple, Alphabet, and Tesla are all among the many ten most beneficial corporations worldwide, but at the moment rank among the many greatest decliners. Market capitalization alone is now not a enough funding criterion.

11 tech laggards within the Nasdaq 100 year-to-date. Supply: TradingView, Gemini

These weak tech shares will be divided into 5 key sub-sectors. Their weak point will not be random, however concentrated in segments notably affected by tariff dangers and structural headwinds:

Sub-sector 1: Software program, Cloud and Advert-Tech – The Commerce Desk, Atlassian Company, Adobe, Workday

Sub-sector 2: Semiconductors and Semiconductor Gear – Marvell Know-how, ON Semiconductor Company, GlobalFoundries

Sub-sector 3: Web Providers and Platforms – Alphabet, PayPal

Sub-sector 4: {Hardware} and Client Electronics – Apple

Sub-sector 5: Automotive and E-Mobility – Tesla

Bottomline: Buyers ought to take a differentiated strategy to their tech publicity. Digital enterprise fashions have a tendency to supply safety from tariff dangers, whereas globalized {hardware} and manufacturing corporations are extra weak. Sharp worth strikes are particularly possible in response to tariff-related information, in each instructions. A comeback begins with belief, and constructing belief is a course of that takes time.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.