Key Takeaways:

Michael Saylor says if $MSTR crashes to $1, the corporate will purchase again inventory and double down on Bitcoin.Technique now holds 580,250 BTC, valued at over $40.6 billion, and should set off a Wall Avenue provide squeeze.Saylor claims the Bitcoin Normal is coming, and the period of $1 million BTC may start if establishments maintain simply 10% of the provision.

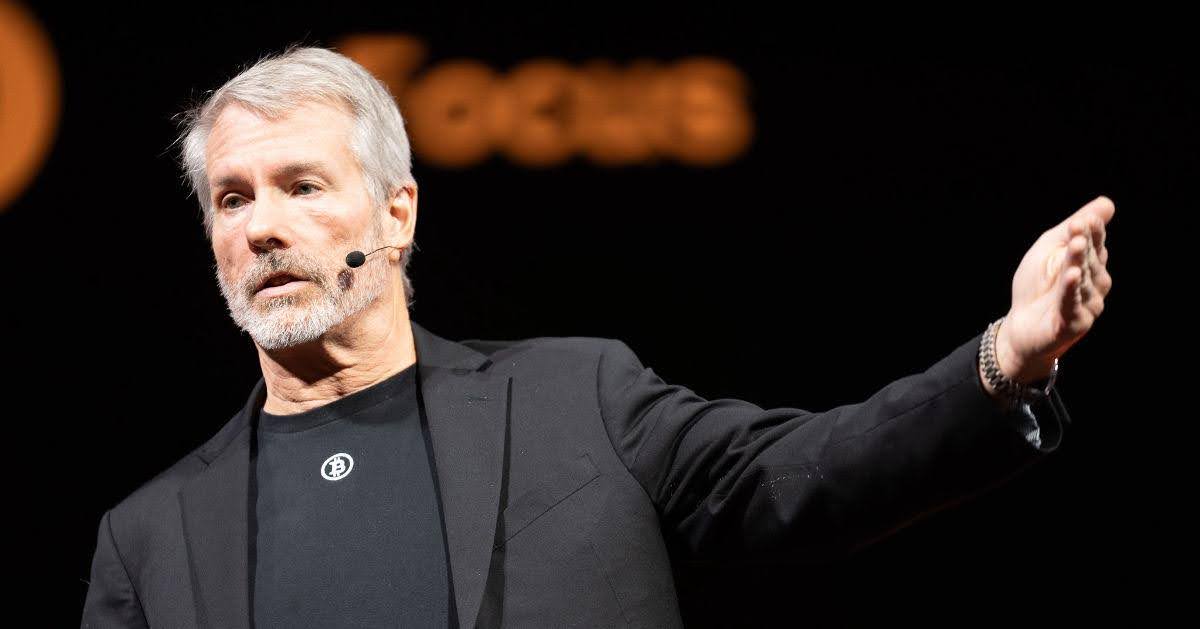

On the Bitcoin 2025 convention in Las Vegas, Michael Saylor, Govt Chairman of Technique (previously MicroStrategy), made waves with a daring, calculated response to rising doubts across the firm’s leverage-heavy Bitcoin technique. Going through criticism over $MSTR’s inventory plunge, Saylor fired again with a multi-billion greenback plan that might reshape institutional adoption—and probably Bitcoin’s future value trajectory.

Learn Extra: $1.34B Bitcoin Purchase Sends Shockwaves as Technique Nears $40B BTC Holdings—Is a Pullback Coming?

Technique’s Nuclear Choice: Buybacks, Bitcoin, and Brief Squeezes

Saylor didn’t shrink back from powerful questions, particularly round what would occur if $MSTR’s a number of to internet asset worth (mNAV) plunged beneath 1 once more—a situation that spooked traders throughout earlier crypto winters. His reply? Use most popular devices like STRK and STRF to repurchase frequent shares, squeeze the shorts, and purchase extra Bitcoin.

“If our inventory went to $1 tomorrow, we’d simply recapitalize the corporate by promoting preferreds and shopping for again fairness,” stated Saylor.

