Victoria d’Este

Revealed: October 25, 2024 at 3:00 pm Up to date: October 25, 2024 at 11:39 am

Edited and fact-checked:

October 25, 2024 at 3:00 pm

In Temporary

Binance’s newest paper explores the influence of spot BTC ETFs on market demand, liquidity, and adoption tendencies, revealing their important affect in the marketplace provide.

Inspecting these dynamics, the most recent Binance paper, “Spot ETFs in Crypto Markets,” describes how spot BTC ETFs have an effect on market demand, liquidity, and adoption tendencies.

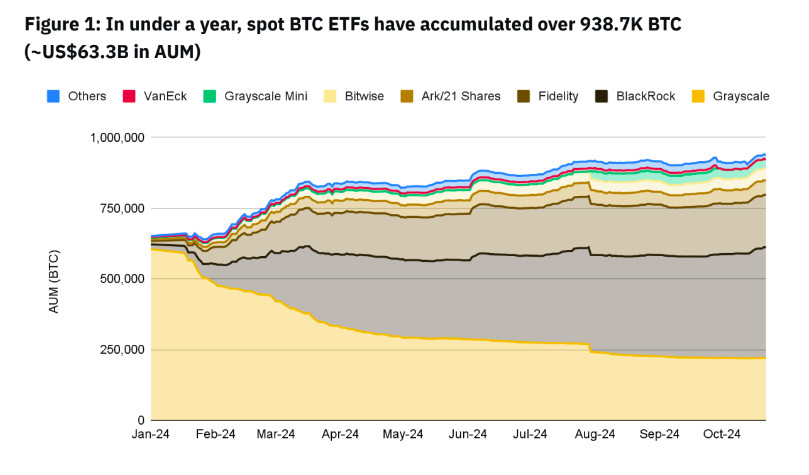

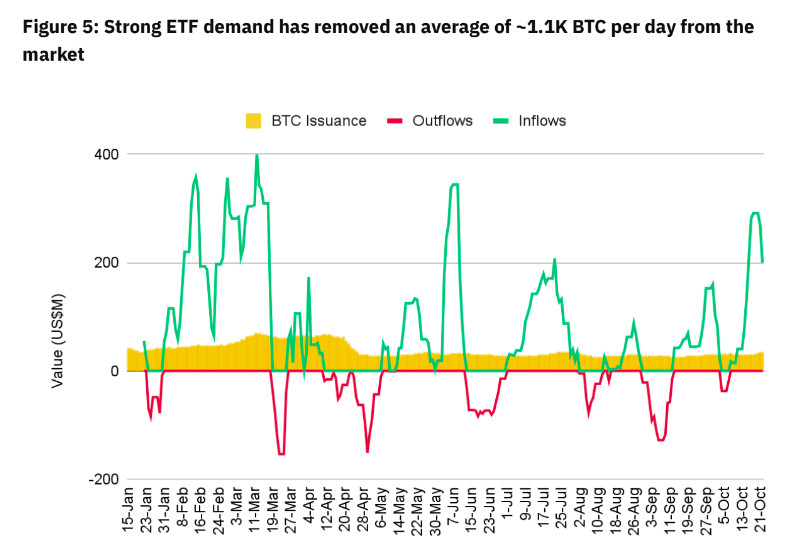

Main capital has rapidly poured into spot bitcoin exchange-traded funds, with holdings already totaling over 938,700 BTC, or over $63.3 billion. This quantity, which quantities to virtually 5.2% of the complete provide of Bitcoin, highlights the extent to which spot BTC ETFs are influencing the market. Giant internet inflows of over 312,500 BTC help this demand, demonstrating the perform of those ETFs in selling constant demand and reducing market provide.

As half of a bigger development towards securitizing digital property, spot Bitcoin ETFs have been launched, making them extra accessible to buyers who would in any other case desire to work together with cryptocurrency by means of typical monetary devices.

With ramifications for value dynamics and liquidity, the magnitude of those inflows demonstrates that spot BTC ETFs are extra than simply monetary devices; they’re more and more taking part in a key position within the construction of the Bitcoin market. Though the ETF mechanism isn’t new to the monetary trade, its use within the cryptocurrency subject has revealed demand ranges that surpass even these of the primary gold ETFs, indicating that Bitcoin ETFs have a definite attraction.

ETF Divergence and Comparability with Gold ETFs

Gold ETFs, that are seen as extra steady and have set a sample for asset-backed funds up to now, grew very modestly of their early phases, drawing simply round $1.5 billion over the same time period. Nonetheless, in lower than a 12 months, BTC ETFs have amassed virtually $18.9 billion, demonstrating the elevated curiosity in Bitcoin as a hedge in opposition to wider financial volatility in addition to a speculative asset. Remarkably, though simply 95 establishments invested in gold ETFs of their first 12 months, over 1,200 establishments have already invested in bitcoin ETFs.

Nonetheless, Ethereum (ETH) ETFs haven’t been as profitable as Bitcoin ETFs. Ethereum ETFs have had withdrawals of virtually 43,700 ETH, or $103.1 million, based on the Binance knowledge, with unfavourable flows occurring in eight of the primary eleven weeks.

With Bitcoin changing into a extra common digital asset for ETF investments, this disparity between BTC and ETH ETFs factors to a shift in investor curiosity and market sentiment. Bitcoin’s standing as the primary cryptocurrency and its popularity as a digital retailer of wealth could also be contributing components to this development because it appeals to extra cautious buyers.

Institutional and Non-Institutional Traders’ Contribution to the Progress of Bitcoin ETFs

The involvement of each institutional and non-institutional buyers has vastly aided the expansion of spot BTC ETFs. Robust curiosity in these merchandise has been proven by non-institutional buyers, who make up round 80% of demand. Retail buyers and particular person merchants that desire the benefit of getting Bitcoin publicity by means of ETFs slightly than personally managing wallets, keys, and exchanges make up this funding base.

There has additionally been a noticeable enhance in institutional funding in Bitcoin ETFs. Due largely to monetary advisers, whose Bitcoin holdings surged by 44.2% to achieve 71,800 BTC, institutional holdings have grown by virtually 30% since Q1. The transfer towards extra regulated and managed entry to digital property is mirrored in institutional buyers’ gradual acceptance of Bitcoin ETFs.

Nonetheless, it’s anticipated {that a} full-scale institutional adoption involving banks, consulting providers, and broker-dealers can be a gradual course of that takes years to finish. Such a shift could make Bitcoin and different digital property extra extensively accepted by bringing them into the mainstream of worldwide monetary markets.

Bitcoin’s Convergence with Conventional Finance (TradFi)

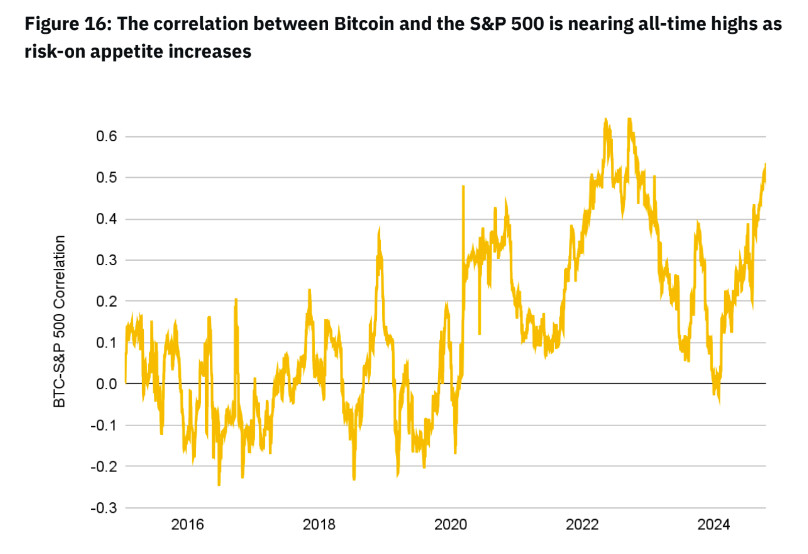

The Binance examine highlights a noteworthy development: the rising hyperlink between Bitcoin and standard monetary property, specifically the S&P 500 index. This growing hyperlink, which has been stronger because the starting of 2024, factors to a change in how buyers see Bitcoin. Bitcoin is now seen as each a risk-on asset and a hedge in opposition to macroeconomic uncertainty, whereas earlier than, it was considered largely uncorrelated. This twin position is a mirrored image of buyers’ altering perceptions, as many now view Bitcoin as each a growth-oriented asset and a potential buffer during times of market volatility.

Each market stability and funding strategies are impacted by Bitcoin’s convergence with conventional finance. Because the cryptocurrency market begins to behave extra like different well-known asset lessons, for instance, the stronger reference to shares could point out that the market is maturing. Moreover, the interplay between typical monetary property and digital currencies is anticipated to accentuate as institutional gamers commit increased percentages of their portfolios to BTC ETFs, due to this fact reinforcing Bitcoin’s place in typical investing frameworks.

The Impression of Spot BTC ETFs on Market Volatility and Effectivity

Along with creating direct demand for Bitcoin, spot BTC ETFs have had a serious influence on the cryptocurrency market general by means of second-order impacts. Spot BTC ETFs make up a mean of 26.4% of Bitcoin’s spot buying and selling quantity, with occasional peaks of 62.6%, based on the Binance report. Because of the ETF mechanism’s introduction of a extra managed type of demand for Bitcoin, this sizeable proportion has helped to enhance market effectivity and decrease volatility. These ETFs’ reliability can maintain extra constant value patterns, drawing much more merchants to the market.

Enterprise capital is changing into extra serious about spot BTC ETFs attributable to their liquidity, which permits for a broader market inclusion that goes past Bitcoin to incorporate a spread of blockchain-native property. The market could turn into extra steady and liquid because of this increasing on-chain presence, which is being pushed by ETF demand each immediately and not directly. As an illustration, the higher legitimacy and liquidity provided by spot BTC ETFs could spur new improvement within the tokenized RWA house.

Disclaimer

In step with the Belief Challenge tips, please word that the knowledge offered on this web page isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you may afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional data, we advise referring to the phrases and situations in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Writer

Victoria is a author on a wide range of expertise matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on a wide range of expertise matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.