In contrast to Grayscale’s GBTC, which is structurally rigid, Saylor emphasised that Technique is an working firm with full entry to debt markets, at-the-market (ATM) choices, and recapitalization instruments. This monetary agility, he argued, makes MSTR not simply resilient—however harmful to quick sellers betting in opposition to it.

Social media has already picked up on this menace. Crypto commentator Towards Wall Avenue posted a viral clip of the occasion with the caption:“Saylor is now conscious of how far $MSTR has fallen… He could be defending the frequent inventory to squeeze the shorts. Then purchase Bitcoin once more. Superior plan.”

If that performs out, Technique may power a brief squeeze that pushes $MSTR up whereas accumulating extra BTC—fueling a flywheel impact with long-term implications.

Bitcoin as Capital: Saylor Declares the Fiat Period Over

In a passionate keynote, Saylor made a sweeping declaration: Bitcoin is incorruptible capital, and it’s now on the coronary heart of an enormous international shift.

“Within the age of Synthetic Intelligence, Bitcoin is the middle of capital,” he stated. “Bonds, actual property, and fiat currencies are inferior belongings—and they are going to be changed.”

Saylor views Bitcoin not merely as an asset however as a base layer of belief for the Twenty first-century economic system. With AI remodeling how capital and labor function, digital shops of worth like Bitcoin will, he claims, develop into the one credible long-term hedge in opposition to inflation, financial debasement, and instability.

He even in contrast the shift to a civilizational evolution, arguing that Bitcoin will develop into the conservative basis of a brand new monetary order.

Learn Extra: Trump’s $2.5B Bitcoin Transfer Ignites Market Buzz: BTC Bull Emerges because the New Token In The Market That Amid Saylor’s Name to Maintain Your Crypto

The $1 Million Bitcoin Thesis — How Wall Avenue Matches In

Why 10% Institutional Allocation Might Be the Catalyst

One of the sensational moments of Saylor’s speak got here when he outlined a clear numerical path to a $1 million Bitcoin:

“We maintain 580,250 BTC—about 2.5% of the entire provide. If Wall Avenue strikes to personal 10%, that’s once we enter the $1 million period.”

In keeping with public information and firm filings, Technique’s present common price foundation for its Bitcoin is $69,979, with complete investments surpassing $40.6 billion. Whereas Bitcoin hovers just under $70,000 at this time, a big improve in institutional shopping for may pressure provide dramatically.

Saylor’s logic is simple:

There’ll solely ever be 21 million BTC.About 19.7 million have already been mined.Massive establishments holding even a small fraction of this provide may create an epic provide crunch.

In that world, Saylor believes Technique’s early positioning offers it a “once-in-a-century” benefit—like proudly owning oil reserves earlier than the invention of the combustion engine.

Technique’s Strategic Resilience: Why It’s Not GBTC

In defending Technique’s method, Saylor took direct purpose at legacy autos like GBTC, which lack the instruments to react to market volatility.

“GBTC is a closed-end belief… no operational flexibility,” he famous. “We will do ATMs. We will concern debt. We will transfer quick.”

With lively monetary engineering, Technique can hedge downturns, entice new capital, and play offense when others retreat. The corporate has already used convertible debt, most popular fairness, and ATM packages throughout a number of jurisdictions to develop its Bitcoin place—generally by means of aggressive accumulation even throughout value dips.

This makes Technique a novel crypto-adjacent fairness: not a tech inventory, not a Bitcoin ETF, however a hybridized stability sheet that strikes with macro forces whereas enjoying the lengthy Bitcoin recreation.

What This Means for Crypto Markets

Saylor’s reaffirmation of his Bitcoin technique is greater than rhetoric. It indicators to institutional gamers that holding BTC by means of public proxies like $MSTR could also be greater than a speculative play—it might be a strategic asset acquisition mannequin.

If Technique triggers a buyback to squeeze shorts, institutional patrons could:

Rush into $MSTR as a Bitcoin proxyDrive BTC spot value upward as a consequence of renewed accumulationImprove demand for regulated publicity through ETFs or direct buys

With BlackRock, Constancy, and others already within the recreation, and Bitcoin ETFs now holding over 1 million BTC mixed, Saylor’s 10% Wall Avenue allocation thesis won’t be far-fetched.